Schedule D is Mass 2017

What is the Schedule D IS Mass

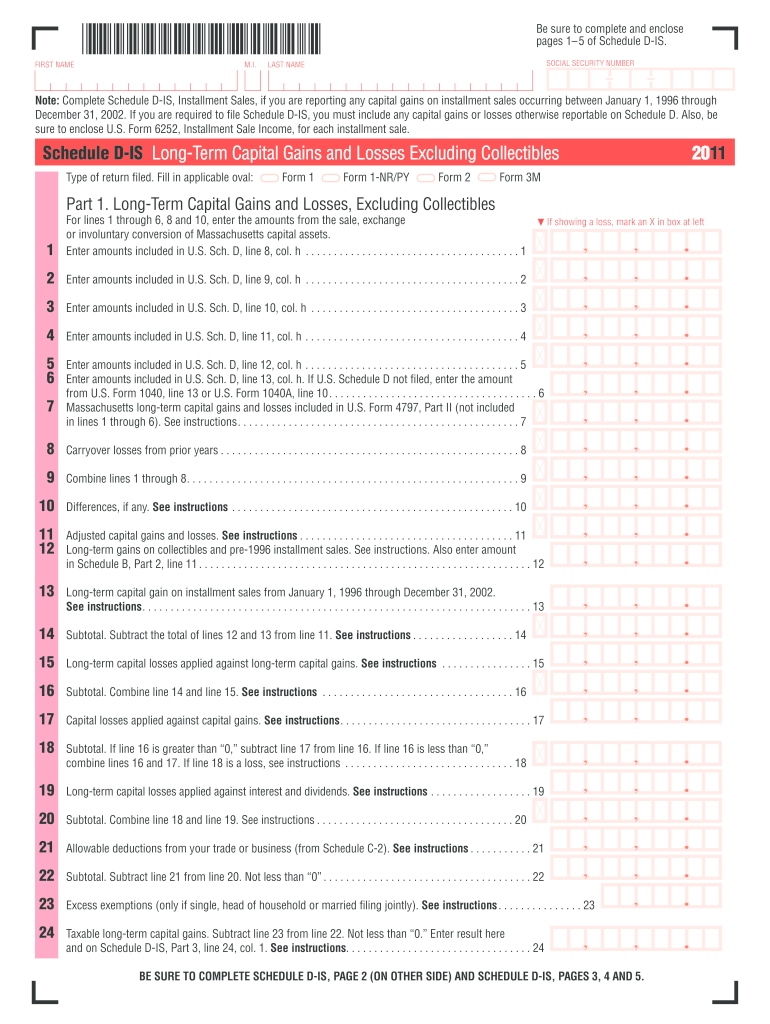

The Schedule D IS Mass is a tax form used in the United States, specifically for reporting capital gains and losses. This form is essential for individuals and businesses that have sold or exchanged capital assets during the tax year. It helps taxpayers calculate their overall tax liability based on these transactions. The Schedule D IS Mass is typically filed alongside the individual income tax return, allowing the IRS to assess the taxpayer's financial activities accurately.

How to use the Schedule D IS Mass

Using the Schedule D IS Mass involves several steps to ensure that all relevant capital gains and losses are reported correctly. Taxpayers must first gather all necessary documentation related to their asset transactions, including purchase and sale records. Once the information is compiled, the taxpayer can fill out the form, detailing each transaction's date, description, and financial outcome. After completing the form, it should be attached to the primary tax return and submitted to the IRS by the filing deadline.

Steps to complete the Schedule D IS Mass

Completing the Schedule D IS Mass requires careful attention to detail. Here are the steps to follow:

- Gather all documentation related to capital asset transactions.

- Determine the holding period for each asset to classify gains or losses as short-term or long-term.

- Fill out the form by entering details for each transaction, including dates, descriptions, and amounts.

- Calculate total capital gains and losses, ensuring to offset short-term against short-term and long-term against long-term.

- Transfer the totals to the appropriate sections of the main tax return.

Legal use of the Schedule D IS Mass

The Schedule D IS Mass is legally recognized as a valid document for reporting capital gains and losses to the IRS. To ensure its legal standing, it must be filled out accurately and submitted by the tax filing deadline. Compliance with IRS regulations is crucial, as errors or omissions can lead to penalties or audits. Additionally, taxpayers should retain copies of the Schedule D IS Mass and supporting documents for at least three years in case of future inquiries.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule D IS Mass align with the standard tax return deadlines. Typically, individual taxpayers must submit their returns by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions they may file, which can provide additional time to complete their tax returns, including the Schedule D IS Mass.

Required Documents

To complete the Schedule D IS Mass accurately, taxpayers need several documents, including:

- Purchase and sale records for each capital asset.

- Brokerage statements detailing transactions.

- Any prior year tax returns that may affect current year calculations.

- Documentation of any adjustments to basis, such as improvements or depreciation.

Quick guide on how to complete schedule d is mass

Effortlessly Complete Schedule D IS Mass on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the necessary resources to create, modify, and electronically sign your documents quickly without delays. Handle Schedule D IS Mass on any device with airSlate SignNow's apps for Android or iOS, streamlining any document-related process today.

How to Modify and Electronically Sign Schedule D IS Mass with Ease

- Find Schedule D IS Mass and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of your documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of submitting your form, whether by email, SMS, invite link, or by downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device you choose. Edit and electronically sign Schedule D IS Mass to ensure clear communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule d is mass

The best way to make an electronic signature for a PDF file in the online mode

The best way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is Schedule D IS Mass and how does it work?

Schedule D IS Mass is a tax form used in Massachusetts for reporting capital gains and losses. It is essential for taxpayers who have sold assets in the state. Using airSlate SignNow can streamline the eSigning process for these documents, making it easy to fill out, sign, and submit your Schedule D IS Mass efficiently.

-

How much does it cost to use airSlate SignNow for Schedule D IS Mass?

airSlate SignNow offers flexible pricing plans, ensuring that businesses of all sizes can afford to eSign documents like Schedule D IS Mass. Depending on your needs, you can choose from various subscription options that provide features tailored for efficient document management and eSigning.

-

What features does airSlate SignNow provide for completing Schedule D IS Mass?

airSlate SignNow offers features such as customizable templates, in-app editing, and secure eSigning to simplify the process of completing Schedule D IS Mass. You can easily upload your document, add necessary fields, and send it out for signatures effortlessly.

-

Can I integrate airSlate SignNow with other applications for Schedule D IS Mass?

Yes, airSlate SignNow supports integrations with various applications such as Google Drive, Dropbox, and CRM systems. This means you can easily manage your documents, including Schedule D IS Mass, directly from your preferred tools, enhancing your workflow efficiency.

-

What are the benefits of using airSlate SignNow for Schedule D IS Mass?

Using airSlate SignNow for Schedule D IS Mass provides several benefits, including time-saving eSigning capabilities and enhanced document security. The platform allows you to track the status of your documents in real-time, ensuring you never miss an important deadline.

-

Is airSlate SignNow secure enough for sensitive tax documents like Schedule D IS Mass?

Absolutely! airSlate SignNow employs advanced security measures, including data encryption and compliant storage, to protect your sensitive documents like Schedule D IS Mass. Your information is safe, allowing you to confidently complete and eSign your tax forms.

-

How can I get started with airSlate SignNow for Schedule D IS Mass?

Getting started with airSlate SignNow for Schedule D IS Mass is easy. Simply sign up for an account, choose your pricing plan, and then you can begin uploading your documents and eSigning right away. The user-friendly interface will guide you through each step.

Get more for Schedule D IS Mass

Find out other Schedule D IS Mass

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template