California Form 3801 CR Passive Activity Credit Limitations California Form 3801 CR Passive Activity Credit Limitations 2021

Understanding the 2021 California Form 3801 CR Passive Activity Credit Limitations

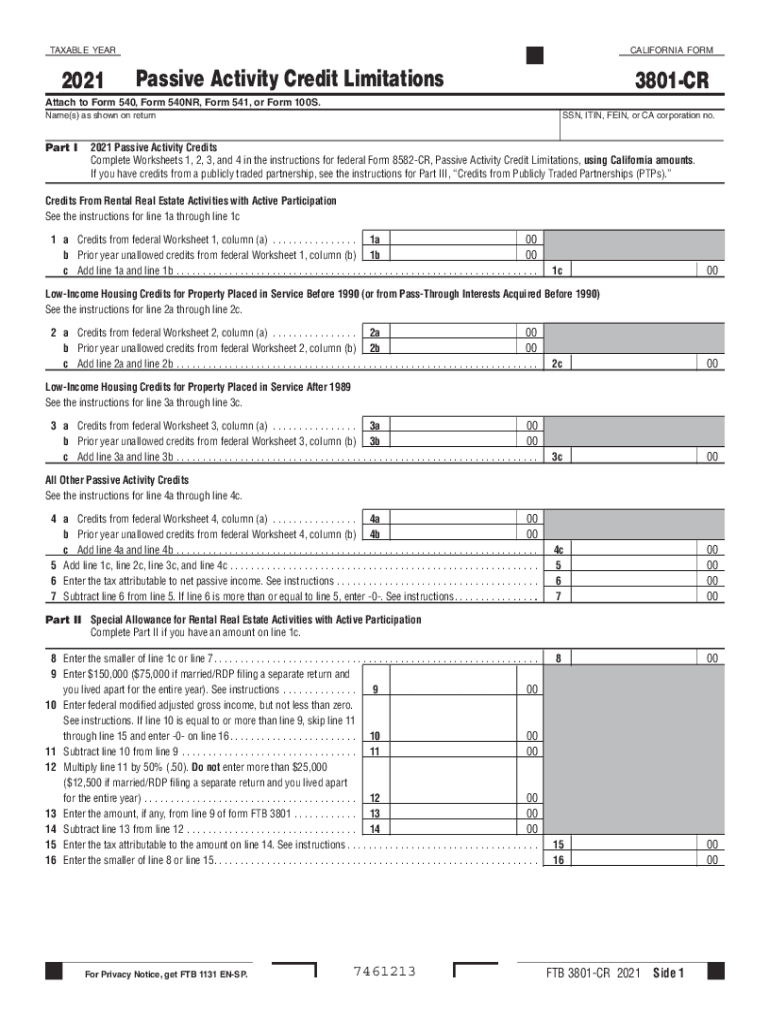

The 2021 California Form 3801 is essential for taxpayers seeking to claim credits for passive activities. This form specifically addresses credit limitations that arise from passive activity losses. Taxpayers must understand how these limitations apply to their individual situations, as they can significantly impact the amount of credit one can claim. The form is particularly relevant for individuals who participate in rental real estate or other passive investment activities, as it helps determine how much of the passive losses can offset their tax liabilities.

Steps to Complete the 2021 California Form 3801

Filling out the 2021 California Form 3801 requires careful attention to detail. Here are the key steps to ensure accurate completion:

- Gather all necessary documentation related to passive activities, including income and loss statements.

- Begin by entering personal information at the top of the form, including your name, address, and Social Security number.

- Identify the passive activities you are involved in and list them as required on the form.

- Calculate the total passive activity losses and credits, ensuring you follow the guidelines for each section of the form.

- Review the limitations for each credit and ensure that you do not exceed these limits.

- Sign and date the form before submitting it with your tax return.

Eligibility Criteria for the 2021 California Form 3801

To qualify for the credits on the 2021 California Form 3801, taxpayers must meet specific eligibility criteria. Generally, these criteria include:

- Participation in passive activities, such as rental real estate or limited partnerships.

- Ability to demonstrate that the losses are from activities in which you do not materially participate.

- Compliance with California tax laws and regulations regarding passive activity losses.

Understanding these criteria is crucial for accurately claiming credits and ensuring compliance with state tax regulations.

Legal Use of the 2021 California Form 3801

The legal use of the 2021 California Form 3801 is governed by state tax laws. To ensure that the form is used correctly, taxpayers should be aware of the following:

- The form must be filed with your California state tax return to be considered valid.

- All information provided must be accurate and truthful to avoid penalties.

- Taxpayers should retain copies of the form and supporting documents in case of an audit.

Using the form legally helps safeguard against potential legal issues and ensures that taxpayers can effectively claim their entitled credits.

Filing Deadlines for the 2021 California Form 3801

Timely filing of the 2021 California Form 3801 is essential to avoid penalties and ensure compliance. The key deadlines include:

- The form must be submitted by the tax return filing deadline, typically April 15 of the following year.

- Extensions may be available, but taxpayers should verify specific requirements for filing extensions with the California Franchise Tax Board.

Being aware of these deadlines helps taxpayers plan accordingly and avoid unnecessary complications.

Examples of Using the 2021 California Form 3801

Understanding practical applications of the 2021 California Form 3801 can clarify its importance. Here are a few scenarios:

- A taxpayer with rental properties that generate passive losses can use the form to offset other income.

- Investors in limited partnerships can report their share of passive losses and claim credits accordingly.

- Individuals who have participated in passive activities but do not meet material participation requirements can utilize the form to claim allowable credits.

These examples illustrate how the form serves as a critical tool for maximizing tax benefits related to passive activities.

Quick guide on how to complete 2021 california form 3801 cr passive activity credit limitations 2021 california form 3801 cr passive activity credit

Effortlessly prepare California Form 3801 CR Passive Activity Credit Limitations California Form 3801 CR Passive Activity Credit Limitations on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly and efficiently. Manage California Form 3801 CR Passive Activity Credit Limitations California Form 3801 CR Passive Activity Credit Limitations on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign California Form 3801 CR Passive Activity Credit Limitations California Form 3801 CR Passive Activity Credit Limitations with ease

- Obtain California Form 3801 CR Passive Activity Credit Limitations California Form 3801 CR Passive Activity Credit Limitations and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Select your preferred method to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to missing or lost files, frustrating form searches, or errors that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign California Form 3801 CR Passive Activity Credit Limitations California Form 3801 CR Passive Activity Credit Limitations and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 california form 3801 cr passive activity credit limitations 2021 california form 3801 cr passive activity credit

Create this form in 5 minutes!

How to create an eSignature for the 2021 california form 3801 cr passive activity credit limitations 2021 california form 3801 cr passive activity credit

How to make an electronic signature for a PDF document online

How to make an electronic signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The best way to generate an e-signature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the 2021 ftb 3801 and how does it relate to eSigning documents?

The 2021 ftb 3801 is a crucial form used for California tax returns, and understanding it is essential for compliance. With airSlate SignNow, businesses can easily eSign and submit this form electronically, ensuring accuracy and efficiency.

-

How can airSlate SignNow help me manage the 2021 ftb 3801 process?

airSlate SignNow streamlines the management of the 2021 ftb 3801 by providing a user-friendly platform to send, sign, and organize documents. This eliminates the hassle of paper forms and allows for real-time tracking of document status.

-

What features does airSlate SignNow offer for handling the 2021 ftb 3801?

Key features of airSlate SignNow include secure eSigning, document templates, and workflow automation. These tools specifically enhance the process of completing the 2021 ftb 3801, saving time and reducing errors.

-

Is airSlate SignNow cost-effective for submitting the 2021 ftb 3801?

Yes, airSlate SignNow offers a cost-effective solution for firms and individuals needing to submit the 2021 ftb 3801. The platform’s pricing plans are designed to accommodate various budgets while providing comprehensive features for document management.

-

Can I integrate airSlate SignNow with other applications for processing the 2021 ftb 3801?

Absolutely! airSlate SignNow offers integrations with popular applications like Google Drive and Dropbox, making it easy to manage files related to the 2021 ftb 3801. This helps streamline your workflow by allowing seamless access to your documents.

-

What are the benefits of using airSlate SignNow to sign the 2021 ftb 3801?

Using airSlate SignNow to sign the 2021 ftb 3801 provides several benefits, including enhanced security, reduced turnaround time, and improved collaboration. These advantages help ensure that your tax forms are filed accurately and promptly.

-

How secure is airSlate SignNow when handling the 2021 ftb 3801?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the 2021 ftb 3801. The platform employs advanced encryption and authentication measures to protect your data during the signing process.

Get more for California Form 3801 CR Passive Activity Credit Limitations California Form 3801 CR Passive Activity Credit Limitations

- Child care services package massachusetts form

- Special or limited power of attorney for real estate sales transaction by seller massachusetts form

- Ma real estate transaction form

- Limited power of attorney where you specify powers with sample powers included massachusetts form

- Limited power of attorney for stock transactions and corporate powers massachusetts form

- Special durable power of attorney for bank account matters massachusetts form

- Massachusetts small business startup package massachusetts form

- Massachusetts property 497309979 form

Find out other California Form 3801 CR Passive Activity Credit Limitations California Form 3801 CR Passive Activity Credit Limitations

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter