Form 3800 Tax Computation for Certain Children with Unearned Income Form 3800 Tax Computation for Certain Children with Unearned 2022

What is the Form 3800 Tax Computation for Certain Children With Unearned Income?

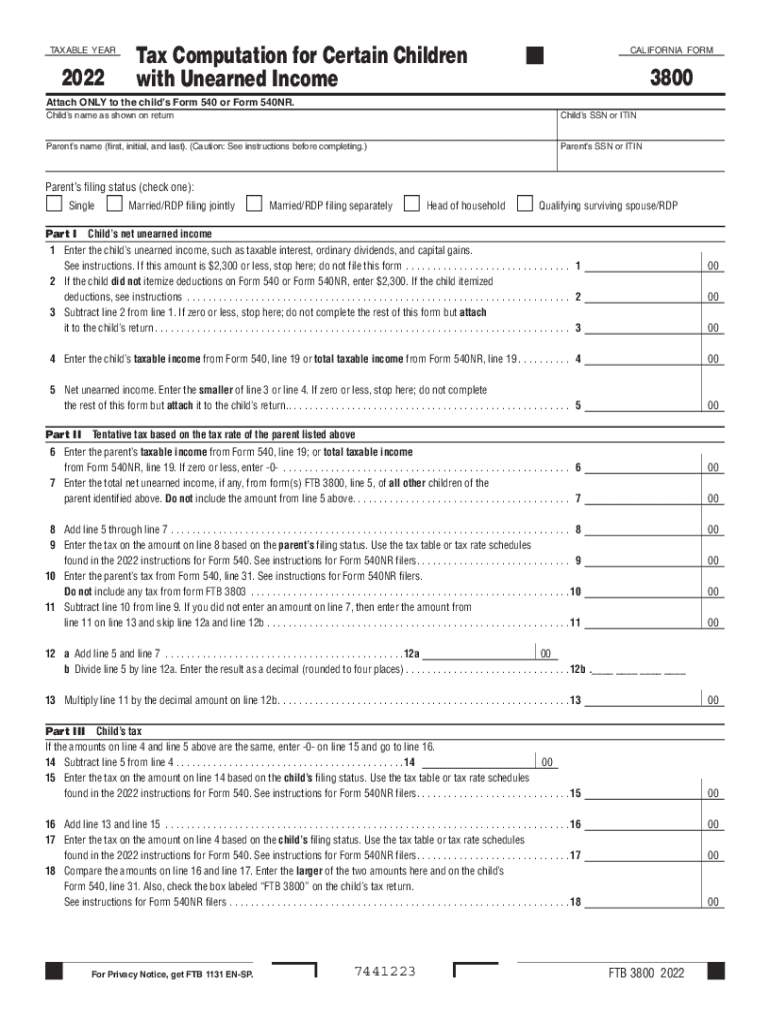

The Form 3800 Tax Computation for Certain Children With Unearned Income is a specific tax form used to calculate the tax liability for children who have unearned income. This form is particularly relevant for minors whose investment income exceeds a certain threshold. The IRS requires this form to ensure that the tax obligations of children are accurately reported and calculated. It serves to determine how much tax is owed based on the child's unearned income, which can include interest, dividends, and capital gains.

How to Use the Form 3800 Tax Computation for Certain Children With Unearned Income

Using the Form 3800 involves several steps to ensure accurate completion. First, gather all necessary financial documents that detail the child’s unearned income. Next, fill out the form by providing the required information, including the child's name, Social Security number, and the total amount of unearned income. Once completed, the form must be submitted along with the child's tax return. It is important to review the form for accuracy before submission to avoid any potential issues with the IRS.

Key Elements of the Form 3800 Tax Computation for Certain Children With Unearned Income

Several key elements must be included when completing the Form 3800. These include:

- Child's Information: Name, address, and Social Security number.

- Income Details: Total amount of unearned income, including sources such as interest and dividends.

- Tax Calculation: The specific tax rates applicable to the child's income bracket.

- Parent or Guardian Information: Details of the parent or guardian who will be filing the tax return on behalf of the child.

Steps to Complete the Form 3800 Tax Computation for Certain Children With Unearned Income

Completing the Form 3800 involves a systematic approach:

- Collect all necessary documentation regarding the child's unearned income.

- Fill in the child's personal information accurately.

- Report the total amount of unearned income from all sources.

- Calculate the tax owed based on the IRS guidelines.

- Review the completed form for any errors or omissions.

- Submit the form along with the child's tax return by the appropriate deadline.

Eligibility Criteria for the Form 3800 Tax Computation for Certain Children With Unearned Income

To be eligible to use the Form 3800, certain criteria must be met. The child must be under the age of 19, or under 24 if a full-time student, and must have unearned income exceeding the IRS threshold for the tax year. Additionally, the child must not have earned income that exceeds a specified limit. Meeting these criteria is essential for the proper use of the form and to ensure compliance with IRS regulations.

Filing Deadlines for the Form 3800 Tax Computation for Certain Children With Unearned Income

Filing deadlines for the Form 3800 align with the standard tax filing deadlines set by the IRS. Typically, this means that the form must be submitted by April 15 of the following year for the income earned. It is crucial to adhere to these deadlines to avoid penalties or interest on any owed taxes. In cases where the deadline falls on a weekend or holiday, the due date may be extended to the next business day.

Quick guide on how to complete form 3800 tax computation for certain children with unearned income form 3800 tax computation for certain children with

Complete Form 3800 Tax Computation For Certain Children With Unearned Income Form 3800 Tax Computation For Certain Children With Unearned effortlessly on any device

Web-based document administration has become increasingly favored by companies and individuals. It offers an ideal environmentally-friendly option to traditional printed and signed documents, allowing you to access the correct template and securely store it online. airSlate SignNow provides all the tools necessary to create, adjust, and electronically sign your documents promptly without any hold-ups. Manage Form 3800 Tax Computation For Certain Children With Unearned Income Form 3800 Tax Computation For Certain Children With Unearned on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Form 3800 Tax Computation For Certain Children With Unearned Income Form 3800 Tax Computation For Certain Children With Unearned with ease

- Obtain Form 3800 Tax Computation For Certain Children With Unearned Income Form 3800 Tax Computation For Certain Children With Unearned and click Access Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click the Finished button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 3800 Tax Computation For Certain Children With Unearned Income Form 3800 Tax Computation For Certain Children With Unearned and ensure optimal communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3800 tax computation for certain children with unearned income form 3800 tax computation for certain children with

Create this form in 5 minutes!

How to create an eSignature for the form 3800 tax computation for certain children with unearned income form 3800 tax computation for certain children with

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 3800 Tax Computation For Certain Children With Unearned Income?

The Form 3800 Tax Computation For Certain Children With Unearned Income is a tax form used to report and calculate the tax owed on unearned income for children. It ensures compliance with IRS regulations by accurately determining tax liability, specifically for minors who have income from investments or other sources.

-

How can airSlate SignNow help with the Form 3800 Tax Computation For Certain Children With Unearned Income?

airSlate SignNow provides a user-friendly platform to eSign and send documents securely, including the Form 3800 Tax Computation For Certain Children With Unearned Income. This simplifies the process, making it easy for parents and guardians to manage and submit tax-related forms efficiently.

-

What are the pricing options for airSlate SignNow when using the Form 3800 Tax Computation For Certain Children With Unearned Income?

airSlate SignNow offers competitive pricing plans to accommodate different needs, whether it's a single user or a business. Our plans are designed to be cost-effective, ensuring you can access tools necessary for managing the Form 3800 Tax Computation For Certain Children With Unearned Income at an affordable rate.

-

Is it safe to use airSlate SignNow for sensitive documents like the Form 3800 Tax Computation For Certain Children With Unearned Income?

Yes, airSlate SignNow prioritizes document security. We implement robust encryption and comply with industry standards to ensure that your sensitive documents, such as the Form 3800 Tax Computation For Certain Children With Unearned Income, are protected from unauthorized access.

-

What features does airSlate SignNow offer for better document management related to the Form 3800 Tax Computation For Certain Children With Unearned Income?

airSlate SignNow offers features like document templates, real-time collaboration, and automated workflows that enhance document management for forms like the Form 3800 Tax Computation For Certain Children With Unearned Income. This streamlines the filing process, reducing time and errors.

-

Can I integrate airSlate SignNow with other software for managing the Form 3800 Tax Computation For Certain Children With Unearned Income?

Absolutely! airSlate SignNow supports various integrations with popular business applications, which can help you manage and eSign the Form 3800 Tax Computation For Certain Children With Unearned Income seamlessly. This connectivity improves efficiency and keeps all your documents in sync.

-

How does airSlate SignNow enhance accuracy for the Form 3800 Tax Computation For Certain Children With Unearned Income?

Our platform features built-in validation and error-checking mechanisms, which signNowly reduce the chances of mistakes in the Form 3800 Tax Computation For Certain Children With Unearned Income. By ensuring accurate data entry and calculations, airSlate SignNow helps you file with confidence.

Get more for Form 3800 Tax Computation For Certain Children With Unearned Income Form 3800 Tax Computation For Certain Children With Unearned

- 680 3a e form 2015 2019

- 5 early childhood pre k health record supplement form

- Worksheet 6 executive summary and tceq tceq state tx form

- Ipsas checklist v10 final deloitte form

- Aru event sanctioning application australian rugby union form

- Apostolic assembly convention 2016 form

- Wv1451_snapshot pedometerpdf sportline form

- 168 hours form

Find out other Form 3800 Tax Computation For Certain Children With Unearned Income Form 3800 Tax Computation For Certain Children With Unearned

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation