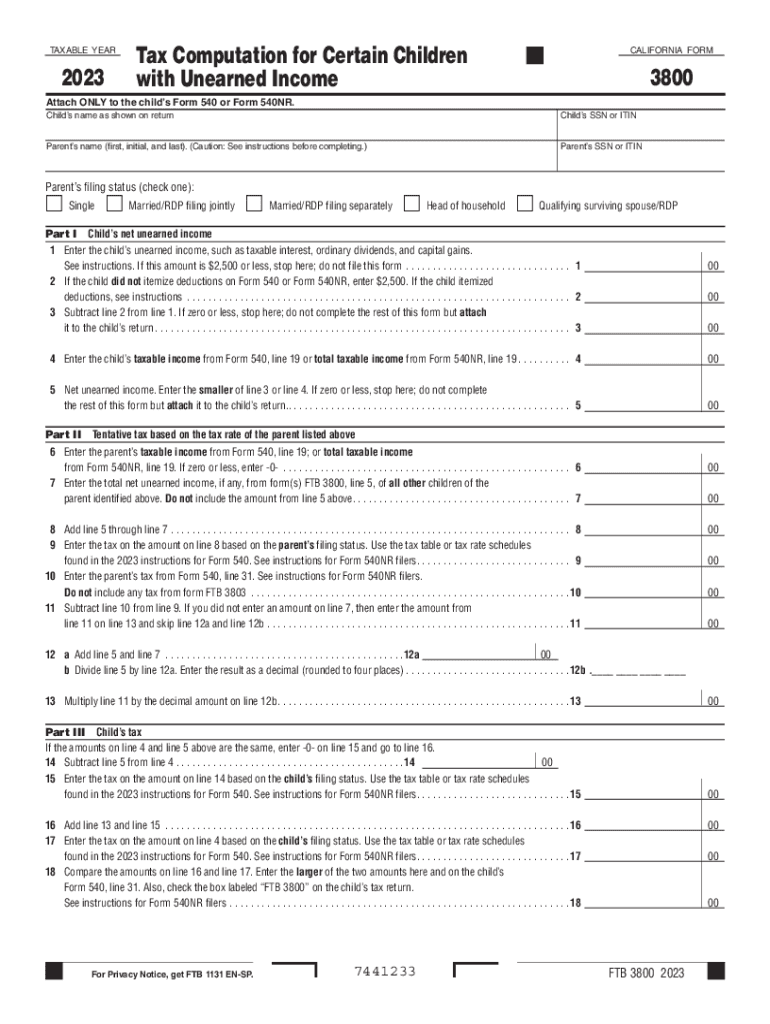

Form 3800 Tax Computation for Certain Children with Unearned Income 2023

Understanding Form 8615 for Children with Unearned Income

Form 8615, officially known as the Tax for Certain Children Who Have Unearned Income, is a tax form used by the Internal Revenue Service (IRS) in the United States. This form is specifically designed for children under the age of 19, or under 24 if they are full-time students, who have unearned income exceeding a certain threshold. The purpose of Form 8615 is to calculate the tax owed on this unearned income, which can include interest, dividends, and other passive income sources. The tax rates applied to this income can be higher than those for ordinary income, making it essential for eligible children and their guardians to understand its implications.

Key Elements of Form 8615

Form 8615 consists of several critical components that taxpayers must complete accurately. These include:

- Personal Information: This section requires the child's name, Social Security number, and other identifying details.

- Unearned Income Calculation: Taxpayers need to report the total amount of unearned income, which is crucial for determining the tax liability.

- Tax Computation: The form provides a worksheet to help calculate the tax based on the child's unearned income, utilizing specific tax rates that may differ from the standard rates.

- Signature: The form must be signed by the child's parent or guardian, affirming the accuracy of the information provided.

Steps to Complete Form 8615

Completing Form 8615 involves a series of straightforward steps:

- Gather all relevant financial documents, including any statements reflecting unearned income.

- Fill out the personal information section accurately, ensuring the child's details are correct.

- Calculate the total unearned income and enter it in the designated section.

- Use the provided worksheet to compute the tax owed based on the unearned income.

- Review the completed form for accuracy before signing it.

- Submit the form along with the child’s tax return by the appropriate deadline.

Eligibility Criteria for Using Form 8615

To qualify for Form 8615, certain eligibility criteria must be met:

- The child must be under 19 years old or under 24 and a full-time student.

- The child’s unearned income must exceed a specific threshold, which is adjusted annually by the IRS.

- The child must not file a joint return with a spouse, unless it is solely to claim a refund of withheld taxes.

Filing Deadlines for Form 8615

Form 8615 must be filed along with the child's tax return, which is typically due on April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should ensure that they file on time to avoid penalties and interest on any owed taxes.

IRS Guidelines for Form 8615

The IRS provides specific guidelines regarding the completion and submission of Form 8615. Taxpayers are encouraged to refer to the official IRS instructions for detailed information on how to fill out the form correctly, including any updates or changes to tax rates that may affect the calculation. Additionally, understanding the implications of unearned income and the associated tax liabilities is crucial for compliance.

Quick guide on how to complete form 3800 tax computation for certain children with unearned income

Complete Form 3800 Tax Computation For Certain Children With Unearned Income effortlessly on any device

The management of online documents has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly replacement for conventional printed and signed documents, allowing you to obtain the necessary form and securely retain it online. airSlate SignNow provides all the resources required to create, modify, and eSign your documents swiftly without unnecessary delays. Handle Form 3800 Tax Computation For Certain Children With Unearned Income on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form 3800 Tax Computation For Certain Children With Unearned Income without any hassle

- Find Form 3800 Tax Computation For Certain Children With Unearned Income and click Get Form to begin.

- Take advantage of the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature with the Sign tool, which requires only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose how you want to submit your form, via email, text (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from your chosen device. Modify and eSign Form 3800 Tax Computation For Certain Children With Unearned Income and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3800 tax computation for certain children with unearned income

Create this form in 5 minutes!

How to create an eSignature for the form 3800 tax computation for certain children with unearned income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is CA Form 3800 and how can airSlate SignNow help?

CA Form 3800 is a tax form used in California to claim a tax credit. airSlate SignNow simplifies the process by allowing you to easily fill out, sign, and send CA Form 3800 digitally, enhancing efficiency and accuracy in your tax filing.

-

How much does airSlate SignNow cost for filing CA Form 3800?

airSlate SignNow offers various pricing plans, making it a cost-effective solution for individuals and businesses needing to submit CA Form 3800. You can choose a plan that best fits your volume of documents and features required.

-

Can I customize CA Form 3800 within airSlate SignNow?

Yes, airSlate SignNow allows you to customize CA Form 3800 by adding your branding, fields, and text as required. This ensures that your documents meet the specific needs of your business while maintaining compliance.

-

Is it secure to use airSlate SignNow for CA Form 3800?

Absolutely! airSlate SignNow employs advanced security measures to protect your data and signed documents. This includes encryption and secure cloud storage, ensuring that your CA Form 3800 and any sensitive information are safeguarded.

-

Can I track the status of my CA Form 3800 submissions?

Yes, airSlate SignNow provides real-time tracking for your document submissions, including CA Form 3800. You can easily check the status of your sent forms, ensuring you stay updated on their progress.

-

Does airSlate SignNow integrate with other software for processing CA Form 3800?

Yes, airSlate SignNow integrates seamlessly with various software applications such as accounting and tax preparation tools. This integration facilitates a smoother workflow when handling CA Form 3800 and other important documents.

-

What are the key benefits of using airSlate SignNow for CA Form 3800?

Using airSlate SignNow for CA Form 3800 offers numerous benefits including speed, ease of use, and accessibility. It enables you to complete the form quickly, sign it electronically, and share it instantly without the hassle of printing and mailing.

Get more for Form 3800 Tax Computation For Certain Children With Unearned Income

Find out other Form 3800 Tax Computation For Certain Children With Unearned Income

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy