Florida Department of Revenue Tallahassee 2022

What is the Florida Department of Revenue?

The Florida Department of Revenue (DOR) is a state agency responsible for managing the collection of taxes and the administration of various revenue programs in Florida. It oversees tax compliance, audits, and the distribution of tax revenues to local governments. The DOR plays a crucial role in ensuring that state tax laws are enforced and that taxpayers meet their obligations.

Steps to complete the Florida Department of Revenue forms

Completing forms for the Florida Department of Revenue requires careful attention to detail. Here are the steps to follow:

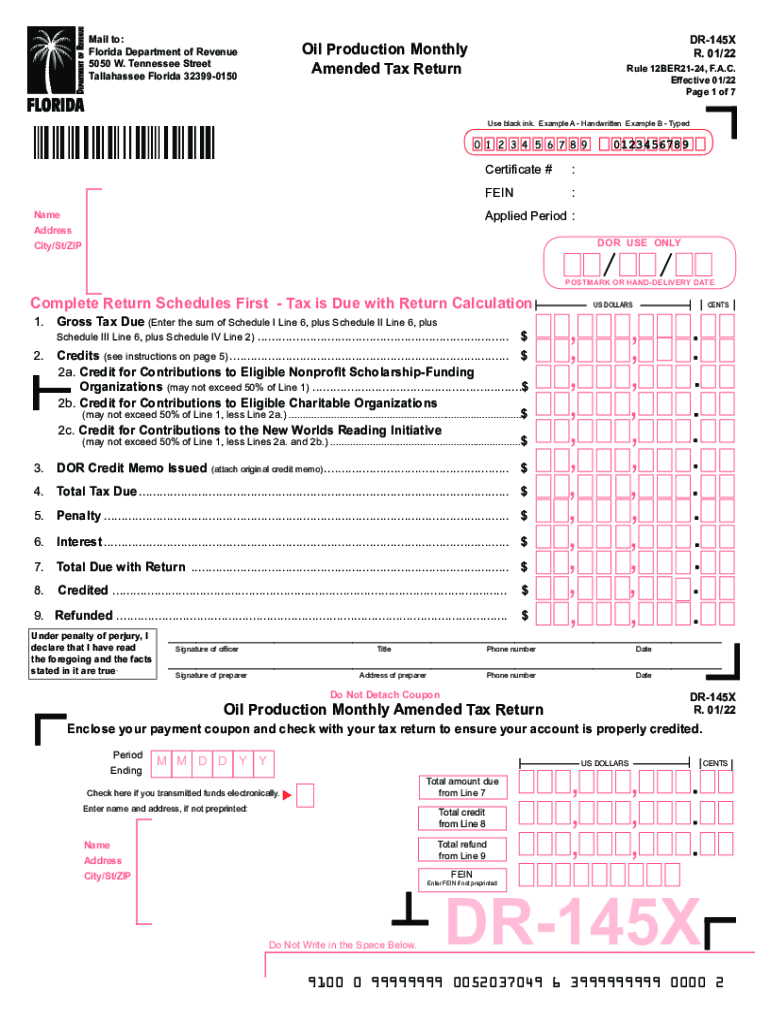

- Identify the correct form you need, such as the DR-145X for amended tax returns.

- Gather all necessary documentation, including previous tax returns and supporting documents.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the form for any errors or omissions before submission.

- Submit the form through the appropriate method, whether online, by mail, or in person.

Required Documents for Florida Department of Revenue forms

When submitting forms to the Florida Department of Revenue, specific documents may be required to support your application or tax return. Commonly required documents include:

- Previous tax returns for reference.

- W-2 forms or 1099 statements for income verification.

- Receipts or records of deductions and credits.

- Any correspondence from the DOR regarding your tax status.

Form Submission Methods

The Florida Department of Revenue provides several methods for submitting forms. You can choose from the following options:

- Online: Many forms can be completed and submitted electronically through the DOR's online portal.

- Mail: You can print your completed form and send it to the appropriate DOR address.

- In-Person: Forms can also be submitted at designated DOR offices throughout Florida.

Penalties for Non-Compliance

Failing to comply with the requirements set by the Florida Department of Revenue can result in various penalties. These may include:

- Fines for late submissions or underpayment of taxes.

- Interest on unpaid tax amounts.

- Potential legal action for continued non-compliance.

Eligibility Criteria

Eligibility for certain forms and tax benefits through the Florida Department of Revenue may depend on various factors, including:

- Your filing status (e.g., individual, business).

- Your income level and sources of income.

- Specific deductions or credits you may qualify for based on your circumstances.

Quick guide on how to complete florida department of revenue tallahassee

Effortlessly Prepare Florida Department Of Revenue Tallahassee on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the appropriate template and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your paperwork quickly without delays. Manage Florida Department Of Revenue Tallahassee on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign Florida Department Of Revenue Tallahassee with Ease

- Obtain Florida Department Of Revenue Tallahassee and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all information carefully and click on the Done button to save your modifications.

- Select your preferred method for delivering your form—via email, SMS, an invitation link, or download it to your PC.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes necessitating fresh document prints. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Edit and eSign Florida Department Of Revenue Tallahassee to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida department of revenue tallahassee

Create this form in 5 minutes!

How to create an eSignature for the florida department of revenue tallahassee

The best way to create an e-signature for a PDF online

The best way to create an e-signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

The way to generate an e-signature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What is the airSlate SignNow solution for the Florida Department of Revenue?

The airSlate SignNow solution provides a user-friendly platform for businesses interacting with the Florida Department of Revenue. It enables efficient document signing and management, ensuring compliance with state regulations. Businesses can streamline their operations and manage paperwork effectively with this powerful e-signature tool.

-

How does airSlate SignNow enhance the document signing process for the Florida Department of Revenue?

airSlate SignNow simplifies the document signing process for the Florida Department of Revenue by allowing users to eSign documents from anywhere. This eliminates the need for printing, scanning, or faxing paper documents. As a result, businesses can save time and reduce errors in their interactions with state agencies.

-

What pricing options are available for airSlate SignNow users dealing with the Florida Department of Revenue?

airSlate SignNow offers competitive pricing plans that cater to the needs of businesses engaging with the Florida Department of Revenue. The plans vary based on features and the number of users, enabling businesses to choose the most suitable option. This flexibility allows companies to find a cost-effective solution for their document management needs.

-

Can airSlate SignNow integrate with other tools for Florida Department of Revenue documentation?

Yes, airSlate SignNow integrates seamlessly with a variety of applications commonly used for Florida Department of Revenue documentation. This includes CRM systems, cloud storage solutions, and more. Such integrations enhance workflow efficiency, enabling businesses to manage their documents effortlessly across platforms.

-

What benefits does airSlate SignNow offer for businesses dealing with the Florida Department of Revenue?

airSlate SignNow provides signNow benefits for businesses interacting with the Florida Department of Revenue, including increased efficiency and reduced turnaround times. The solution allows for quick document processing and ensures compliance with state regulations. Additionally, the ease of use enhances user adoption and satisfaction.

-

Is airSlate SignNow compliant with Florida Department of Revenue regulations?

Yes, airSlate SignNow is designed to meet compliance requirements set forth by the Florida Department of Revenue. The platform implements secure e-signature processes that adhere to legal standards. Businesses can confidently use airSlate SignNow for their document transactions without worrying about compliance issues.

-

How secure is airSlate SignNow when handling documents for the Florida Department of Revenue?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents for the Florida Department of Revenue. The platform employs advanced encryption methods to safeguard user data and ensure privacy. This commitment to security allows businesses to trust their document management processes.

Get more for Florida Department Of Revenue Tallahassee

- Louisiana letter form

- Louisiana landlord form

- Landlord request repair form

- Letter from tenant to landlord with demand that landlord repair unsafe or broken lights or wiring louisiana form

- Louisiana repair form

- Letter from tenant to landlord with demand that landlord remove garbage and vermin from premises louisiana form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles louisiana form

- Letter from tenant to landlord about landlords failure to make repairs louisiana form

Find out other Florida Department Of Revenue Tallahassee

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile