FL DR 309640 2014

What is the FL DR 309640

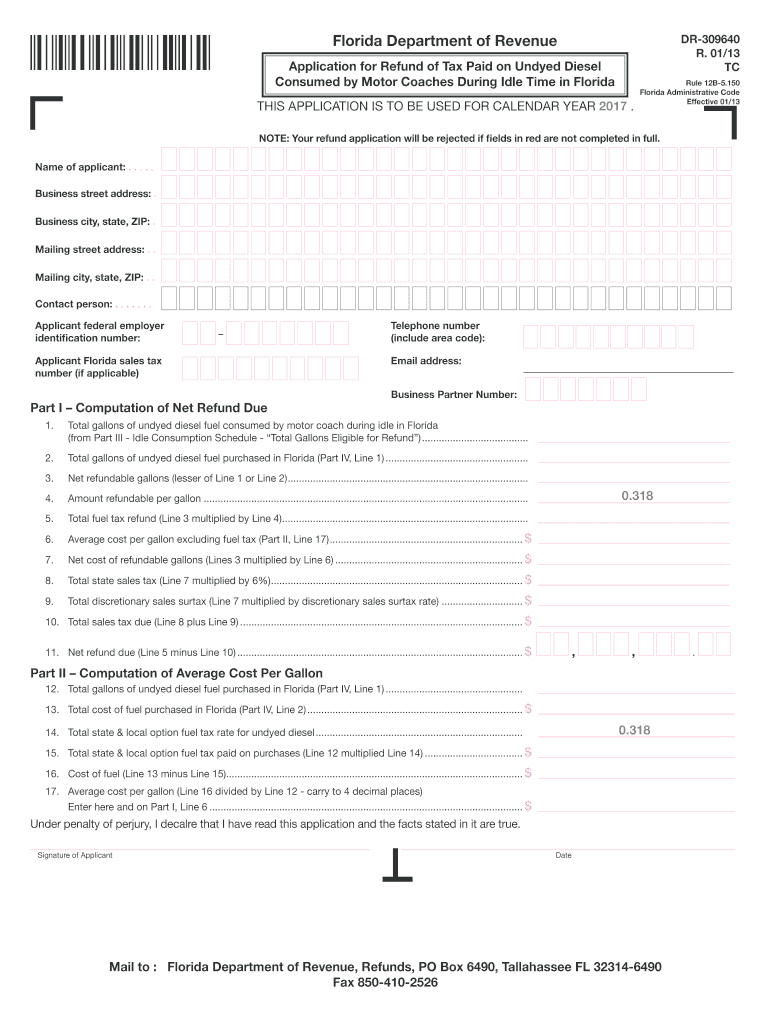

The FL DR 309640 form is a specific document used within the state of Florida, primarily related to tax matters. This form is essential for individuals and businesses to report certain financial information to the state. It is crucial for ensuring compliance with state tax regulations and may involve various disclosures depending on the taxpayer's situation.

How to use the FL DR 309640

Using the FL DR 309640 form involves several steps to ensure that all necessary information is accurately reported. Taxpayers should first gather relevant financial documents, such as income statements and previous tax returns. After filling out the form with the required data, it is important to review it for accuracy before submission. This form can be utilized for various purposes, including tax reporting and compliance verification.

Steps to complete the FL DR 309640

Completing the FL DR 309640 form requires careful attention to detail. Here are the steps involved:

- Gather all necessary financial documents, including income statements and prior year tax returns.

- Fill out the form accurately, ensuring all fields are completed as required.

- Review the completed form for any errors or omissions.

- Sign and date the form to validate the information provided.

- Submit the form via the chosen method, whether online, by mail, or in person.

Legal use of the FL DR 309640

The FL DR 309640 form holds legal significance as it is used to report financial information to the state of Florida. Proper completion and submission of this form ensure compliance with state tax laws. It is essential for taxpayers to understand that inaccuracies or failures to submit the form can lead to legal repercussions, including penalties or audits.

Filing Deadlines / Important Dates

Filing deadlines for the FL DR 309640 form are critical for maintaining compliance. Typically, the form must be submitted by a specific date each year, often aligning with the state tax deadline. Taxpayers should be aware of these deadlines to avoid late fees or penalties. Keeping track of important dates related to the form will help ensure timely submission and compliance with state regulations.

Who Issues the Form

The FL DR 309640 form is issued by the Florida Department of Revenue. This agency is responsible for overseeing tax regulations and ensuring that taxpayers comply with state laws. It is important for individuals and businesses to refer to the official guidelines provided by the Department of Revenue when completing the form to ensure accuracy and compliance.

Quick guide on how to complete 2017 fl dr 309640

Easily Complete FL DR 309640 on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed materials, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage FL DR 309640 on any device using the airSlate SignNow Android or iOS applications and enhance your document-centric tasks today.

Effortlessly Modify and eSign FL DR 309640

- Locate FL DR 309640 and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Select important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to finalize your modifications.

- Choose your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searching, or mistakes that require new copies to be printed. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign FL DR 309640 and guarantee excellent communication at every phase of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 fl dr 309640

Create this form in 5 minutes!

How to create an eSignature for the 2017 fl dr 309640

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is FL DR 309640?

FL DR 309640 refers to a specific regulatory requirement in Florida for document signing and electronic records. airSlate SignNow enables businesses to meet these regulatory standards efficiently. Understanding FL DR 309640 can help ensure compliance and streamline your document management process.

-

How does airSlate SignNow comply with FL DR 309640?

airSlate SignNow is designed to fully comply with FL DR 309640 by providing secure, legally binding eSignatures. The platform also retains a complete audit trail, ensuring that all electronic transactions are documented in line with Florida regulations. This feature is crucial for businesses needing to demonstrate compliance.

-

What pricing plans are available for airSlate SignNow in relation to FL DR 309640?

airSlate SignNow offers various pricing plans that cater to businesses of all sizes looking to address FL DR 309640 compliance. Each plan includes essential features like eSigning, document templates, and mobile access. It's best to visit our pricing page to choose the plan that best fits your needs.

-

What features does airSlate SignNow offer for FL DR 309640 compliance?

airSlate SignNow offers features including customizable workflows, secure document sharing, and comprehensive audit trails to support FL DR 309640 compliance. Our intuitive interface allows users to create and manage documents easily while ensuring they meet all regulatory requirements. Additional integrations can further enhance the user experience.

-

What are the benefits of using airSlate SignNow for FL DR 309640?

Using airSlate SignNow can signNowly improve efficiency and accuracy in managing documents related to FL DR 309640. The platform ensures that your eSignatures are legally binding and compliant with state regulations, which can reduce overall administrative costs and enhance customer satisfaction. Additionally, it's user-friendly and cost-effective.

-

Can airSlate SignNow integrate with other tools for FL DR 309640 management?

Yes, airSlate SignNow seamlessly integrates with a variety of business tools and applications to support FL DR 309640 management. Whether you use CRM systems, cloud storage solutions, or project management tools, integration is straightforward and enhances your document workflow. This interoperability helps maintain compliance while maximizing productivity.

-

Is there a trial period available for airSlate SignNow in relation to FL DR 309640?

Yes, airSlate SignNow offers a free trial period for prospective users to evaluate its effectiveness in meeting FL DR 309640 requirements. During the trial, users can explore all features and determine how it fits their business needs. It's an excellent opportunity to experience the platform before committing to a subscription.

Get more for FL DR 309640

Find out other FL DR 309640

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself