I Amended Returns 2024-2026

What is the I Amended Returns

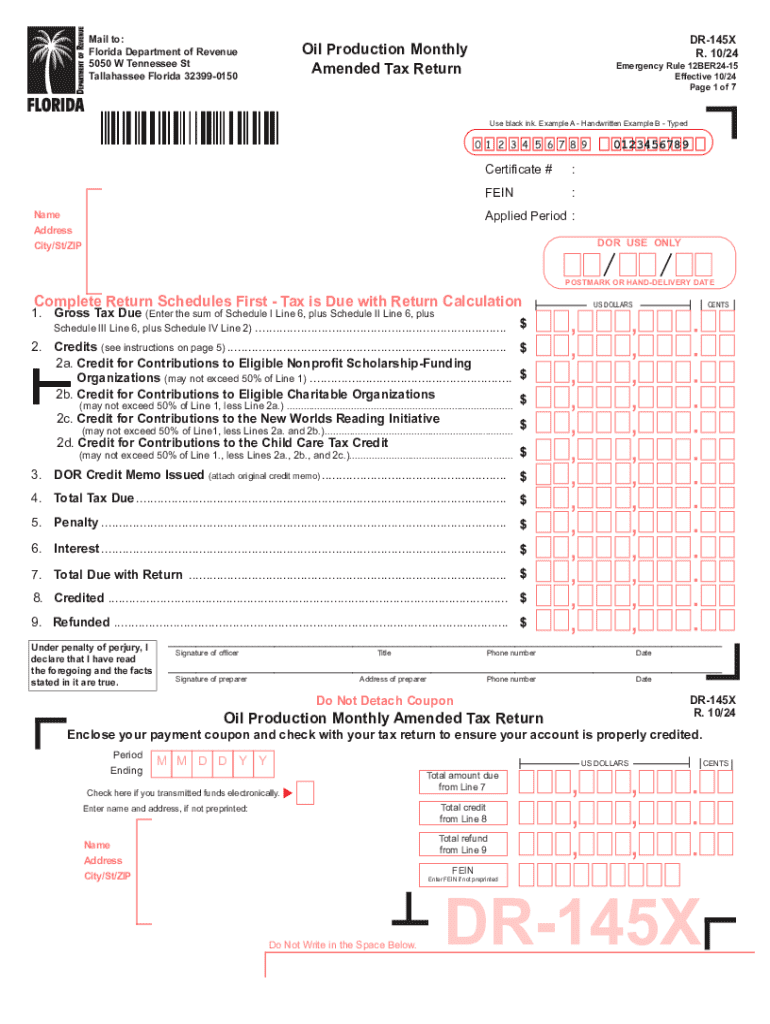

The I Amended Returns is a specific form used by taxpayers in the United States to correct errors on previously filed tax returns. This form allows individuals to report changes in income, deductions, credits, or filing status. By submitting an amended return, taxpayers can ensure that their tax records are accurate and up to date, which is essential for compliance with IRS regulations.

Steps to complete the I Amended Returns

Completing the I Amended Returns involves several key steps:

- Gather necessary documents, including your original tax return and any supporting documents for the changes you are making.

- Obtain the correct form, typically Form 1040-X for individual taxpayers, which is specifically designed for amendments.

- Fill out the form accurately, detailing the changes made, and providing explanations for each adjustment.

- Review the amended return for accuracy to avoid further issues with the IRS.

- Submit the completed form either electronically or by mail, depending on your circumstances and the IRS guidelines.

IRS Guidelines

The IRS provides specific guidelines for filing amended returns. Taxpayers should refer to the IRS website or the instructions accompanying Form 1040-X for detailed information. Key guidelines include:

- Amended returns must be filed within three years from the original filing date or within two years from the date the tax was paid, whichever is later.

- Taxpayers should not file an amended return to correct math errors; the IRS automatically corrects these.

- It's important to include any necessary documentation that supports the changes made on the amended return.

Required Documents

When filing the I Amended Returns, certain documents are necessary to support the changes being made. These typically include:

- Your original tax return.

- Any W-2s or 1099s that reflect income changes.

- Receipts or records for deductions or credits being claimed.

- Any correspondence from the IRS regarding your original tax return.

Form Submission Methods

Taxpayers can submit the I Amended Returns through various methods. The options include:

- Electronically, if eligible, using tax software that supports Form 1040-X.

- By mail, sending the completed form to the appropriate address listed in the IRS instructions.

- In-person at designated IRS offices, though this option may vary based on location and availability.

Penalties for Non-Compliance

Failing to file an amended return when necessary can lead to penalties. Taxpayers may face:

- Interest on any unpaid taxes due to errors on the original return.

- Potential fines for late filing if the amended return is submitted after the established deadlines.

- Increased scrutiny from the IRS, which may lead to audits or further investigation.

Quick guide on how to complete i amended returns

Effortlessly Prepare I Amended Returns on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly option to traditional printed and signed documents, as you can easily access the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage I Amended Returns on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to Alter and eSign I Amended Returns Without Any Fuss

- Obtain I Amended Returns and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that necessitate printing fresh document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign I Amended Returns to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct i amended returns

Create this form in 5 minutes!

How to create an eSignature for the i amended returns

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are amended returns and how can airSlate SignNow help?

Amended returns are tax returns that correct errors or omissions in previously filed returns. airSlate SignNow simplifies the process of submitting amended returns by allowing users to eSign and send documents securely and efficiently. With our platform, you can ensure that your amended returns are filed accurately and on time.

-

How does airSlate SignNow ensure the security of my amended returns?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and secure cloud storage to protect your amended returns and sensitive information. You can trust that your documents are safe while you eSign and manage your amended returns.

-

What features does airSlate SignNow offer for managing amended returns?

airSlate SignNow offers a range of features designed to streamline the management of amended returns. These include customizable templates, automated workflows, and real-time tracking of document status. Our user-friendly interface makes it easy to navigate and manage your amended returns efficiently.

-

Is there a cost associated with using airSlate SignNow for amended returns?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solution allows you to manage your amended returns without breaking the bank. You can choose a plan that fits your budget while still accessing all the essential features for eSigning and document management.

-

Can I integrate airSlate SignNow with other software for my amended returns?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easy to manage your amended returns alongside your existing tools. Whether you use accounting software or CRM systems, our integrations enhance your workflow and improve efficiency.

-

How can airSlate SignNow benefit my business when filing amended returns?

Using airSlate SignNow for filing amended returns can signNowly benefit your business by saving time and reducing errors. Our platform allows for quick eSigning and document sharing, ensuring that your amended returns are processed swiftly. This efficiency can lead to better compliance and improved financial management.

-

What support does airSlate SignNow provide for users dealing with amended returns?

airSlate SignNow offers comprehensive support for users managing amended returns. Our customer service team is available to assist with any questions or issues you may encounter. Additionally, we provide resources and tutorials to help you navigate the process of eSigning and submitting your amended returns.

Get more for I Amended Returns

- Notice extend lease 497329579 form

- Notice to lessor by lessees of lessees intention not to renew where lease provides for automatic renewal in absence of contrary form

- Not renewing 497329581 form

- Guaranty performance

- Mortgage securing guaranty of performance of lease

- Discharge bankruptcy assets form

- Complaint objecting to discharge in bankruptcy proceeding for transfer removal destruction or concealment of property within form

- Discharge bankruptcy form

Find out other I Amended Returns

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter