Other State Tax CreditFTB Ca Gov State of California 2020

What is the Other State Tax Credit?

The Other State Tax Credit is a tax benefit available to California residents who pay taxes to another state on income earned in that state. This credit helps to alleviate the double taxation burden that can occur when taxpayers are required to pay taxes in multiple jurisdictions. By claiming this credit, individuals can reduce their California state tax liability, ensuring that they are not taxed twice on the same income.

Eligibility Criteria for the Other State Tax Credit

To qualify for the Other State Tax Credit, taxpayers must meet specific eligibility requirements. These include:

- Being a resident of California for the entire tax year.

- Having income that is also taxed by another state.

- Filing a tax return in the other state and providing proof of taxes paid.

It is essential to ensure that the income in question is subject to tax in both California and the other state to claim this credit successfully.

Steps to Complete the Other State Tax Credit Form

Completing the Other State Tax Credit form involves several key steps:

- Gather all necessary documentation, including tax returns from the other state.

- Calculate the amount of tax paid to the other state on the applicable income.

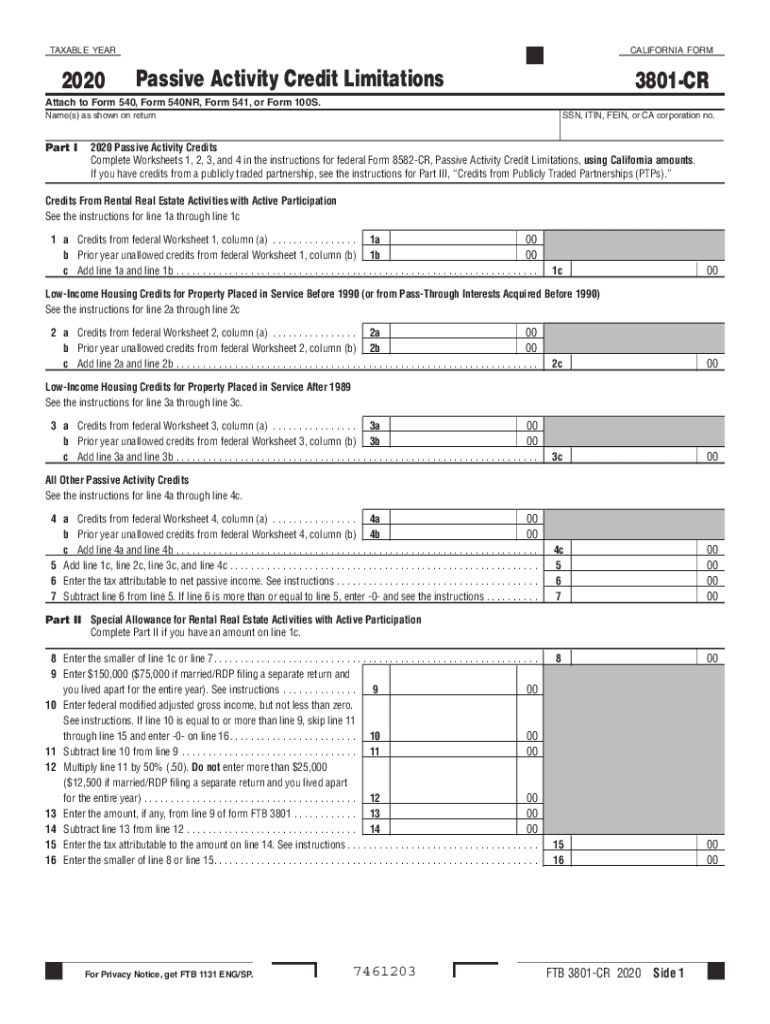

- Fill out the 2020 Form 3801 accurately, ensuring all information is correct.

- Attach any required documentation, such as proof of tax payments.

- Submit the completed form with your California state tax return.

