Business Tangible Personal Property Return Form 104 2023-2026

What is the Business Tangible Personal Property Return Form 104

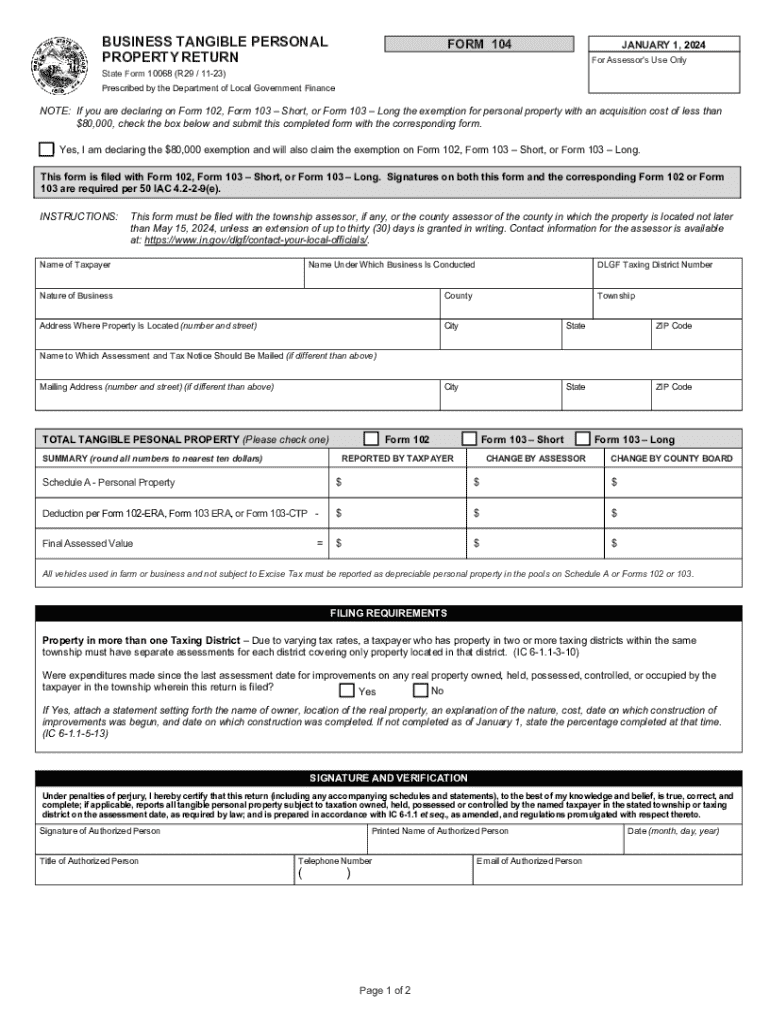

The Business Tangible Personal Property Return Form 104 is a tax document used by businesses in the United States to report tangible personal property owned as of January first of the tax year. This form is essential for assessing property taxes on items such as machinery, equipment, and furniture. Accurate reporting ensures compliance with state tax regulations and helps determine the taxable value of the business's assets.

How to use the Business Tangible Personal Property Return Form 104

Using the Business Tangible Personal Property Return Form 104 involves several steps. First, gather all necessary information about the tangible personal property owned by the business. This includes details about each asset, such as purchase date, cost, and current value. Next, complete the form by entering the required information in the designated sections. After filling out the form, review it for accuracy before submitting it to the appropriate local tax authority.

Steps to complete the Business Tangible Personal Property Return Form 104

Completing the Business Tangible Personal Property Return Form 104 requires careful attention to detail. Follow these steps:

- Collect documentation for all tangible personal property owned by the business.

- Fill in the business information, including name, address, and tax identification number.

- List each item of tangible personal property, providing details such as acquisition date and cost.

- Calculate the total value of all reported assets.

- Sign and date the form to certify its accuracy.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Business Tangible Personal Property Return Form 104. Typically, this form must be submitted by April fifteenth of the tax year. However, specific deadlines may vary by state, so it is advisable to check with local tax authorities for any changes or extensions that may apply.

Required Documents

To complete the Business Tangible Personal Property Return Form 104, certain documents are necessary. These may include:

- Purchase invoices for tangible personal property.

- Previous tax returns that include asset information.

- Depreciation schedules for any assets owned.

- Any additional documentation that supports the valuation of the property.

Penalties for Non-Compliance

Failing to file the Business Tangible Personal Property Return Form 104 on time or providing inaccurate information can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action by the state. It is essential for businesses to adhere to filing requirements to avoid these consequences.

Quick guide on how to complete business tangible personal property return form 104

Effortlessly Prepare Business Tangible Personal Property Return Form 104 on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal sustainable alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Business Tangible Personal Property Return Form 104 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Alter and Electronically Sign Business Tangible Personal Property Return Form 104 Effortlessly

- Locate Business Tangible Personal Property Return Form 104 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or mistakes requiring the printing of new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Business Tangible Personal Property Return Form 104 to ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business tangible personal property return form 104

Create this form in 5 minutes!

How to create an eSignature for the business tangible personal property return form 104

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 104 form and why is it important?

The 104 form is a crucial tax document used by individuals to report their annual income to the IRS. Understanding how to properly fill out and submit a 104 form is essential for compliance and to avoid penalties. airSlate SignNow simplifies the process of signing and sending your 104 form electronically, ensuring accuracy and efficiency.

-

How can airSlate SignNow help with the 104 form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending your 104 form. With features like templates and secure storage, you can streamline your tax filing process. This ensures that your 104 form is completed accurately and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the 104 form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that can help you manage your 104 form efficiently. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the 104 form?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage. These tools make it easier to prepare, sign, and send your 104 form. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for my 104 form?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your workflow for managing the 104 form. You can connect it with accounting software, CRMs, and more to streamline your document management process. This integration helps ensure that your 104 form is handled efficiently.

-

What are the benefits of using airSlate SignNow for the 104 form?

Using airSlate SignNow for your 104 form provides numerous benefits, including time savings, enhanced security, and improved accuracy. The platform allows you to complete your tax documents quickly and securely, reducing the risk of errors. This can lead to a smoother tax filing experience.

-

Is airSlate SignNow secure for sending my 104 form?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including the 104 form. With encryption and secure access controls, you can trust that your sensitive information is safe while using the platform. This ensures peace of mind when sending your tax documents.

Get more for Business Tangible Personal Property Return Form 104

Find out other Business Tangible Personal Property Return Form 104

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast