Printable California Form 3800 Tax Computation for Certain Children with Unearned Income 2020

What is the Printable California Form 3800 Tax Computation For Certain Children With Unearned Income

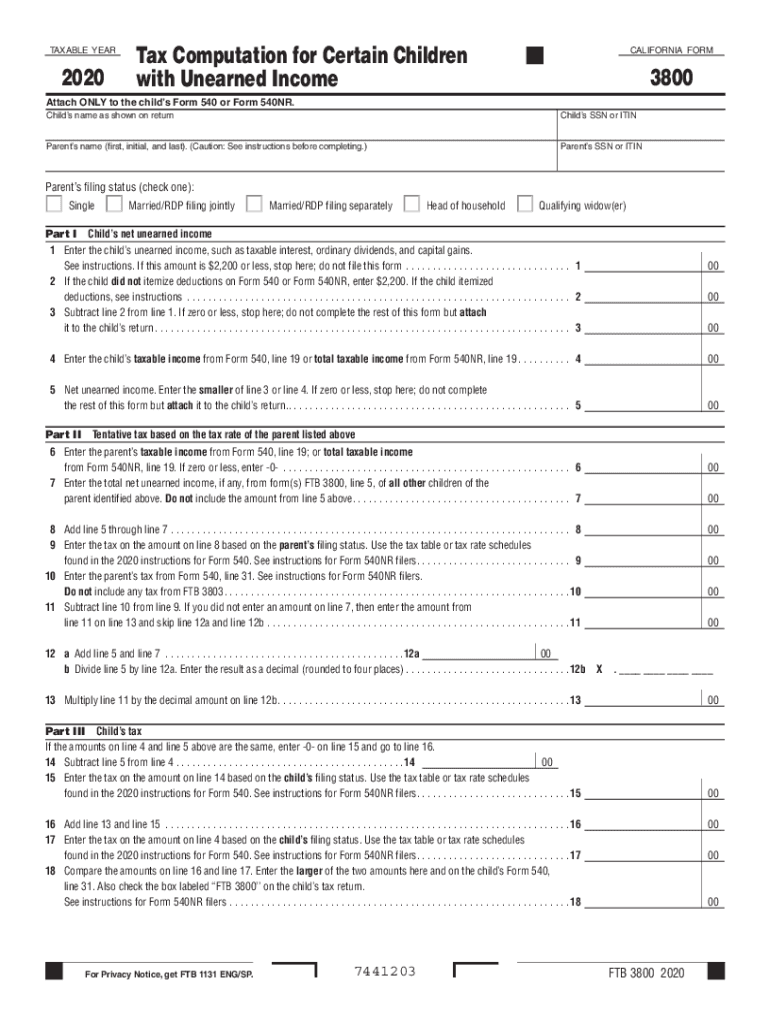

The California Form 3800, also known as the 3800 unearned form, is specifically designed for calculating the tax liability of certain children with unearned income. This form is essential for families where children receive income from sources such as investments, dividends, or interest. The purpose of the form is to ensure that the tax obligations associated with this unearned income are accurately reported and calculated in accordance with California tax laws.

Steps to Complete the Printable California Form 3800 Tax Computation For Certain Children With Unearned Income

Completing the California Form 3800 involves several key steps to ensure accuracy and compliance:

- Gather necessary information: Collect all relevant financial documents, including income statements and details about the child's unearned income sources.

- Fill out the personal information: Provide the child's name, Social Security number, and any other required identification details.

- Report unearned income: Enter the total amount of unearned income on the designated lines of the form.

- Calculate tax liability: Use the tax tables provided with the form to determine the tax owed based on the reported unearned income.

- Review and sign: Double-check all entries for accuracy before signing and dating the form.

Legal Use of the Printable California Form 3800 Tax Computation For Certain Children With Unearned Income

The legal use of the California Form 3800 is governed by state tax regulations. It is crucial for taxpayers to complete and submit this form accurately to avoid penalties. The form serves as a formal declaration of a child's unearned income and the corresponding tax calculation. Proper use of the form ensures compliance with California tax laws, which can help prevent legal complications or audits by tax authorities.

Eligibility Criteria for the Printable California Form 3800 Tax Computation For Certain Children With Unearned Income

To be eligible to use the California Form 3800, specific criteria must be met:

- The child must be under the age of 19 (or under 24 if a full-time student).

- The child must have unearned income exceeding a certain threshold, which is adjusted annually.

- The income must not be derived from a trade or business.

Key Elements of the Printable California Form 3800 Tax Computation For Certain Children With Unearned Income

Understanding the key elements of the California Form 3800 is essential for accurate completion. The form includes sections for reporting personal information, detailing sources of unearned income, and calculating the tax owed. Additionally, there are instructions for determining eligibility and specific tax rates applicable to unearned income. Familiarity with these elements can streamline the filing process and ensure compliance with state tax requirements.

How to Obtain the Printable California Form 3800 Tax Computation For Certain Children With Unearned Income

The California Form 3800 can be obtained through various channels. It is available for download from the California Franchise Tax Board (FTB) website. Additionally, physical copies can often be found at local tax offices or public libraries. Ensuring that you have the most current version of the form is important, as tax regulations may change from year to year.

Quick guide on how to complete printable 2020 california form 3800 tax computation for certain children with unearned income

Complete Printable California Form 3800 Tax Computation For Certain Children With Unearned Income easily on any device

Web-based document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Printable California Form 3800 Tax Computation For Certain Children With Unearned Income on any device with the airSlate SignNow Android or iOS applications and enhance any document-driven task today.

The simplest way to alter and eSign Printable California Form 3800 Tax Computation For Certain Children With Unearned Income smoothly

- Locate Printable California Form 3800 Tax Computation For Certain Children With Unearned Income and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent portions of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your preference. Edit and eSign Printable California Form 3800 Tax Computation For Certain Children With Unearned Income and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 california form 3800 tax computation for certain children with unearned income

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 california form 3800 tax computation for certain children with unearned income

The best way to create an eSignature for a PDF file online

The best way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is Form 3800 and how can airSlate SignNow help with it?

Form 3800 is used for claiming certain credits against income tax in the United States. AirSlate SignNow simplifies the process by allowing businesses to easily eSign and manage their Form 3800 documents, ensuring compliance and quick submission.

-

Is airSlate SignNow suitable for filing Form 3800?

Yes, airSlate SignNow is suitable for filing Form 3800. Our platform provides a user-friendly interface that helps users fill out, sign, and send their Form 3800 securely and efficiently, saving time and reducing errors.

-

What are the pricing options for using airSlate SignNow for Form 3800?

AirSlate SignNow offers flexible pricing plans designed to accommodate various business needs, starting with a free trial. Each plan includes features perfect for managing documents like Form 3800, allowing users to choose the best option for their workload.

-

How does airSlate SignNow ensure the security of Form 3800 submissions?

AirSlate SignNow employs industry-leading security measures such as encryption and secure servers to protect your Form 3800 submissions. This ensures that your sensitive tax information remains confidential throughout the signing and submission process.

-

Can I integrate airSlate SignNow with other software for Form 3800 processing?

Absolutely! AirSlate SignNow offers extensive integrations with popular software like CRM systems and accounting tools. This means you can streamline your workflow and manage Form 3800 processing seamlessly across platforms.

-

What features does airSlate SignNow offer for managing Form 3800?

AirSlate SignNow provides features like document templates, in-app signing, and tracking for Form 3800 documents. These tools enhance productivity and ensure that you can manage your eSignatures efficiently and effectively.

-

Is there a mobile app available for airSlate SignNow to handle Form 3800?

Yes, airSlate SignNow has a mobile app that allows users to manage and eSign Form 3800 documents on the go. This flexibility ensures that you can complete important tasks no matter where you are.

Get more for Printable California Form 3800 Tax Computation For Certain Children With Unearned Income

- Contract name repairrehabilitation of multi purpose building including ground improvement form

- Obligation slip form

- Annex f 7 commission on elections form

- Annual statistical report for birthing homes form

- Philippines member panlungsod form

- Dpwh form no 96 001 e

- Sss r1a form

- How to fill up spa form pag ibig

Find out other Printable California Form 3800 Tax Computation For Certain Children With Unearned Income

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online