Tax Return for Trustees of Registered Pension Schemes Use Form SA970 to File Your Tax Returnfor the Tax Year Ended 5 April If Yo 2020

Understanding the Tax Return for Trustees of Registered Pension Schemes

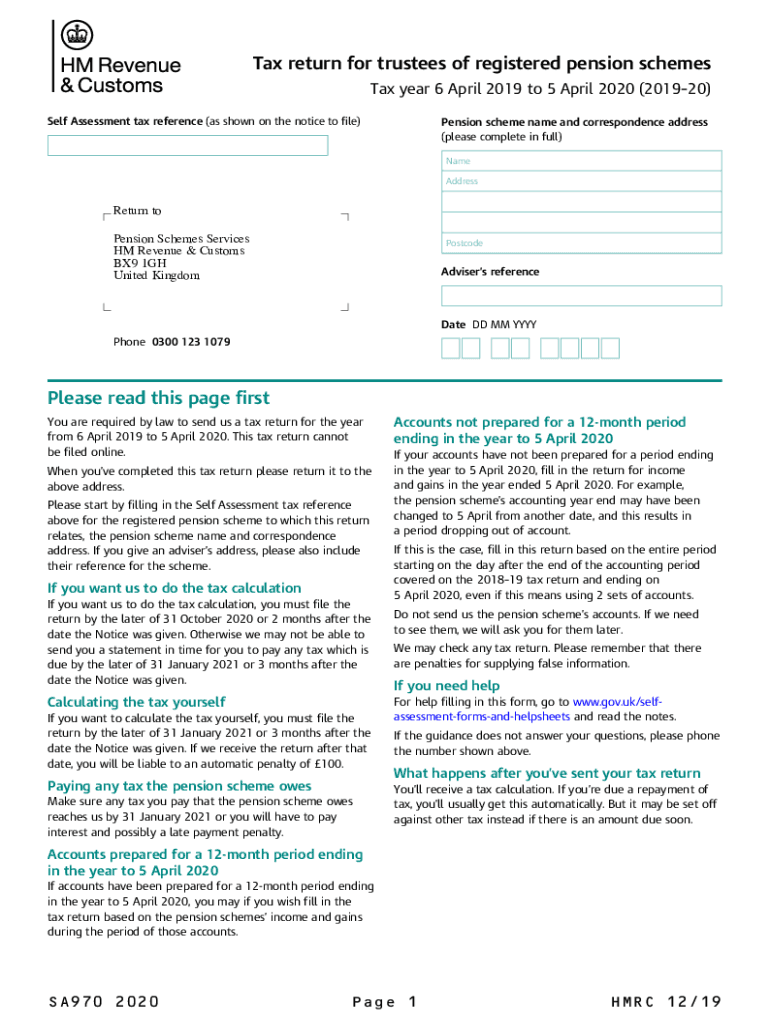

The form SA970 is specifically designed for trustees of registered pension schemes to file their tax returns for the tax year ending on April 5. This form is essential for ensuring compliance with tax regulations governing pension schemes in the United Kingdom. By using the SA970, trustees can report income and gains, ensuring that the pension scheme meets its tax obligations. It is important for trustees to accurately complete this form to avoid potential penalties and ensure the proper management of the pension scheme's finances.

Steps to Complete the SA970 Form

Completing the SA970 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records related to the pension scheme, including income statements, investment gains, and expenses. Next, fill out the form with accurate figures, ensuring that all sections are completed. Pay special attention to the calculations, as errors can lead to complications. Once the form is filled out, review it for completeness and accuracy before submission. Finally, submit the form by the deadline to avoid any penalties.

Legal Use of the SA970 Form

The SA970 form must be used in accordance with the legal requirements set forth by HM Revenue and Customs (HMRC). This includes ensuring that the information provided is truthful and complete. The form serves as a declaration of the pension scheme's financial activities for the specified tax year. Trustees should be aware that submitting false information can lead to serious legal consequences, including fines and potential criminal charges. Therefore, it is crucial to use the form responsibly and in compliance with all applicable laws.

Filing Deadlines for the SA970 Form

Timely submission of the SA970 form is critical for compliance. The deadline for filing the form is typically aligned with the end of the tax year, which is April 5. Trustees should be aware of any extensions or specific deadlines that may apply to their circumstances. Missing the deadline can result in penalties, so it is advisable to plan ahead and complete the form well in advance of the due date.

Required Documents for the SA970 Form

To successfully complete the SA970 form, trustees will need to gather several key documents. These include financial statements detailing the pension scheme's income and expenses, investment records, and any relevant correspondence from HMRC. Having these documents readily available will streamline the process of filling out the form and ensure that all necessary information is included.

Penalties for Non-Compliance with the SA970 Form

Failure to comply with the requirements of the SA970 form can lead to significant penalties. These may include financial fines, interest on unpaid taxes, and potential legal action. It is essential for trustees to understand the importance of timely and accurate filing to avoid these repercussions. Regular training and updates on tax obligations can help trustees remain compliant and informed.

Quick guide on how to complete tax return for trustees of registered pension schemes 2020 use form sa9702020 to file your tax returnfor the tax year ended 5

Complete Tax Return For Trustees Of Registered Pension Schemes Use Form SA970 To File Your Tax Returnfor The Tax Year Ended 5 April If Yo effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the required form and securely save it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Tax Return For Trustees Of Registered Pension Schemes Use Form SA970 To File Your Tax Returnfor The Tax Year Ended 5 April If Yo on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Tax Return For Trustees Of Registered Pension Schemes Use Form SA970 To File Your Tax Returnfor The Tax Year Ended 5 April If Yo effortlessly

- Locate Tax Return For Trustees Of Registered Pension Schemes Use Form SA970 To File Your Tax Returnfor The Tax Year Ended 5 April If Yo and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with features offered by airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal value as a conventional ink signature.

- Review the details and click the Done button to save your changes.

- Select how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Tax Return For Trustees Of Registered Pension Schemes Use Form SA970 To File Your Tax Returnfor The Tax Year Ended 5 April If Yo to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax return for trustees of registered pension schemes 2020 use form sa9702020 to file your tax returnfor the tax year ended 5

Create this form in 5 minutes!

How to create an eSignature for the tax return for trustees of registered pension schemes 2020 use form sa9702020 to file your tax returnfor the tax year ended 5

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

The best way to create an eSignature for a PDF file on Android

People also ask

-

What is the form sa970 and how is it used?

The form sa970 is a crucial document used for tax reporting purposes. It allows businesses to report their income and expenses accurately, ensuring compliance with tax regulations. With airSlate SignNow, you can easily fill out and sign the form sa970 electronically, streamlining your tax preparation process.

-

How much does it cost to use airSlate SignNow for form sa970?

airSlate SignNow offers flexible pricing plans that fit various business needs, including options for individuals and enterprises. Depending on the features you choose, you can manage the form sa970 and other documents at an affordable rate. Visit our pricing page for more details and to find the right plan for your business.

-

What features does airSlate SignNow offer for managing form sa970?

airSlate SignNow provides a range of features that facilitate the efficient handling of form sa970, such as templates, cloud storage, and team collaboration tools. You can create, edit, and manage your forms seamlessly while ensuring that all necessary signatures are obtained digitally. These features enhance productivity and simplify the document management process.

-

Can I integrate airSlate SignNow with other tools for using form sa970?

Yes, airSlate SignNow offers seamless integration with various third-party applications, allowing you to manage the form sa970 and other documents effortlessly. You can connect with popular tools like Google Drive, Dropbox, and CRM systems. This functionality helps consolidate your workflows and improves overall efficiency.

-

Is it secure to sign the form sa970 using airSlate SignNow?

Definitely! airSlate SignNow prioritizes security, employing robust encryption and authentication measures to protect your sensitive data, including the form sa970. Our platform complies with various regulatory standards to ensure that your documents are safe during the eSigning process.

-

How does airSlate SignNow simplify the completion of form sa970?

airSlate SignNow simplifies the completion of form sa970 by providing a user-friendly interface that allows for easy navigation and filling out of fields. You can also save your progress and return to the form at any time, making it convenient for busy professionals. Plus, the electronic signature feature expedites the signing process.

-

What benefits will I gain by using airSlate SignNow for form sa970?

Using airSlate SignNow for form sa970 offers numerous benefits, including time savings, increased accuracy, and enhanced organization. The platform eliminates the hassle of paper documents, making it easier to manage your filings electronically. Furthermore, the ability to track document status in real-time boosts accountability and ensures nothing is overlooked.

Get more for Tax Return For Trustees Of Registered Pension Schemes Use Form SA970 To File Your Tax Returnfor The Tax Year Ended 5 April If Yo

- Floridarevenuecomformslibrarycurrentinstructions for f 1120n corporate incomefranchise tax return

- Taxcoloradogov sites tax2022 colorado employee withholding certificate dr 0004 form

- 2021 income tax formsindividuals ampamp families colorado

- Dr 1002 colorado salesuse tax rates form

- Revenuesupporttngov200549005 sales use taxsales ampamp use taxtennessee department of revenue form

- Form dr 601g ampquotgovernmental leasehold intangible personal property tax

- Form e 500 sales and use tax return general instructions

- Download ilovepdf for windows free 3220 digital trendsdownload ilovepdf for windows free 3220 digital trendsdownload ilovepdf 623803708 form

Find out other Tax Return For Trustees Of Registered Pension Schemes Use Form SA970 To File Your Tax Returnfor The Tax Year Ended 5 April If Yo

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now