Forms for Claiming a VAT Refund If Your Business GOV UK 2019-2026

Steps to complete the HMRC form refund

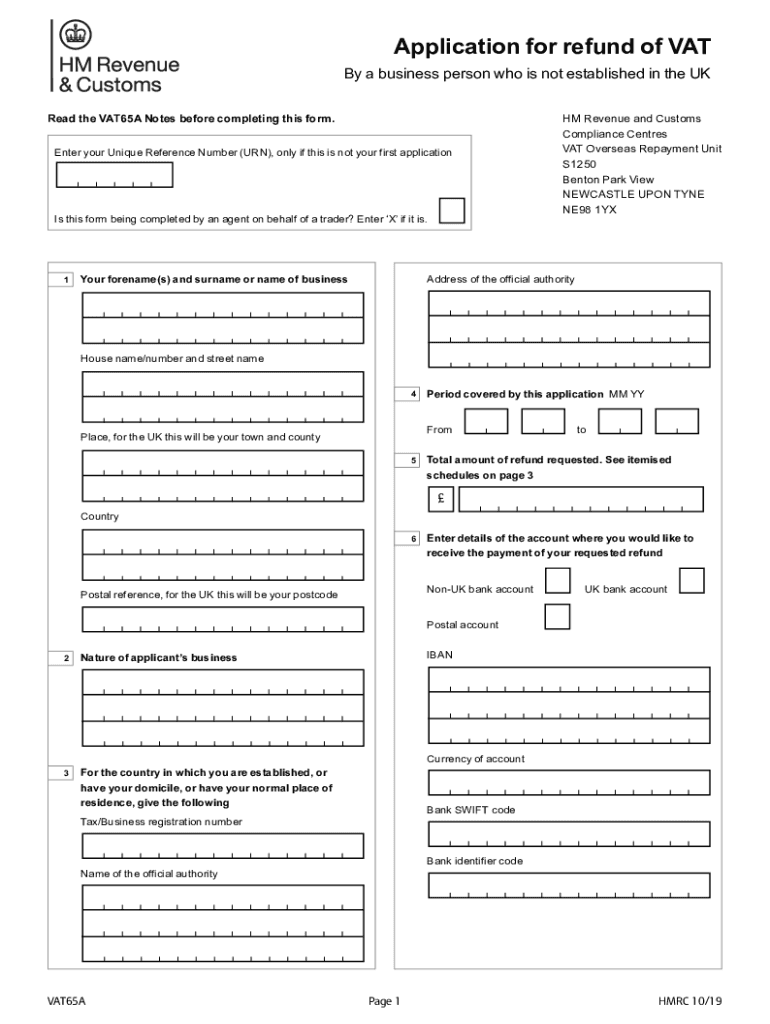

Completing the HMRC form refund involves several critical steps to ensure accuracy and compliance. First, gather all necessary documents, including receipts and invoices related to your claim. Next, carefully fill out the form, ensuring that all fields are completed accurately. Pay special attention to the sections that require financial details, as errors can lead to delays or rejections.

After filling out the form, review it thoroughly for any mistakes. It's advisable to have another person check your work as well. Once confirmed, submit the form either online or via traditional mail, depending on your preference and the specific requirements outlined by HMRC.

Required Documents for HMRC form refund

To successfully submit your HMRC form refund, you will need several essential documents. These typically include:

- Invoices or receipts that substantiate your claim

- Bank statements showing relevant transactions

- Any previous correspondence with HMRC regarding your tax status

- Identification documents to verify your identity

Ensure that all documents are clear and legible, as this will facilitate a smoother review process by HMRC.

Eligibility Criteria for HMRC form refund

Understanding the eligibility criteria for the HMRC form refund is crucial for a successful claim. Generally, you may qualify for a refund if you have overpaid your taxes or if your business has incurred VAT on purchases that exceed the VAT collected on sales. Additionally, ensure that you are registered for VAT and that your business activities fall within the scope of the refund.

It is also important to note that specific time limits apply for submitting your claim, so be aware of these deadlines to avoid missing out on potential refunds.

Form Submission Methods

The HMRC form refund can be submitted through various methods, providing flexibility based on your preferences. You can choose to file your claim online through the HMRC portal, which is often the quickest method. Alternatively, you may opt to send your completed form and supporting documents via traditional mail. Ensure that you retain copies of everything you submit for your records.

For those who prefer in-person interactions, visiting an HMRC office may also be an option, but it is advisable to check for any specific requirements or appointments needed before going.

IRS Guidelines

While the HMRC form refund pertains to UK tax matters, it is essential to be aware of IRS guidelines if you are a U.S. taxpayer. Understanding how your tax obligations in the U.S. may interact with foreign tax refunds can help you navigate your financial responsibilities more effectively. Consult with a tax professional to ensure compliance with both HMRC and IRS regulations.

Penalties for Non-Compliance

Failing to comply with the regulations surrounding the HMRC form refund can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial to adhere to all guidelines and deadlines to avoid these consequences. Keeping accurate records and submitting your claims in a timely manner will help mitigate risks associated with non-compliance.

Quick guide on how to complete forms for claiming a vat refund if your business govuk

Complete Forms For Claiming A VAT Refund If Your Business GOV UK effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the required form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly and without holdups. Manage Forms For Claiming A VAT Refund If Your Business GOV UK on any device with airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The easiest way to modify and eSign Forms For Claiming A VAT Refund If Your Business GOV UK without hassle

- Obtain Forms For Claiming A VAT Refund If Your Business GOV UK and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, SMS, or a shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate the printing of additional document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Alter and eSign Forms For Claiming A VAT Refund If Your Business GOV UK to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct forms for claiming a vat refund if your business govuk

Create this form in 5 minutes!

How to create an eSignature for the forms for claiming a vat refund if your business govuk

The way to make an eSignature for your PDF document online

The way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is an HMRC form refund and how can airSlate SignNow assist with it?

An HMRC form refund refers to the process of reclaiming overpaid taxes from HMRC. airSlate SignNow simplifies this process by allowing you to eSign and send necessary documents securely and efficiently, ensuring a hassle-free submission for your HMRC form refund.

-

How does airSlate SignNow streamline the HMRC form refund process?

airSlate SignNow streamlines the HMRC form refund process by providing a user-friendly platform for electronic signatures and document management. This allows users to complete the required paperwork quickly, minimizing delays and maximizing the chances of a successful refund.

-

What features does airSlate SignNow offer for managing HMRC form refunds?

airSlate SignNow offers various features to enhance the management of HMRC form refunds, including customizable templates, secure cloud storage, and automated workflows. These tools help ensure all necessary information is accurately captured and submitted promptly.

-

Are there any costs associated with using airSlate SignNow for HMRC form refunds?

Yes, airSlate SignNow operates on a subscription model, offering several pricing plans that cater to different business needs. Each plan provides access to key features that can optimize the process of submitting an HMRC form refund, making it a cost-effective solution.

-

Can I integrate airSlate SignNow with other tools to manage my HMRC form refund?

Absolutely! airSlate SignNow integrates seamlessly with various applications, such as CRM systems and cloud storage services. This integration capability enhances the overall efficiency when handling HMRC form refunds, allowing for smoother operations across your business.

-

Is airSlate SignNow secure for submitting sensitive HMRC form refund documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that all documents, including HMRC form refund submissions, are protected with advanced encryption methods. Your data integrity is paramount, so you can confidently manage sensitive information.

-

What benefits does airSlate SignNow provide for businesses handling HMRC form refunds?

Using airSlate SignNow offers numerous benefits for businesses managing HMRC form refunds, such as time savings, reduced paperwork, and improved accuracy. These advantages enable companies to focus on their core operations while ensuring efficient tax refund processes.

Get more for Forms For Claiming A VAT Refund If Your Business GOV UK

- Delaware 613381459 form

- Suggested affidavit form nonresident purchaser

- Az joint tax application form

- File adjust or review quarterly tax ampamp wage reportdes ncfile adjust or review quarterly tax ampamp wage reportdes ncfile form

- Florida dept of revenue reemployment tax return and payment information

- Reporting agent authorization form

- Form 165 instructions azdorgov

- Exemption certificates for sales taxexemption certificates for sales taxexemption certificates for sales taxexemption form

Find out other Forms For Claiming A VAT Refund If Your Business GOV UK

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free