Form 13h Form

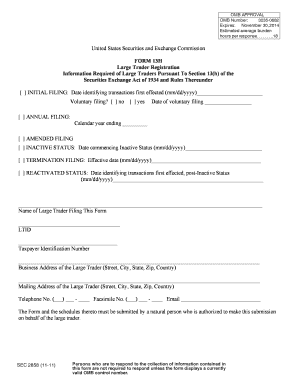

What is the Form 13h Form

The Form 13h is a crucial document used for reporting specific financial information to the IRS. It is typically associated with certain tax obligations and is essential for ensuring compliance with federal tax regulations. This form is designed to provide necessary details about income, deductions, and credits, allowing taxpayers to accurately report their financial status. Understanding the purpose and requirements of the Form 13h is vital for anyone who needs to file it, as it helps avoid potential penalties and ensures proper tax handling.

How to use the Form 13h Form

Using the Form 13h involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and deduction records. Next, download the fillable Form 13h from a reliable source. Fill in the required fields with precise information, ensuring that all figures are accurate. After completing the form, review it carefully for any errors or omissions. Finally, submit the form as per the IRS guidelines, either electronically or via mail, depending on your preference and the filing requirements.

Steps to complete the Form 13h Form

Completing the Form 13h requires attention to detail. Follow these steps:

- Gather required documents, such as W-2s and 1099s.

- Download the latest version of the Form 13h.

- Fill in personal information, including your name, address, and Social Security number.

- Provide accurate financial details, including income and deductions.

- Double-check all entries for accuracy.

- Sign and date the form where indicated.

- Submit the completed form according to IRS instructions.

Penalties for Non-Compliance

Failing to file the Form 13h on time can result in significant penalties. The IRS imposes late filing penalties, which can accumulate over time. These penalties may vary based on how late the form is submitted and the amount of tax owed. Additionally, incorrect information on the form can lead to audits or further penalties. It is essential to understand these consequences to encourage timely and accurate filing.

Filing Deadlines / Important Dates

Timeliness is crucial when submitting the Form 13h. The IRS typically sets specific deadlines for filing this form, which can vary each tax year. Generally, the deadline aligns with the standard tax filing date, but it is important to verify the exact date each year. Missing the deadline can result in penalties, so staying informed about these important dates is essential for compliance.

Legal use of the Form 13h Form

The Form 13h must be used in accordance with IRS regulations to ensure its legal validity. This includes providing accurate and truthful information, as well as adhering to filing deadlines. Using the form incorrectly or submitting false information can lead to legal repercussions, including fines or criminal charges. Understanding the legal framework surrounding the Form 13h is essential for all taxpayers to avoid complications.

Quick guide on how to complete form 13h form

Handle Form 13h Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, enabling you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Form 13h Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The simplest way to edit and eSign Form 13h Form with ease

- Obtain Form 13h Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your device of choice. Edit and eSign Form 13h Form to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 13h form

The way to generate an electronic signature for your PDF in the online mode

The way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the form 13h late filing penalty?

The form 13h late filing penalty is a financial consequence imposed by tax authorities for failing to submit the required form on time. This penalty can increase the overall tax liability for businesses, making timely filing crucial. Utilizing tools like airSlate SignNow can help streamline the filing process and minimize the risk of incurring such penalties.

-

How can airSlate SignNow help prevent form 13h late filing penalties?

By using airSlate SignNow, businesses can automate their document signing and submission processes, ensuring timely completion. The platform offers reminders and tracking features, which help users stay on top of filing deadlines. This proactive approach signNowly reduces the risk of late filing penalties, including the form 13h late filing penalty.

-

What features does airSlate SignNow offer to assist with document filing?

airSlate SignNow provides an easy-to-use interface, customizable templates, and automated workflows designed for efficient document management. With eSignature capabilities and integration with popular accounting software, it streamlines the submission of documents such as the form 13h. These features collectively aid in timely filings and avoidance of penalties.

-

Is airSlate SignNow cost-effective for small businesses concerned about penalties?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, including small businesses. By investing in this solution, companies can not only save on costs associated with late filing penalties like the form 13h late filing penalty but also enhance their overall operational efficiency. The affordability paired with value makes it a smart choice for budget-conscious businesses.

-

What integrations does airSlate SignNow provide for ensuring timely filings?

airSlate SignNow integrates seamlessly with popular platforms like Google Drive, Dropbox, and various accounting software. This connectivity ensures that businesses can easily access and manage all necessary documentation in one place. Efficient integrations aid in avoiding mistakes or delays that could lead to penalties like the form 13h late filing penalty.

-

How secure is airSlate SignNow when handling sensitive documents?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and complies with legal standards to protect sensitive document data. By ensuring that critical filings are securely handled, users can have peace of mind when submitting documents like the form 13h, thus avoiding potential penalties.

-

Can airSlate SignNow help track the status of my form 13h filing?

Absolutely! airSlate SignNow includes tracking capabilities that allow users to monitor the status of their submitted documents. Users can receive notifications and updates, ensuring they are informed about the filing process and any actions needed to avoid penalties like the form 13h late filing penalty.

Get more for Form 13h Form

Find out other Form 13h Form

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now