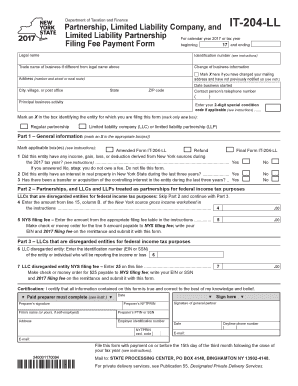

Partnership, Limited Liability Company, and it 204 LL 2017

What is the Partnership, Limited Liability Company, And IT 204 LL

The Partnership, Limited Liability Company, and IT 204 LL form is a crucial document used in the United States for tax reporting purposes. This form is specifically designed for partnerships and limited liability companies (LLCs) to report income, deductions, and credits to the Internal Revenue Service (IRS). It plays a significant role in ensuring that these business entities comply with federal tax regulations. Understanding the details of this form is essential for accurate tax filing and maintaining the legal standing of the business.

Steps to complete the Partnership, Limited Liability Company, And IT 204 LL

Completing the Partnership, Limited Liability Company, and IT 204 LL form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense reports, and any supporting documentation for deductions. Next, fill out the form by providing relevant information about the partnership or LLC, including the names of partners, their respective shares, and the entity's overall income. After completing the form, review it thoroughly to check for errors or omissions. Finally, ensure that all required signatures are obtained before submission.

Legal use of the Partnership, Limited Liability Company, And IT 204 LL

The legal use of the Partnership, Limited Liability Company, and IT 204 LL form is essential for compliance with federal tax laws. This form must be filed accurately and on time to avoid penalties. It serves as a declaration of the business's income and expenses, and it is used by the IRS to assess tax liabilities. Ensuring that the form is completed in accordance with IRS guidelines helps protect the partnership or LLC from potential legal issues related to tax non-compliance.

IRS Guidelines

The IRS provides specific guidelines for completing the Partnership, Limited Liability Company, and IT 204 LL form. These guidelines include instructions on how to report various types of income, allowable deductions, and credits. It is important to follow these guidelines closely to ensure that the form is filled out correctly. The IRS also updates its guidelines periodically, so staying informed about any changes is crucial for accurate reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Partnership, Limited Liability Company, and IT 204 LL form are critical for compliance. Typically, the form must be filed by the fifteenth day of the third month following the end of the partnership’s tax year. For partnerships operating on a calendar year, this generally means a due date of March 15. It is important to keep track of these deadlines to avoid late filing penalties, which can impact the financial standing of the business.

Required Documents

To complete the Partnership, Limited Liability Company, and IT 204 LL form, certain documents are required. These include financial statements, records of income and expenses, and any supporting documentation for deductions claimed. Additionally, it may be necessary to provide information regarding the partners or members of the LLC, including their identification details and ownership percentages. Having these documents ready will facilitate a smoother and more accurate filing process.

Quick guide on how to complete partnership limited liability company and it 204 ll

Complete Partnership, Limited Liability Company, And IT 204 LL effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Manage Partnership, Limited Liability Company, And IT 204 LL on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Partnership, Limited Liability Company, And IT 204 LL with ease

- Find Partnership, Limited Liability Company, And IT 204 LL and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow accommodates all your document management needs in just a few clicks from any device you choose. Edit and eSign Partnership, Limited Liability Company, And IT 204 LL and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct partnership limited liability company and it 204 ll

Create this form in 5 minutes!

How to create an eSignature for the partnership limited liability company and it 204 ll

How to generate an eSignature for your PDF online

How to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

How to make an eSignature for a PDF document on Android

People also ask

-

What is the process for forming a Partnership or Limited Liability Company using airSlate SignNow?

Using airSlate SignNow, forming a Partnership or Limited Liability Company is straightforward. You can easily draft, eSign, and send all necessary documents directly through our platform, ensuring compliance with all legal requirements for IT 204 LL. This simplifies the process and saves you time.

-

How does airSlate SignNow support the eSigning needs of a Limited Liability Company?

airSlate SignNow provides comprehensive support for the eSigning needs of Limited Liability Companies. Our platform allows multiple signers to review documents like IT 204 LL concurrently, streamlining approval processes. This enhances collaboration and speeds up the formalization of your Partnership or Limited Liability Company.

-

What pricing plans does airSlate SignNow offer for businesses forming Partnerships or Limited Liability Companies?

airSlate SignNow offers flexible pricing plans tailored for businesses, including those forming Partnerships and Limited Liability Companies. Our plans are competitive, allowing access to features essential for managing documents related to IT 204 LL without breaking the bank. Custom quotes are available for large teams or specialized needs.

-

Can airSlate SignNow assist with compliance for IT 204 LL forms?

Absolutely! airSlate SignNow is equipped to assist with compliance for IT 204 LL forms by providing templates and guidance. Our platform ensures that all documentation meets necessary state regulations for Partnerships and Limited Liability Companies, helping you stay compliant efficiently.

-

What features does airSlate SignNow provide to enhance document management for a Partnership?

airSlate SignNow offers robust document management features that are essential for Partnerships. You can create, send, and track your documents related to IT 204 LL seamlessly. The platform also includes options for document storage and retrieval, making it easy to manage all partnership agreements and legal documents.

-

How does airSlate SignNow integrate with other tools for Limited Liability Companies?

airSlate SignNow integrates easily with various business tools to enhance efficiency for Limited Liability Companies. Whether you're using CRM systems, project management tools, or financial software, our platform works to create a seamless workflow for managing documents related to IT 204 LL. Integration options help centralize your operations.

-

What benefits can a Limited Liability Company expect when using airSlate SignNow?

A Limited Liability Company can expect numerous benefits when using airSlate SignNow, including faster turnaround times on document signing and reduced administrative overhead. The platform is user-friendly, making it easy for all members of your Partnership to eSign documents related to IT 204 LL, thereby enhancing overall operational efficiency.

Get more for Partnership, Limited Liability Company, And IT 204 LL

- Aetna behavioral health precertification form

- Non erisa 403b withdrawal request form

- Gauteng city region academy unemployment database form 2013

- Each month you will need to completeverify the current months information on the billing template

- Us club soccer form

- Aggression assessment tool form

- Olympia pharmacy form

- State farm release form

Find out other Partnership, Limited Liability Company, And IT 204 LL

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free