Form it 255 Claim for Solar Energy System Equipment Credit Tax Year 2020

What is the Form IT 255 Claim For Solar Energy System Equipment Credit Tax Year

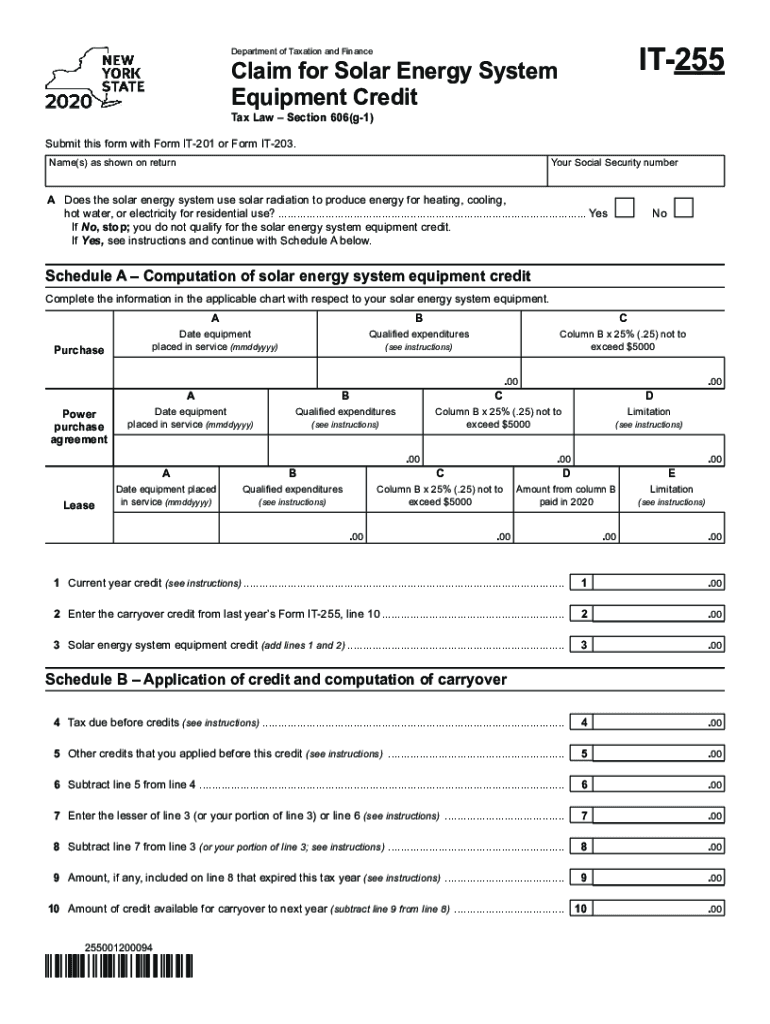

The IT 255 form is a tax document used to claim a credit for solar energy system equipment in the state of New York. This form is specifically designed for taxpayers who have installed solar energy systems in their homes or businesses. By completing the IT 255, individuals can receive a tax credit that reduces their overall tax liability, making solar energy a more affordable option. The credit is applicable for various types of solar energy systems, including photovoltaic panels and solar water heating systems, provided they meet specific eligibility criteria set forth by the state.

How to use the Form IT 255 Claim For Solar Energy System Equipment Credit Tax Year

To effectively use the IT 255 form, taxpayers should first ensure they meet the eligibility requirements, which include having a qualified solar energy system installed. Once eligibility is confirmed, the taxpayer can obtain the form from the New York State Department of Taxation and Finance website or through tax preparation software. After filling out the necessary information regarding the installation and costs of the solar energy system, the completed form should be submitted along with the taxpayer's annual income tax return. It is important to keep copies of all related documents and receipts for future reference or audits.

Steps to complete the Form IT 255 Claim For Solar Energy System Equipment Credit Tax Year

Completing the IT 255 form involves several key steps:

- Gather necessary documentation, including receipts for the solar energy system and installation costs.

- Download the IT 255 form from the New York State Department of Taxation and Finance website.

- Fill in personal information, including your name, address, and Social Security number.

- Provide details about the solar energy system, including the type of system installed and the total cost.

- Calculate the credit amount based on the guidelines provided in the form instructions.

- Sign and date the form before submitting it with your tax return.

Legal use of the Form IT 255 Claim For Solar Energy System Equipment Credit Tax Year

The IT 255 form is legally recognized as a valid claim for tax credits under New York State law. To ensure compliance with legal requirements, taxpayers must accurately report their solar energy system installation and associated costs. The form must be completed in accordance with the guidelines provided by the New York State Department of Taxation and Finance. Failing to adhere to these regulations may result in penalties or denial of the claimed credit.

Eligibility Criteria

To qualify for the IT 255 tax credit, taxpayers must meet specific eligibility criteria. These include:

- The solar energy system must be installed on a property located in New York State.

- The system must be operational and used for residential or commercial purposes.

- Taxpayers must provide proof of purchase and installation costs.

- The installation must comply with local building codes and regulations.

Filing Deadlines / Important Dates

It is essential for taxpayers to be aware of the filing deadlines associated with the IT 255 form. Typically, the form must be submitted along with the annual income tax return by the tax filing deadline, which is usually April fifteenth. If additional time is needed, taxpayers may file for an extension, but they should ensure that the IT 255 form is submitted by the extended deadline to avoid missing out on the tax credit.

Quick guide on how to complete form it 255 claim for solar energy system equipment credit tax year 2020

Complete Form IT 255 Claim For Solar Energy System Equipment Credit Tax Year effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as the ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Form IT 255 Claim For Solar Energy System Equipment Credit Tax Year on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign Form IT 255 Claim For Solar Energy System Equipment Credit Tax Year without effort

- Locate Form IT 255 Claim For Solar Energy System Equipment Credit Tax Year and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Form IT 255 Claim For Solar Energy System Equipment Credit Tax Year to ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 255 claim for solar energy system equipment credit tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the form it 255 claim for solar energy system equipment credit tax year 2020

The best way to generate an electronic signature for your PDF document in the online mode

The best way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to it 255?

airSlate SignNow is a powerful eSignature and document management solution that enables businesses to manage their documents efficiently. With features tailored for compliance and ease of use, it simplifies the digital signing process, making it an ideal choice for companies dealing with it 255 forms and other documentation.

-

How does airSlate SignNow improve the efficiency of handling it 255 forms?

By using airSlate SignNow for your it 255 forms, businesses can streamline their document workflows, reduce turnaround times, and minimize errors. The platform allows for quick eSigning and automated document routing, which enhances productivity and ensures that compliance deadlines are met.

-

What are the key features of airSlate SignNow for managing it 255 documents?

Key features of airSlate SignNow include customizable templates, real-time tracking, and robust security measures tailored for sensitive documents like it 255. These features help ensure that all signed documents are stored securely and are easily retrievable for future reference.

-

Is there a free trial available for airSlate SignNow targeting it 255 users?

Yes, airSlate SignNow offers a free trial that allows potential users to explore its features specifically designed for managing it 255 documents. This trial provides an opportunity to test the platform's capabilities in a hands-on environment before committing to a subscription.

-

What pricing options does airSlate SignNow offer for it 255-related services?

airSlate SignNow provides flexible pricing plans suitable for businesses of all sizes, ensuring that it 255-related services are accessible to everyone. The tiers vary based on features and user requirements, allowing companies to choose a plan that best fits their needs and budget.

-

Can airSlate SignNow integrate with other software systems for it 255 processing?

Absolutely! airSlate SignNow offers numerous integrations with popular software applications, allowing for seamless connectivity when managing it 255 documents. Users can easily connect their existing workflows with other software to enhance productivity and ensure data consistency.

-

What security measures are in place for eSigning it 255 documents with airSlate SignNow?

airSlate SignNow employs industry-standard security protocols, including encryption and secure storage, to protect it 255 documents during transmission and at rest. These measures help safeguard sensitive information, ensuring compliance with regulations while using their eSigning services.

Get more for Form IT 255 Claim For Solar Energy System Equipment Credit Tax Year

Find out other Form IT 255 Claim For Solar Energy System Equipment Credit Tax Year

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now