California Individual Forms Availability 2022

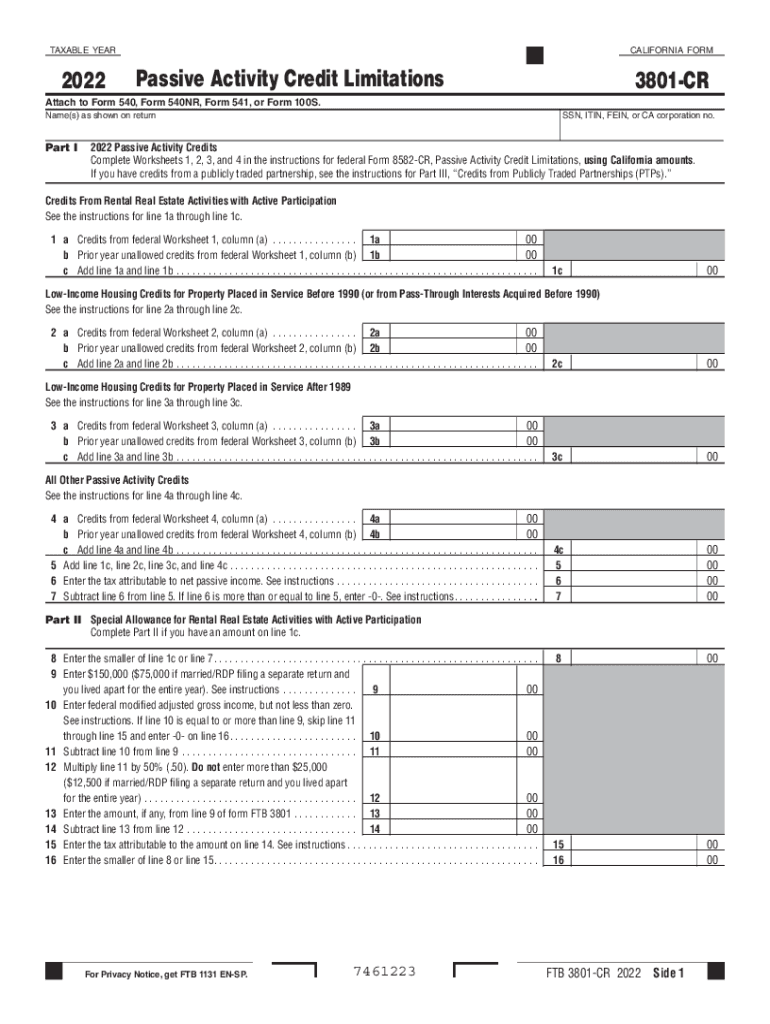

What is the 2022 California 3801 Form?

The 2022 California 3801 form, also known as the 2022 FTB 3801, is a tax form used by California residents to claim a credit for certain activities. This form is specifically designed to assist taxpayers in reporting and calculating their credits related to various qualifying activities, such as investments in certain businesses or contributions to specific programs. By utilizing this form, individuals can potentially reduce their tax liability, making it an important document for those eligible for the credit.

Steps to Complete the 2022 California 3801 Form

Completing the 2022 California 3801 form involves several key steps to ensure accurate reporting and eligibility for the credit. First, gather all necessary documentation that supports your claim, including proof of qualifying activities and any related financial statements. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Carefully follow the instructions provided on the form to report your qualifying activities and calculate the credit amount. Finally, review your completed form for accuracy before submission.

Eligibility Criteria for the 2022 California 3801 Form

To qualify for the credits available through the 2022 California 3801 form, taxpayers must meet specific eligibility criteria. Generally, this includes being a California resident and engaging in qualifying activities that align with the state's guidelines. It is essential to ensure that all activities reported are compliant with California tax laws. Additionally, certain income limits or other restrictions may apply, depending on the specific credit being claimed. Taxpayers should consult the instructions accompanying the form for detailed eligibility requirements.

Required Documents for the 2022 California 3801 Form

When preparing to submit the 2022 California 3801 form, it is crucial to gather all required documents to support your claim. This may include:

- Proof of qualifying activities, such as receipts or contracts.

- Financial statements that demonstrate the impact of these activities.

- Any previous tax returns that may be relevant to your current claim.

- Identification documents, including your Social Security number.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with California tax regulations.

Form Submission Methods for the 2022 California 3801

The 2022 California 3801 form can be submitted through various methods, allowing taxpayers flexibility in how they file. Options include:

- Online Submission: Taxpayers can file electronically through the California Franchise Tax Board's website, which may expedite processing times.

- Mail: Completed forms can be printed and mailed to the appropriate address as indicated on the form's instructions.

- In-Person: Some taxpayers may choose to deliver their forms directly to local tax offices for submission.

Choosing the right submission method can affect the processing time and confirmation of your claim.

Penalties for Non-Compliance with the 2022 California 3801 Form

Failing to comply with the requirements of the 2022 California 3801 form can result in various penalties. Taxpayers who do not accurately report their qualifying activities or submit the form by the deadline may face fines or interest charges on any unpaid taxes. Additionally, incorrect claims can lead to audits, further complicating the taxpayer's situation. It is essential to ensure all information is accurate and submitted on time to avoid these potential penalties.

Quick guide on how to complete california individual forms availability

Complete California Individual Forms Availability effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without any hold-ups. Manage California Individual Forms Availability on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign California Individual Forms Availability with ease

- Find California Individual Forms Availability and click Get Form to begin.

- Utilize the tools available to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, or shareable link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign California Individual Forms Availability and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california individual forms availability

Create this form in 5 minutes!

How to create an eSignature for the california individual forms availability

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 ca 3801, and how does it relate to airSlate SignNow?

The 2022 ca 3801 refers to a specific form used for certain tax purposes in California. airSlate SignNow allows users to easily fill out, sign, and send the 2022 ca 3801 digitally, streamlining the process and ensuring compliance.

-

What features does airSlate SignNow offer for managing the 2022 ca 3801?

airSlate SignNow provides a variety of features, including customizable templates and an intuitive document editor to simplify the management of the 2022 ca 3801. Users can easily add fields for signatures, dates, and other required information without any hassle.

-

How does airSlate SignNow ensure the security of my 2022 ca 3801 documents?

airSlate SignNow employs advanced encryption and security measures to protect all documents, including the 2022 ca 3801. Your data is stored securely, and access is controlled to ensure that only authorized users can view or modify your documents.

-

What are the pricing options for using airSlate SignNow for the 2022 ca 3801?

airSlate SignNow offers several affordable pricing plans that cater to different business needs. Depending on your usage, you can choose a plan that fits your budget while gaining access to all the necessary tools for managing forms like the 2022 ca 3801.

-

Can I integrate airSlate SignNow with other applications while handling the 2022 ca 3801?

Yes, airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Salesforce, and Zapier. This makes it easy to handle the 2022 ca 3801 alongside your other important business tools and streamline workflows.

-

What are the benefits of using airSlate SignNow for eSigning the 2022 ca 3801?

Using airSlate SignNow for eSigning the 2022 ca 3801 provides benefits such as faster turnaround times and the convenience of signing from anywhere. You can also track the signing process in real-time, ensuring that your documents are completed promptly.

-

Is there customer support available for issues related to the 2022 ca 3801?

Absolutely! airSlate SignNow offers comprehensive customer support to assist users with any issues concerning the 2022 ca 3801. Whether you need help with document setup or troubleshooting, our support team is ready to help you.

Get more for California Individual Forms Availability

- Permits licenses ampamp forms morristown new jersey

- Request for proposal fire pumper leasepurchasedeering nh form

- City of milton building permit application form

- Release form headwaters outfitters

- Maintenance bond release city of westfield upon executing form

- Indiana application certificate compliance form

- Indiana development plan westfield form

- Westfield united kingdomthe destination for fashion form

Find out other California Individual Forms Availability

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free