Appeal Against Penalties for Late Filing and Late Payment Fill 2020-2026

Understanding the Appeal Against Penalties for Late Filing and Late Payment

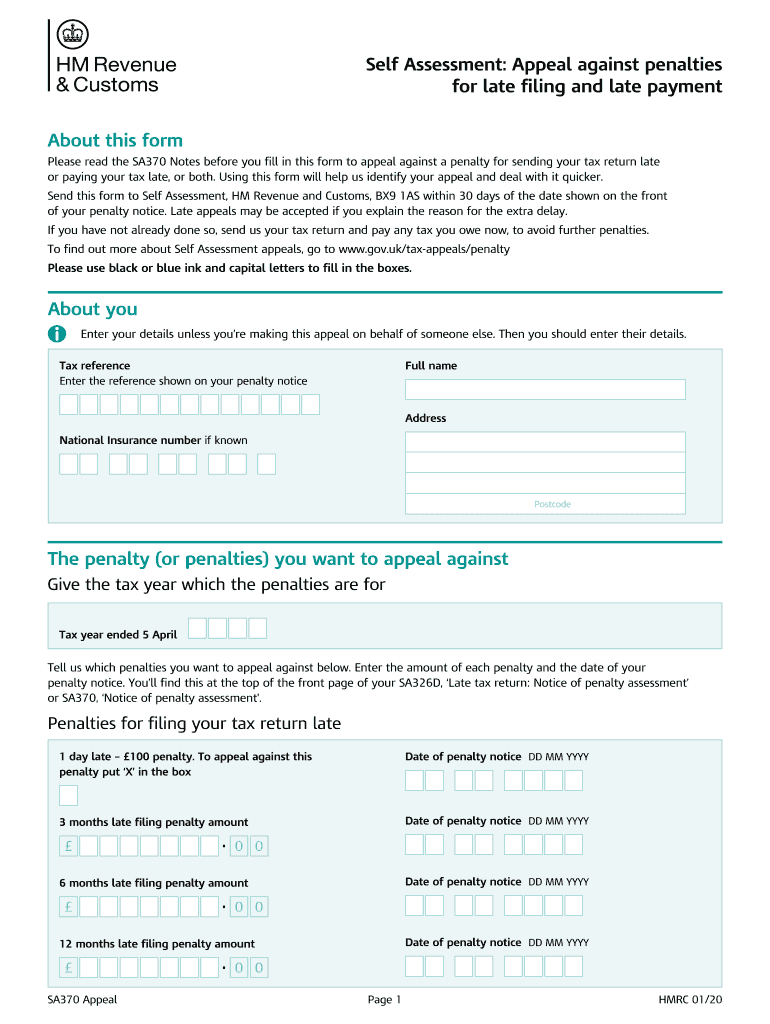

The appeal against penalties for late filing and late payment is a formal request submitted to HMRC when a taxpayer believes they have been unfairly penalized. This appeal can be based on various grounds, such as extenuating circumstances that prevented timely filing or payment. Understanding the basis for your appeal is crucial, as it will guide the information you need to provide in your sa370 appeal form.

Steps to Complete the Appeal Against Penalties

Filling out the sa370 appeal form involves several key steps:

- Gather relevant documentation that supports your case, such as correspondence with HMRC or evidence of circumstances that led to the delay.

- Clearly state the reasons for your appeal in the form, ensuring you provide a comprehensive explanation of your situation.

- Review the completed form for accuracy before submission, as any errors may delay the process.

- Submit the form via the preferred method, whether online or by mail, ensuring you keep a copy for your records.

Key Elements of the Appeal Form

The sa370 appeal form requires specific information to be considered valid. Key elements include:

- Your personal details, including name and address.

- The specific penalty you are appealing against, including the amount and the reason for the penalty.

- A detailed explanation of why you believe the penalty is unjust, supported by any relevant documentation.

- Your signature, which is necessary for the form to be legally binding.

Legal Use of the Appeal Form

When used correctly, the sa370 appeal form is legally binding. It is essential to comply with all legal requirements when filling out the form, including providing truthful information and adhering to submission deadlines. The form must be signed, and if submitted electronically, it should meet the standards set by eSignature regulations to ensure its validity.

Obtaining the Appeal Form

The sa370 appeal form can be obtained directly from HMRC's website or through official channels that provide tax-related documentation. It is advisable to ensure you are using the most current version of the form to avoid any issues during the appeal process.

Filing Deadlines for Appeals

Timeliness is crucial when submitting your sa370 appeal form. Generally, appeals must be filed within a specific timeframe following the issuance of the penalty notice. It is important to check the exact deadlines applicable to your situation to ensure your appeal is considered valid.

Quick guide on how to complete appeal against penalties for late filing and late payment fill

Complete Appeal Against Penalties For Late Filing And Late Payment Fill effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Appeal Against Penalties For Late Filing And Late Payment Fill on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric task today.

How to modify and eSign Appeal Against Penalties For Late Filing And Late Payment Fill with ease

- Locate Appeal Against Penalties For Late Filing And Late Payment Fill and then click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, laborious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from a device of your choice. Alter and eSign Appeal Against Penalties For Late Filing And Late Payment Fill and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct appeal against penalties for late filing and late payment fill

Create this form in 5 minutes!

How to create an eSignature for the appeal against penalties for late filing and late payment fill

The way to make an eSignature for your PDF file online

The way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the sa370 appeal form and who needs it?

The sa370 appeal form is a document used for appealing decisions made regarding certain government benefits or services. It is essential for individuals who believe that their benefits have been calculated incorrectly or who wish to contest a decision made by the relevant authorities. Filling out this form properly can ensure that your appeal is processed smoothly.

-

How can airSlate SignNow help with the sa370 appeal form?

airSlate SignNow provides a streamlined platform to eSign and send the sa370 appeal form securely. Users can easily fill out, sign, and share their forms from any device. This not only saves time but also ensures that the document is transmitted safely and promptly.

-

Is there a cost associated with using airSlate SignNow for the sa370 appeal form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including options for individuals needing to process the sa370 appeal form. Pricing is competitive, ensuring that you get a cost-effective solution for eSigning and managing your documents. You can choose a plan that best suits your budget and requirements.

-

What are the key features of airSlate SignNow for managing the sa370 appeal form?

Key features include user-friendly eSigning, secure document storage, and the ability to track the status of your sa370 appeal form. Additionally, airSlate SignNow integrates seamlessly with various applications, ensuring a smooth workflow for all your document needs. These features make the process efficient and organized.

-

Can I integrate airSlate SignNow with other tools when using the sa370 appeal form?

Yes, airSlate SignNow integrates with numerous third-party platforms, allowing you to manage the sa370 appeal form in conjunction with tools you already use. This integration can enhance productivity and streamline your workflow, making it easier to send and receive important documents electronically.

-

What are the benefits of using airSlate SignNow for the sa370 appeal form?

Using airSlate SignNow for the sa370 appeal form offers several benefits, including time-saving capabilities and increased security for your sensitive documents. The platform simplifies the process of completing and submitting your appeal, allowing you to focus on more important tasks while ensuring that your documents are handled with care.

-

Is airSlate SignNow suitable for businesses handling the sa370 appeal form?

Absolutely, airSlate SignNow is designed to cater to businesses of all sizes that need to handle documents like the sa370 appeal form efficiently. Its robust features enable organizations to manage and track multiple submissions while maintaining compliance with legal standards. This ensures that your business can operate smoothly without compromising on document integrity.

Get more for Appeal Against Penalties For Late Filing And Late Payment Fill

- 2021 tax tables form

- Wwwuslegalformscomform library537313generate and send customized year end tax statementsreceipts

- Wwwdfaarkansasgovincome taxfiduciary andfiduciary and estate income tax forms arkansas

- Arkansasgovdfaincometaxstate of arkansas ar4ec employees withholding exemption form

- Char410 charities form

- Delaware form

- Md 433 a form

- Delaware 613381459 form

Find out other Appeal Against Penalties For Late Filing And Late Payment Fill

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed