Consent to Obtain Credit Report Consent to Obtain Credit Report Form

What is the Consent To Obtain Credit Report Consent To Obtain Credit Report

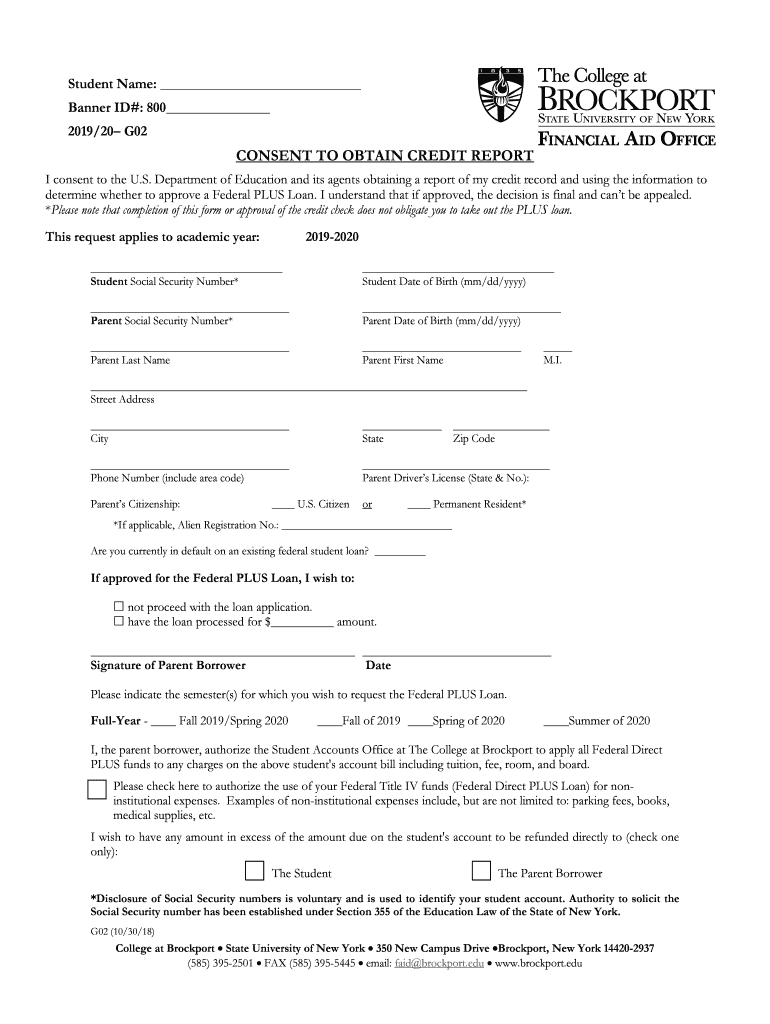

The Consent To Obtain Credit Report is a formal document that allows a lender or other authorized entity to access an individual's credit history. This consent is crucial in various financial transactions, including loan applications, credit card approvals, and rental agreements. By signing this document, the individual grants permission for the institution to review their credit report, which contains information about their credit history, outstanding debts, and payment behavior. This consent is essential for ensuring transparency and compliance with legal requirements in the lending process.

Key elements of the Consent To Obtain Credit Report Consent To Obtain Credit Report

Understanding the key elements of the Consent To Obtain Credit Report is vital for both consumers and lenders. The essential components typically include:

- Identification of the parties: The document should clearly state the names and contact information of both the individual granting consent and the entity requesting the credit report.

- Purpose of the consent: It should specify why the credit report is being requested, such as for a loan application or rental approval.

- Duration of consent: The form may indicate how long the consent is valid, whether it is a one-time check or ongoing access.

- Signature and date: The individual must sign and date the form to validate the consent legally.

Steps to complete the Consent To Obtain Credit Report Consent To Obtain Credit Report

Completing the Consent To Obtain Credit Report involves several straightforward steps:

- Review the document: Read through the entire consent form to understand the terms and implications.

- Fill in personal information: Provide accurate details, including your name, address, and Social Security number, as required.

- Specify the purpose: Clearly state why you are granting access to your credit report.

- Sign and date: Ensure you sign the document and include the date to confirm your consent.

Legal use of the Consent To Obtain Credit Report Consent To Obtain Credit Report

The Consent To Obtain Credit Report must comply with federal and state laws governing privacy and consumer rights. Under the Fair Credit Reporting Act (FCRA), consent must be obtained before a credit report can be accessed. This legal framework ensures that individuals are aware of who is reviewing their credit information and for what purpose. Failure to obtain proper consent can result in legal repercussions for the requesting entity, including fines and penalties.

How to use the Consent To Obtain Credit Report Consent To Obtain Credit Report

Using the Consent To Obtain Credit Report is a straightforward process. Once completed, the form should be submitted to the requesting entity, such as a bank or landlord. It is advisable to keep a copy of the signed consent for personal records. This ensures that you have documentation of your approval, which can be useful in case of disputes or misunderstandings regarding your credit report access.

State-specific rules for the Consent To Obtain Credit Report Consent To Obtain Credit Report

Each state may have specific regulations regarding the Consent To Obtain Credit Report. It is important to be aware of these variations, as they can affect the validity and requirements of the consent form. Some states may require additional disclosures or have different rules regarding how consent must be obtained. Consulting with a legal professional or reviewing state guidelines can help ensure compliance with local laws.

Quick guide on how to complete consent to obtain credit report consent to obtain credit report

Finish Consent To Obtain Credit Report Consent To Obtain Credit Report effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious substitute for conventional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without any holdups. Manage Consent To Obtain Credit Report Consent To Obtain Credit Report on any gadget with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign Consent To Obtain Credit Report Consent To Obtain Credit Report with ease

- Locate Consent To Obtain Credit Report Consent To Obtain Credit Report and click on Get Form to begin.

- Utilize the available tools to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for such tasks.

- Craft your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to secure your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign Consent To Obtain Credit Report Consent To Obtain Credit Report to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the consent to obtain credit report consent to obtain credit report

How to make an eSignature for a PDF in the online mode

How to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

The best way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the 'Consent To Obtain Credit Report Consent To Obtain Credit Report' feature?

The 'Consent To Obtain Credit Report Consent To Obtain Credit Report' feature allows businesses to efficiently collect consent from clients before accessing their credit reports. This is crucial for compliance with legal regulations. By utilizing airSlate SignNow, businesses can ensure they have secure and documented consent, streamlining the process.

-

How does airSlate SignNow facilitate the 'Consent To Obtain Credit Report Consent To Obtain Credit Report' process?

Using airSlate SignNow, businesses can easily create and send documents that include the 'Consent To Obtain Credit Report Consent To Obtain Credit Report' request. The platform offers customizable templates and electronic signatures, which help speed up the consent process. This ensures that your clients can respond quickly and securely.

-

Is there a cost associated with using the 'Consent To Obtain Credit Report Consent To Obtain Credit Report' feature?

The 'Consent To Obtain Credit Report Consent To Obtain Credit Report' feature is included in the pricing plans of airSlate SignNow. The platform offers competitive pricing models that cater to businesses of all sizes. You can choose a plan that aligns with your budget and needs, ensuring cost-effective use of this feature.

-

Can I integrate airSlate SignNow for 'Consent To Obtain Credit Report Consent To Obtain Credit Report' with other applications?

Yes, airSlate SignNow provides seamless integrations with various tools and applications to enhance the 'Consent To Obtain Credit Report Consent To Obtain Credit Report' workflow. This means that you can link it to your Customer Relationship Management (CRM) systems, email services, and more. These integrations help streamline processes and maintain centralized documentation.

-

What are the benefits of using airSlate SignNow for 'Consent To Obtain Credit Report Consent To Obtain Credit Report'?

Using airSlate SignNow for 'Consent To Obtain Credit Report Consent To Obtain Credit Report' offers numerous benefits, including enhanced security, efficiency, and compliance. It allows you to manage consent documentation with ease, ensuring you remain compliant with industry regulations. Additionally, the platform saves time, making your business operations smoother.

-

How secure is the 'Consent To Obtain Credit Report Consent To Obtain Credit Report' feature in airSlate SignNow?

The 'Consent To Obtain Credit Report Consent To Obtain Credit Report' feature in airSlate SignNow prioritizes security and complies with industry standards. The platform uses advanced encryption methods to protect sensitive documents and data. This ensures that client information remains confidential and secure throughout the consent process.

-

Can I track the status of the 'Consent To Obtain Credit Report Consent To Obtain Credit Report' requests?

Yes, airSlate SignNow allows you to easily track the status of all 'Consent To Obtain Credit Report Consent To Obtain Credit Report' requests. You will receive real-time updates on whether the consent has been granted or denied. This transparency helps you manage your workflow effectively and follow up accordingly with clients.

Get more for Consent To Obtain Credit Report Consent To Obtain Credit Report

Find out other Consent To Obtain Credit Report Consent To Obtain Credit Report

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy