FL DR 145X 2019

What is the FL DR 145X

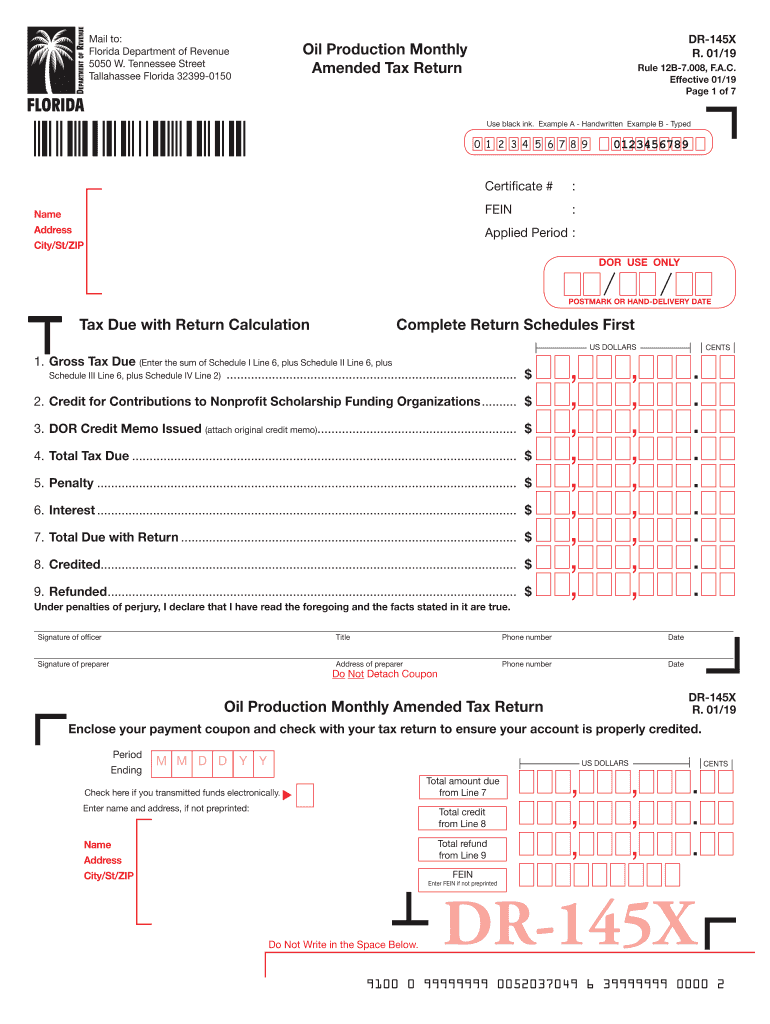

The Florida DR 145X form, also known as the Production Amended Tax Return, is a document used by taxpayers in Florida to amend their previously filed tax returns. This form is essential for correcting errors or making changes to income, deductions, or credits reported in the original return. By submitting the DR 145X, taxpayers can ensure that their tax records are accurate and up to date, which can help prevent future issues with the Florida Department of Revenue.

How to use the FL DR 145X

Using the Florida DR 145X form involves several key steps. First, obtain the form from the Florida Department of Revenue website or other official sources. Next, carefully review your original tax return to identify the errors or changes that need to be made. Fill out the DR 145X by providing the necessary information, including your taxpayer identification number and details of the amendments. Once completed, submit the form according to the instructions provided, ensuring that all required documentation is included to support your amendments.

Steps to complete the FL DR 145X

Completing the Florida DR 145X form requires attention to detail. Follow these steps:

- Obtain a copy of your original tax return for reference.

- Download the FL DR 145X form from the Florida Department of Revenue.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Clearly indicate the changes being made, specifying the line items that are being amended.

- Attach any supporting documents that justify the changes, such as W-2 forms or additional schedules.

- Review the completed form for accuracy before submission.

- Submit the form via the prescribed method, whether online, by mail, or in person.

Legal use of the FL DR 145X

The Florida DR 145X form is legally recognized for amending tax returns within the state. Its use is governed by Florida tax laws, which stipulate that taxpayers have the right to correct their tax filings. When properly completed and submitted, the DR 145X serves as a formal request to the Florida Department of Revenue to adjust the taxpayer's records. Compliance with the legal requirements ensures that the amendments are valid and can help avoid potential penalties or disputes.

Filing Deadlines / Important Dates

Timely filing of the Florida DR 145X is crucial to avoid penalties. Generally, the amended return must be submitted within three years from the original filing date or within two years from the date the tax was paid, whichever is later. It is important to stay informed about specific deadlines each tax year, as they may vary based on changes in tax regulations or state policies. Always check the Florida Department of Revenue's official communications for the most current dates.

Required Documents

When filing the Florida DR 145X form, certain documents are required to support your amendments. These may include:

- A copy of the original tax return.

- Any W-2 forms or 1099 forms that reflect income changes.

- Additional schedules or forms that pertain to the amendments.

- Documentation that supports any deductions or credits being claimed.

Having these documents ready will facilitate a smoother filing process and help ensure that your amendments are processed efficiently.

Quick guide on how to complete 2019 fl dr 145x

Complete FL DR 145X effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and without delays. Manage FL DR 145X on any gadget with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign FL DR 145X with ease

- Locate FL DR 145X and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate creating new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and eSign FL DR 145X and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 fl dr 145x

Create this form in 5 minutes!

How to create an eSignature for the 2019 fl dr 145x

The best way to generate an eSignature for a PDF in the online mode

The best way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

The way to create an eSignature for a PDF on Android OS

People also ask

-

What is the Florida DR145X form?

The Florida DR145X form is a document used for various tax purposes in the state of Florida. It is essential for businesses to understand how to properly fill out and submit this form to ensure compliance with state tax regulations. Using airSlate SignNow simplifies this process by allowing for easy eSigning and document management.

-

How can airSlate SignNow help with the Florida DR145X form?

airSlate SignNow provides a streamlined approach to managing the Florida DR145X form. With its easy-to-use digital signing capabilities, you can complete and send the form securely without hassle. This saves time and reduces the chance of errors during the submission process.

-

Is there a cost associated with using airSlate SignNow for the Florida DR145X form?

Yes, airSlate SignNow offers cost-effective plans that cater to various business needs. You can choose a pricing tier that makes sense for your usage, which is beneficial when signing and managing documents like the Florida DR145X form. The value provided often outweighs the minimal costs involved.

-

What features does airSlate SignNow offer for managing documents like the Florida DR145X form?

airSlate SignNow offers several features, including customizable templates, secure cloud storage, and electronic signatures. These tools make it easier to draft, fill, and eSign the Florida DR145X form, ensuring efficiency and organization when dealing with important tax documents.

-

Can I integrate airSlate SignNow with other tools for handling the Florida DR145X form?

Absolutely! airSlate SignNow integrates seamlessly with various tools and software, allowing for efficient workflows. You can connect with CRM systems or cloud storage services to simplify your process of managing the Florida DR145X form and keep all relevant data in one place.

-

Is airSlate SignNow secure for submitting the Florida DR145X form?

Yes, security is a top priority for airSlate SignNow. The platform employs robust encryption and authentication measures, ensuring that your submission of the Florida DR145X form and any sensitive information is protected from unauthorized access.

-

How can I track the status of my submitted Florida DR145X form using airSlate SignNow?

With airSlate SignNow, you can easily track the status of your submitted documents, including the Florida DR145X form. The platform provides real-time updates, so you’ll know when the document has been viewed, signed, and completed, keeping you informed throughout the process.

Get more for FL DR 145X

Find out other FL DR 145X

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document