Form 3801 CR Passive Activity Credit Limitations 2024-2026

Understanding the Form 3801 CR Passive Activity Credit Limitations

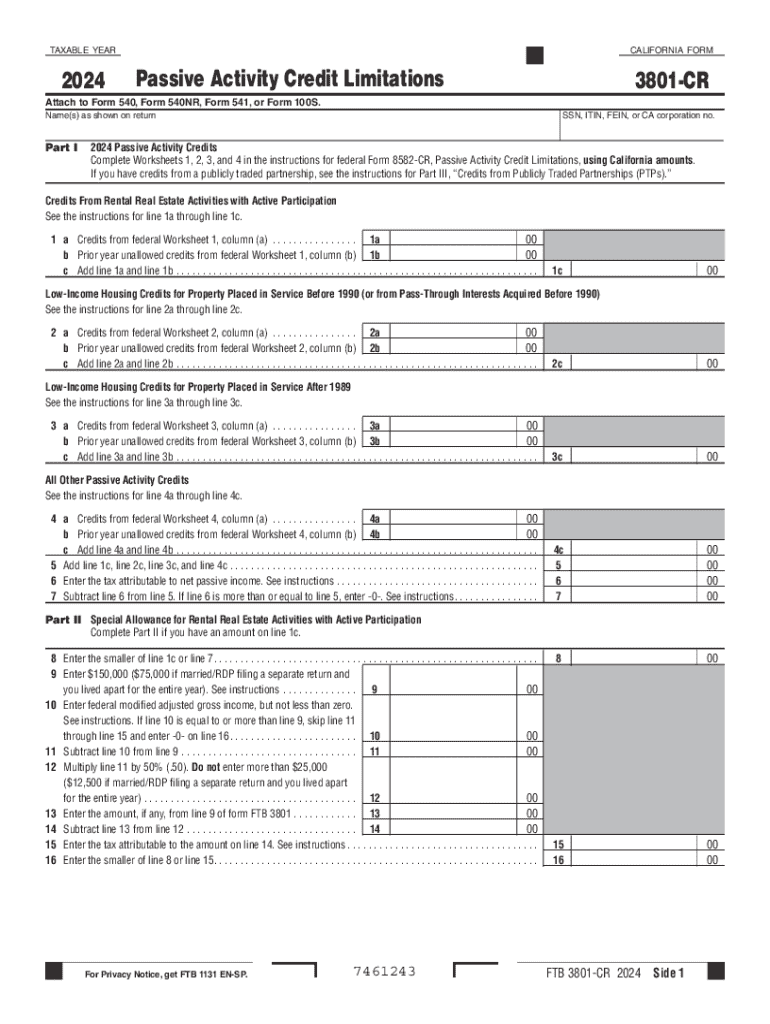

The 2024 Form 3801 is designed to help taxpayers calculate the limitations on passive activity credits. These credits are essential for individuals who engage in passive activities, such as rental real estate or limited partnerships. The form outlines how much of the credit can be claimed based on income and other factors. Understanding these limitations is crucial for accurate tax reporting and maximizing potential credits.

Steps to Complete the Form 3801 CR Passive Activity Credit Limitations

Completing the 2024 Form 3801 involves several key steps:

- Gather necessary financial documents, including income statements and details of passive activities.

- Determine your total passive activity credits and any prior year carryovers.

- Fill out the form by entering your income, deductions, and other relevant information.

- Calculate the allowable credit based on the instructions provided in the form.

- Review the completed form for accuracy before submission.

Legal Use of the Form 3801 CR Passive Activity Credit Limitations

The 2024 Form 3801 must be used in compliance with IRS regulations. Taxpayers are legally required to report passive activity credits accurately. Misreporting can lead to penalties and interest on unpaid taxes. It is important to ensure that all information is truthful and complete to avoid any legal issues.

Filing Deadlines / Important Dates

For the 2024 tax year, the deadline to file Form 3801 is typically April 15, unless that date falls on a weekend or holiday. In such cases, the deadline may be extended to the next business day. Taxpayers should also be aware of any extension deadlines if they file for an extension on their tax returns.

Eligibility Criteria for Form 3801 CR Passive Activity Credit Limitations

To be eligible to use the 2024 Form 3801, taxpayers must have engaged in passive activities during the tax year. This includes individuals who have rental properties or are involved in partnerships where they do not materially participate. Additionally, income thresholds may affect eligibility for claiming certain credits, so it is essential to review these criteria carefully.

Examples of Using the Form 3801 CR Passive Activity Credit Limitations

Taxpayers may encounter various scenarios where Form 3801 is applicable. For instance, an individual who owns rental properties may use the form to calculate their passive activity credits based on rental income and expenses. Another example includes a partner in a limited partnership who does not actively manage the business but still wants to claim credits based on their share of passive losses.

Create this form in 5 minutes or less

Find and fill out the correct form 3801 cr passive activity credit limitations

Create this form in 5 minutes!

How to create an eSignature for the form 3801 cr passive activity credit limitations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 3801 and how does it benefit my business?

The 2024 3801 is an innovative feature of airSlate SignNow that streamlines the document signing process. It empowers businesses to send and eSign documents efficiently, reducing turnaround time and enhancing productivity. By utilizing the 2024 3801, you can ensure a seamless experience for both your team and clients.

-

How much does the 2024 3801 feature cost?

The pricing for the 2024 3801 feature is competitive and designed to fit various business budgets. airSlate SignNow offers flexible subscription plans that include access to the 2024 3801, ensuring you get the best value for your investment. For detailed pricing information, visit our pricing page.

-

What are the key features of the 2024 3801?

The 2024 3801 includes advanced eSignature capabilities, customizable templates, and real-time tracking of document status. These features are designed to enhance user experience and improve workflow efficiency. With the 2024 3801, you can manage your documents with ease and confidence.

-

Can I integrate the 2024 3801 with other software?

Yes, the 2024 3801 is designed to integrate seamlessly with various software applications. This includes popular CRM systems, cloud storage services, and productivity tools. By integrating the 2024 3801, you can enhance your existing workflows and improve overall efficiency.

-

Is the 2024 3801 secure for sensitive documents?

Absolutely! The 2024 3801 prioritizes security with advanced encryption and compliance with industry standards. Your sensitive documents are protected throughout the signing process, ensuring that your business remains compliant and secure. Trust the 2024 3801 for your document management needs.

-

How does the 2024 3801 improve document turnaround time?

The 2024 3801 signNowly reduces document turnaround time by automating the signing process. With features like instant notifications and reminders, you can ensure that documents are signed promptly. This efficiency allows your business to operate faster and more effectively.

-

What types of documents can I manage with the 2024 3801?

The 2024 3801 allows you to manage a wide variety of documents, including contracts, agreements, and forms. Whether you need to send a simple document or a complex contract, the 2024 3801 can handle it all. This versatility makes it an essential tool for any business.

Get more for Form 3801 CR Passive Activity Credit Limitations

Find out other Form 3801 CR Passive Activity Credit Limitations

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast