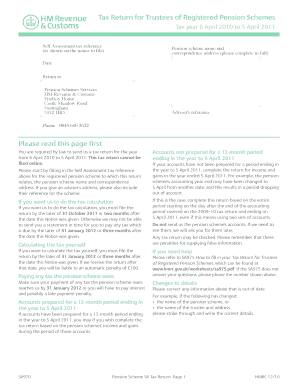

Tax Return for Trustees of Registered Pension Schemes Use Form SA970 to File Your Tax Return for the Tax Year Ended 5 April If Y 2020

Understanding the Tax Return for Trustees of Registered Pension Schemes

The tax return for trustees of registered pension schemes is a crucial document for those managing pension funds. It allows trustees to report income and gains to tax authorities. In the United States, while the specific form SA970 is not applicable, understanding the concept of tax returns for pension schemes is essential. Trustees must ensure compliance with relevant tax regulations to avoid penalties and ensure proper management of pension assets.

Steps to Complete the Tax Return for Trustees

Completing the tax return involves several key steps. First, gather all necessary financial records related to the pension scheme. This includes income statements, investment gains, and any applicable deductions. Next, fill out the tax return form accurately, ensuring all information is complete and correct. It is advisable to review the form thoroughly before submission to prevent errors that could lead to delays or penalties.

Required Documents for Filing

To file the tax return, trustees need specific documents. These typically include:

- Financial statements of the pension scheme

- Records of contributions and distributions

- Investment income reports

- Any correspondence with tax authorities

Having these documents ready will streamline the filing process and help ensure that all necessary information is reported accurately.

Filing Methods for the Tax Return

Trustees can submit their tax return through various methods. The most common methods include:

- Online submission through authorized tax platforms

- Mailing a paper copy to the relevant tax authority

- In-person filing at designated tax offices

Choosing the right method depends on the trustee's preference and the specific requirements of the tax authority.

Penalties for Non-Compliance

Failure to file the tax return on time or inaccuracies in the submission can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Trustees should be aware of the deadlines and ensure that all information is submitted accurately to avoid these consequences.

Digital vs. Paper Versions of the Tax Return

While both digital and paper versions of the tax return are available, digital submissions are often preferred. Electronic filing can be more efficient, reducing the risk of errors and speeding up processing times. Additionally, digital platforms typically offer features that help ensure compliance with tax regulations, making the process smoother for trustees.

Quick guide on how to complete tax return for trustees of registered pension schemes 2011 use form sa970 to file your tax return for the tax year ended 5

Prepare Tax Return For Trustees Of Registered Pension Schemes Use Form SA970 To File Your Tax Return For The Tax Year Ended 5 April If Y effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and eSign your documents quickly and without delays. Handle Tax Return For Trustees Of Registered Pension Schemes Use Form SA970 To File Your Tax Return For The Tax Year Ended 5 April If Y on any device using airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

How to modify and eSign Tax Return For Trustees Of Registered Pension Schemes Use Form SA970 To File Your Tax Return For The Tax Year Ended 5 April If Y without any hassle

- Locate Tax Return For Trustees Of Registered Pension Schemes Use Form SA970 To File Your Tax Return For The Tax Year Ended 5 April If Y and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, monotonous form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Tax Return For Trustees Of Registered Pension Schemes Use Form SA970 To File Your Tax Return For The Tax Year Ended 5 April If Y to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax return for trustees of registered pension schemes 2011 use form sa970 to file your tax return for the tax year ended 5

Create this form in 5 minutes!

How to create an eSignature for the tax return for trustees of registered pension schemes 2011 use form sa970 to file your tax return for the tax year ended 5

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is the Tax Return For Trustees Of Registered Pension Schemes using Form SA970?

The Tax Return For Trustees Of Registered Pension Schemes allows trustees to report income and claim relief for a registered pension scheme by using Form SA970. It is essential for ensuring compliance with HMRC requirements for the tax year ended 5 April. This ensures trustees accurately disclose the scheme's financial activities.

-

Who needs to use Form SA970 for their tax return?

If you are a trustee of a registered pension scheme, you must use Form SA970 to file your Tax Return For Trustees Of Registered Pension Schemes. This form is specifically designed for trustees managing pension-related trusts and helps in properly reporting the financial performance of the schemes.

-

How do I start the process of filing my tax return as a trustee?

To file your tax return as a trustee, you will need to complete Form SA970 before the filing deadline set by HMRC. You can obtain this form from the official HMRC website, which provides guidance on filling it out accurately for the tax year ended 5 April.

-

What are the key benefits of using airSlate SignNow for tax returns?

airSlate SignNow offers a user-friendly platform that simplifies the process of signing and submitting your tax return documents. With features like eSignature integration and document management, it ensures your Tax Return For Trustees Of Registered Pension Schemes is filed efficiently and securely.

-

Is airSlate SignNow compliant with HMRC regulations?

Yes, airSlate SignNow is compliant with HMRC regulations, ensuring that your documents, including the Tax Return For Trustees Of Registered Pension Schemes using Form SA970, are processed in accordance with legal requirements. This compliance provides peace of mind to trustees managing registered pension schemes.

-

Are there any costs associated with filing tax returns using airSlate SignNow?

While airSlate SignNow provides a cost-effective solution for document management, there may be subscription fees or charges based on the features you utilize. However, the investment ensures that your Tax Return For Trustees Of Registered Pension Schemes using Form SA970 is managed efficiently and securely.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow supports integrations with various accounting and financial software, which can streamline your workflow. This integration facilitates more efficient management of your Tax Return For Trustees Of Registered Pension Schemes and helps maintain accurate financial records.

Get more for Tax Return For Trustees Of Registered Pension Schemes Use Form SA970 To File Your Tax Return For The Tax Year Ended 5 April If Y

Find out other Tax Return For Trustees Of Registered Pension Schemes Use Form SA970 To File Your Tax Return For The Tax Year Ended 5 April If Y

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free