Use This Form to Request to Reduce Your Old Age Security OAS Recovery Tax If You Estimate that Your Income for the Current Year 2020

What is the Use This Form To Request To Reduce Your Old Age Security OAS Recovery Tax If You Estimate That Your Income For The Current Year Will Be Lower Than The

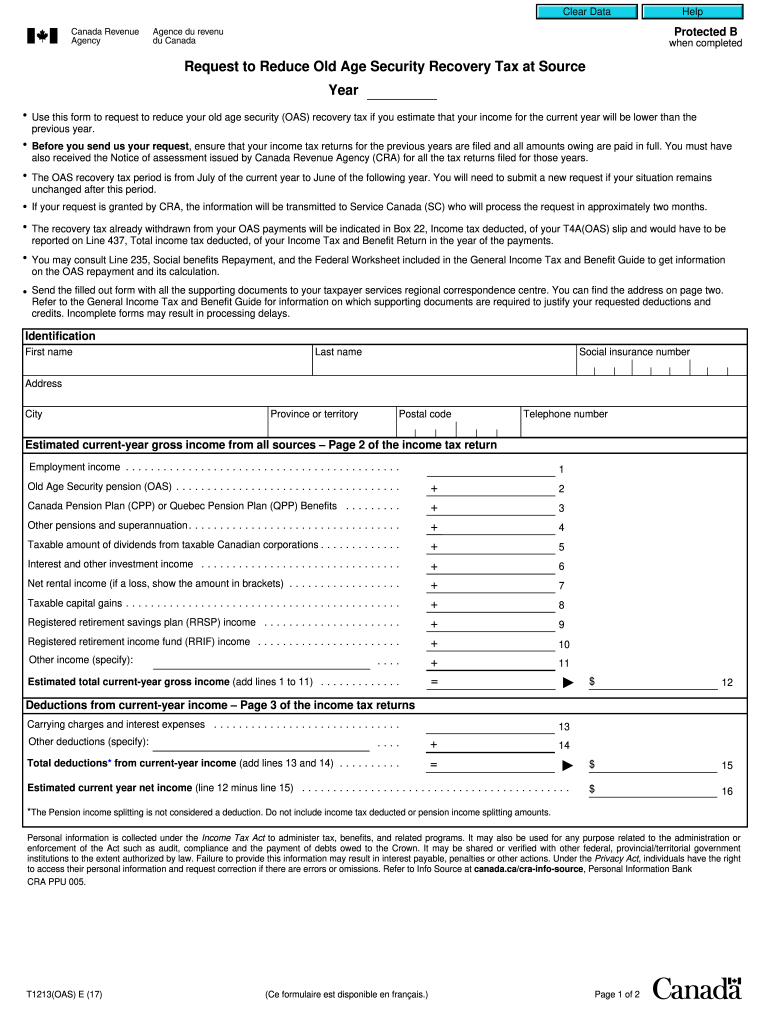

This form is designed for individuals who wish to request a reduction in their Old Age Security (OAS) recovery tax based on an estimation that their income for the current year will be lower than in previous years. The OAS recovery tax is a mechanism that adjusts the amount of benefits received based on the income level of the recipient. By submitting this form, individuals can potentially lower their tax burden and receive a more accurate benefit amount that reflects their current financial situation.

Steps to complete the Use This Form To Request To Reduce Your Old Age Security OAS Recovery Tax If You Estimate That Your Income For The Current Year Will Be Lower Than The

Completing this form involves several key steps to ensure accuracy and compliance. First, gather all relevant financial documents that support your income estimation, such as pay stubs, tax returns, and any other income statements. Next, fill out the form with your personal information, including your Social Security number and current address. Clearly indicate your estimated income for the current year and provide any necessary explanations or justifications for the reduction request. Finally, review the completed form for accuracy before submitting it either electronically or by mail, depending on the submission options available.

Legal use of the Use This Form To Request To Reduce Your Old Age Security OAS Recovery Tax If You Estimate That Your Income For The Current Year Will Be Lower Than The

The legal use of this form is governed by specific regulations that ensure its validity in the context of tax law. It is essential to complete the form accurately and submit it in accordance with the guidelines provided by the relevant authorities. This form must be signed and dated to be considered legally binding. Additionally, retaining copies of all submitted documents is advisable for future reference and to comply with any potential audits or inquiries.

Eligibility Criteria

To be eligible to use this form, individuals must meet certain criteria. Primarily, they should be recipients of Old Age Security benefits and have a reasonable basis for estimating that their income for the current year will be lower than in prior years. This could include circumstances such as retirement, reduced work hours, or other financial changes. It is important to ensure that all eligibility requirements are met to avoid delays or rejections in processing the request.

Form Submission Methods (Online / Mail / In-Person)

This form can typically be submitted through various methods to accommodate different preferences. Individuals may have the option to submit the form online via a secure portal, which often provides immediate confirmation of receipt. Alternatively, the form can be mailed to the designated address provided in the instructions, ensuring it is sent with sufficient time to meet any deadlines. In some cases, in-person submission may also be available at local offices, allowing for direct interaction with staff who can provide assistance.

Required Documents

When completing the form, certain documents may be required to support your request. These typically include proof of income, such as recent tax returns, pay stubs, or other financial statements that substantiate your income estimation. Additionally, any documentation that explains changes in your financial situation, such as retirement letters or medical records, may also be beneficial. Ensuring that all required documents are included will help facilitate a smoother review process.

Quick guide on how to complete use this form to request to reduce your old age security oas recovery tax if you estimate that your income for the current year

Effortlessly Prepare Use This Form To Request To Reduce Your Old Age Security OAS Recovery Tax If You Estimate That Your Income For The Current Year on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without interruptions. Manage Use This Form To Request To Reduce Your Old Age Security OAS Recovery Tax If You Estimate That Your Income For The Current Year on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to Modify and eSign Use This Form To Request To Reduce Your Old Age Security OAS Recovery Tax If You Estimate That Your Income For The Current Year with Ease

- Find Use This Form To Request To Reduce Your Old Age Security OAS Recovery Tax If You Estimate That Your Income For The Current Year and click on Get Form to begin.

- Use the tools available to fill out your form.

- Select important sections of your documents or redact sensitive data using the tools airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searching, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Edit and eSign Use This Form To Request To Reduce Your Old Age Security OAS Recovery Tax If You Estimate That Your Income For The Current Year to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct use this form to request to reduce your old age security oas recovery tax if you estimate that your income for the current year

Create this form in 5 minutes!

How to create an eSignature for the use this form to request to reduce your old age security oas recovery tax if you estimate that your income for the current year

The best way to generate an electronic signature for your PDF file in the online mode

The best way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is the purpose of the form to request a reduction in Old Age Security OAS Recovery Tax?

The form allows you to formally request a reduction in your Old Age Security OAS Recovery Tax if you estimate that your income for the current year will be lower than the threshold. Completing this form can help you retain more of your benefits, making it an essential step for those experiencing a change in their financial situation.

-

How can airSlate SignNow help me use this form effectively?

With airSlate SignNow, you can easily fill out and eSign the form to request a reduction in your OAS Recovery Tax. The platform offers a user-friendly interface that simplifies document management, ensuring you meet deadlines without any hassle.

-

Is there a cost associated with using airSlate SignNow for this process?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. The cost is typically competitive, providing great value for the ability to electronically manage, eSign, and submit forms, such as the one to request a reduction in your Old Age Security OAS Recovery Tax.

-

What features does airSlate SignNow offer for managing my tax-related documents?

airSlate SignNow provides several features, including document templates, secure eSigning, and easy sharing options. These features are designed to streamline the process, helping you use this form to request to reduce your Old Age Security OAS Recovery Tax with minimal effort.

-

How do I know if I qualify to use this form?

You qualify to use this form if your estimated income for the current year will be lower than the required threshold set by the government. It’s essential to review your financial situation carefully before submitting this request, and airSlate SignNow can assist with the documentation needed.

-

Can I access airSlate SignNow from multiple devices?

Absolutely! airSlate SignNow is cloud-based, allowing you to access and manage your documents from any device with internet connectivity. This flexibility makes it easy to use this form to request to reduce your Old Age Security OAS Recovery Tax wherever you are.

-

What benefits does using airSlate SignNow provide for seniors handling tax forms?

Using airSlate SignNow provides senior users the benefit of a simplified process for managing important tax documents, enhancing accessibility and security. This ensures that you can use this form to request a reduction in your OAS Recovery Tax efficiently and stress-free.

Get more for Use This Form To Request To Reduce Your Old Age Security OAS Recovery Tax If You Estimate That Your Income For The Current Year

Find out other Use This Form To Request To Reduce Your Old Age Security OAS Recovery Tax If You Estimate That Your Income For The Current Year

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template