Indiana Form 104 2003

What is the Indiana Form 104

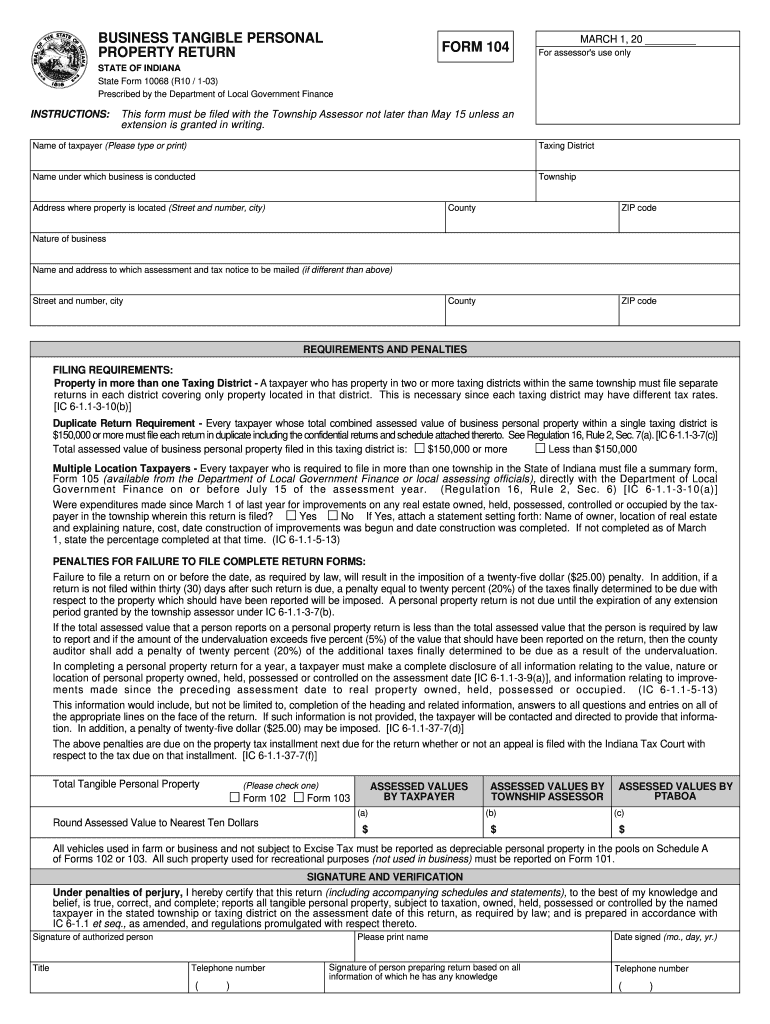

The Indiana Form 104 is a state-specific tax form used to report personal property taxes in Indiana. This form is essential for individuals and businesses that own tangible personal property, such as equipment, machinery, and inventory. Completing the form accurately ensures compliance with Indiana tax regulations and helps determine the amount of personal property tax owed to the state. The Indiana Form 104 is also known as the State of Indiana Business Personal Property Form 104.

How to use the Indiana Form 104

To use the Indiana Form 104 effectively, gather all necessary information regarding your personal property. This includes details about the type of property owned, its location, and its value. The form requires you to list each item of personal property and provide a description, acquisition date, and cost. After completing the form, ensure that you sign it and submit it to the appropriate county assessor's office. Using electronic tools like signNow can streamline this process, allowing for a secure and efficient completion of the form.

Steps to complete the Indiana Form 104

Completing the Indiana Form 104 involves several key steps:

- Gather all relevant information about your personal property.

- Download the Indiana Form 104 from the official state website or obtain a printed copy.

- Fill out the form, ensuring to include accurate descriptions and values for each item.

- Review the completed form for any errors or omissions.

- Sign the form to validate your submission.

- Submit the form to your county assessor's office by the specified deadline.

Legal use of the Indiana Form 104

The Indiana Form 104 is legally binding when completed and submitted according to state regulations. It is crucial to ensure that all information provided is accurate and truthful, as providing false information can lead to penalties. The form must be signed by the property owner or an authorized representative, and electronic signatures are acceptable if completed using a compliant eSignature solution. Adhering to the legal requirements surrounding this form helps protect your rights and ensures compliance with Indiana tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Indiana Form 104 are critical to avoid penalties. Typically, the form must be filed annually by May 15. If May 15 falls on a weekend or holiday, the deadline is extended to the next business day. It is important to stay informed about any changes to these dates, as timely submission is essential for maintaining compliance with Indiana tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The Indiana Form 104 can be submitted through various methods to accommodate different preferences. You can choose to file the form online using the Indiana Department of Revenue's electronic filing system, which offers a convenient and secure way to submit your information. Alternatively, you can mail the completed form to your county assessor's office or deliver it in person. Each method has its advantages, so select the one that best suits your needs.

Required Documents

When completing the Indiana Form 104, certain documents may be required to support your claims. These documents typically include:

- Proof of acquisition for each item of personal property.

- Previous year’s tax returns, if applicable.

- Any relevant financial statements or appraisals for high-value items.

Having these documents ready will facilitate the completion of the form and ensure that all necessary information is accurately reported.

Quick guide on how to complete indiana state form 104

Prepare Indiana Form 104 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Indiana Form 104 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to edit and eSign Indiana Form 104 seamlessly

- Obtain Indiana Form 104 and click on Get Form to start.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, monotonous form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and eSign Indiana Form 104 and ensure excellent communication at any stage of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indiana state form 104

FAQs

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Do you have to fill out a separate form to avail state quota in NEET?

No..you dont have to fill form..But you have to register yourself in directorate of medical education/DME of your state for state quota counselling process..DME Will issue notice regarding process, date, of 1st round of counsellingCounselling schedule have info regarding date for registration , process of counselling etc.You will have to pay some amount of fee at the time of registration as registration fee..As soon as neet result is out..check for notification regarding counselling on DmE site..Hope this helpBest wishes dear.

Create this form in 5 minutes!

How to create an eSignature for the indiana state form 104

How to create an eSignature for the Indiana State Form 104 in the online mode

How to make an electronic signature for your Indiana State Form 104 in Google Chrome

How to create an electronic signature for signing the Indiana State Form 104 in Gmail

How to generate an electronic signature for the Indiana State Form 104 from your mobile device

How to create an electronic signature for the Indiana State Form 104 on iOS

How to create an electronic signature for the Indiana State Form 104 on Android devices

People also ask

-

What is the Indiana Form 104?

The Indiana Form 104 is the state's individual income tax return form for residents. It is used to report income, deductions, and credits to determine the amount of tax owed to the Indiana Department of Revenue. Completing the Indiana Form 104 accurately is essential for filing your taxes timely and avoiding penalties.

-

How can airSlate SignNow help with the Indiana Form 104?

airSlate SignNow simplifies the process of signing and sending the Indiana Form 104. With our user-friendly platform, you can easily upload your completed form, add electronic signatures, and send it directly to the appropriate tax authority or recipients. This streamlines the tax filing process and ensures your documents are securely handled.

-

What are the pricing options for using airSlate SignNow for the Indiana Form 104?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, starting with a free trial for new users. Our subscription options are competitively priced, making it cost-effective for individuals and businesses looking to manage their document signing, including the Indiana Form 104. Check our website for the latest pricing details.

-

Are there any features specifically beneficial for managing the Indiana Form 104?

Yes, airSlate SignNow provides several features that are particularly useful for handling the Indiana Form 104. These include customizable templates for tax forms, secure cloud storage, and the ability to track document status in real-time, ensuring you can manage your tax documents efficiently and securely.

-

Can I integrate airSlate SignNow with other software for filing the Indiana Form 104?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your Indiana Form 104 alongside other financial documents. Popular integrations include QuickBooks, Salesforce, and Google Drive, helping you streamline your workflows and enhance productivity.

-

What benefits does airSlate SignNow offer for businesses filing the Indiana Form 104?

Using airSlate SignNow for the Indiana Form 104 provides numerous benefits, including faster processing times and reduced administrative burdens. The electronic signing process is legally binding and secure, which helps businesses save time and increase efficiency when submitting their tax forms.

-

Is airSlate SignNow compliant with Indiana tax regulations for the Form 104?

Yes, airSlate SignNow is designed to comply with all relevant tax regulations, including those pertaining to the Indiana Form 104. Our platform ensures that all electronic signatures meet legal standards, enabling you to file your tax documents with confidence and in accordance with state laws.

Get more for Indiana Form 104

- Forcible detainer form

- Fillable notice to vacate kentucky for non payment form

- Bapplicationb for hardship driver39s license kentucky court of justice courts ky form

- Affidavit and truancy evaluation form kentucky court of justice courts ky

- 10 krs 189a courts ky form

- Retired judge voucher for services as special judge courts ky form

- Kentucky 2 aoc form

- Contract of employment standard latest doc form

Find out other Indiana Form 104

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document