Legal Use of the Other State Tax Credit

The Other State Tax Credit is legally recognized under California tax law, allowing residents to claim it as a legitimate means of reducing their tax liability. Compliance with the state's regulations is crucial to ensure that the credit is applied correctly. Taxpayers should maintain thorough records of their income and taxes paid to other states to support their claims if needed.

Filing Deadlines for the Other State Tax Credit

Taxpayers must be aware of the filing deadlines for claiming the Other State Tax Credit. Generally, the deadline aligns with the California state tax return due date, which is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any updates or changes to the filing schedule each tax year.

Required Documents for the Other State Tax Credit

To successfully claim the Other State Tax Credit, taxpayers need to prepare specific documents, including:

- Completed 2020 Form 3801.

- Tax returns from the other state showing income and taxes paid.

- Any supporting documentation that verifies the tax payments made to the other state.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with state requirements.

Quick guide on how to complete other state tax creditftbcagov state of california

Complete Other State Tax CreditFTB ca gov State Of California effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can find the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly and without delays. Manage Other State Tax CreditFTB ca gov State Of California on any device using the airSlate SignNow Android or iOS apps and enhance any document-based task today.

How to modify and eSign Other State Tax CreditFTB ca gov State Of California with ease

- Obtain Other State Tax CreditFTB ca gov State Of California and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Other State Tax CreditFTB ca gov State Of California and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct other state tax creditftbcagov state of california

Create this form in 5 minutes!

How to create an eSignature for the other state tax creditftbcagov state of california

The best way to create an electronic signature for your PDF document in the online mode

The best way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the 2020 3801 feature offered by airSlate SignNow?

The 2020 3801 feature in airSlate SignNow offers a comprehensive eSignature solution, allowing businesses to securely sign documents online. This feature simplifies the signing process, making it easier for teams to collaborate and finalize agreements quickly. With the 2020 3801, you can ensure compliance and enhance workflow efficiency.

-

How much does airSlate SignNow cost for the 2020 3801 feature?

airSlate SignNow provides flexible pricing plans for the 2020 3801 feature, tailored to meet different business needs. The plans are designed to be cost-effective, ensuring you only pay for what you need. For more specific pricing details, you can visit our pricing page or contact our sales team.

-

What are the main benefits of using airSlate SignNow with the 2020 3801 capability?

Using the 2020 3801 capability with airSlate SignNow unlocks numerous benefits like reduced turnaround time for document signing and enhanced security. Businesses can improve their operational efficiency by eliminating paper-based processes. Additionally, the intuitive interface allows users of all skill levels to adapt quickly.

-

Can I integrate other software with airSlate SignNow's 2020 3801?

Yes, airSlate SignNow's 2020 3801 feature seamlessly integrates with various software applications, enhancing your productivity. Whether you need CRM, cloud storage, or project management tools, the integrations allow you to streamline workflows. This flexibility is key to maintaining a well-connected technology ecosystem.

-

Is the 2020 3801 feature secure for sensitive documents?

Absolutely! The 2020 3801 feature in airSlate SignNow employs advanced security protocols, including encryption and authentication, to protect your sensitive documents. You can rest assured knowing that your data is secure during the signing process. Compliance with industry standards further reinforces our commitment to security.

-

What types of documents can I sign using the 2020 3801 feature?

The 2020 3801 feature in airSlate SignNow supports a wide range of document types, from contracts and agreements to forms and policies. Whether you're in real estate, legal, or another industry, this feature caters to your document signing needs. You can easily upload, manage, and sign any necessary documents with ease.

-

How easy is it to use the 2020 3801 feature for new users?

The 2020 3801 feature in airSlate SignNow is designed for ease of use, even for new users. The intuitive interface guides you through the document signing process, making it simple to add signatures and manage workflows. Online tutorials and customer support further assist in getting started effortlessly.

Get more for Other State Tax CreditFTB ca gov State Of California

Find out other Other State Tax CreditFTB ca gov State Of California

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease