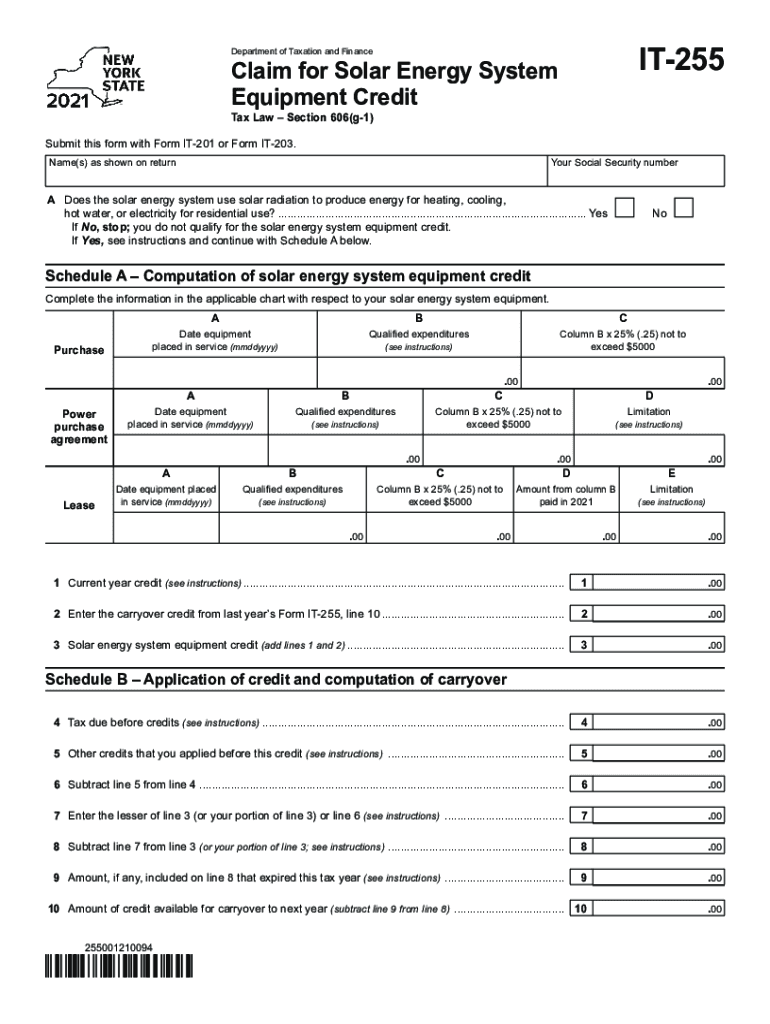

Form it 255 Claim for Solar Energy System Equipment Credit 2021

What is the Form IT 255 Claim For Solar Energy System Equipment Credit

The Form IT 255 is a tax form used by New York residents to claim a credit for solar energy system equipment. This credit helps offset the costs associated with purchasing and installing solar energy systems. The form is specifically designed for individuals and businesses that invest in solar technology, allowing them to benefit from state incentives aimed at promoting renewable energy usage. By completing the IT 255, taxpayers can reduce their overall tax liability, making solar investments more financially viable.

How to use the Form IT 255 Claim For Solar Energy System Equipment Credit

Using the Form IT 255 involves several steps to ensure accurate submission. First, gather all necessary documentation related to your solar energy system, including receipts and installation contracts. Next, fill out the form with your personal information, details about the solar system, and the total costs incurred. It is essential to provide accurate figures to avoid delays or penalties. Once completed, submit the form along with your tax return to the appropriate tax authority. Ensure you keep copies of all documents for your records.

Steps to complete the Form IT 255 Claim For Solar Energy System Equipment Credit

Completing the Form IT 255 requires careful attention to detail. Here are the steps to follow:

- Gather your receipts and documentation for the solar energy system.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about the solar energy system, including the installation date and costs.

- Calculate the credit amount based on the eligible expenses.

- Review the form for accuracy and completeness.

- Submit the form with your tax return by the filing deadline.

Eligibility Criteria

To qualify for the credit outlined in the Form IT 255, certain eligibility criteria must be met. Taxpayers must be residents of New York State and have installed a solar energy system that meets specific guidelines. The system must be used primarily for generating electricity for personal use or for sale to the grid. Additionally, the installation must comply with local building codes and regulations. It is important to review the specific requirements to ensure that your installation qualifies for the credit.

Required Documents

When completing the Form IT 255, several documents are required to substantiate your claim. These include:

- Receipts for the purchase and installation of the solar energy system.

- Contracts or agreements with the installation company.

- Proof of payment, such as bank statements or credit card statements.

- Any additional documentation that demonstrates compliance with local regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 255 align with the general tax filing deadlines in New York. Typically, individual income tax returns are due on April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to tax deadlines, especially if you are claiming credits or deductions that may require additional time for documentation. Mark your calendar to ensure timely submission of your form.

Quick guide on how to complete form it 255 claim for solar energy system equipment credit

Complete Form IT 255 Claim For Solar Energy System Equipment Credit effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the appropriate template and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and without delays. Manage Form IT 255 Claim For Solar Energy System Equipment Credit on any device using airSlate SignNow's Android or iOS apps and simplify any document-related process today.

How to modify and eSign Form IT 255 Claim For Solar Energy System Equipment Credit with ease

- Locate Form IT 255 Claim For Solar Energy System Equipment Credit and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just a few seconds and carries the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form IT 255 Claim For Solar Energy System Equipment Credit and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 255 claim for solar energy system equipment credit

Create this form in 5 minutes!

How to create an eSignature for the form it 255 claim for solar energy system equipment credit

The best way to create an e-signature for your PDF file in the online mode

The best way to create an e-signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

The best way to make an e-signature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The best way to make an e-signature for a PDF file on Android

People also ask

-

What is it 255 and how does it work with airSlate SignNow?

It 255 refers to a specific feature within the airSlate SignNow platform designed for efficient document management. This feature allows users to streamline the signing process, ensuring that documents are sent and signed quickly, reducing the turnaround time for critical business agreements.

-

How much does using it 255 through airSlate SignNow cost?

Pricing for it 255 through airSlate SignNow varies depending on the plan you choose. The platform offers different tiers to fit various business needs, allowing companies to find a cost-effective solution that matches their document signing requirements without overspending.

-

What are the key features of it 255 in airSlate SignNow?

The key features of it 255 include customizable templates, advanced tracking options, and real-time notifications. These functionalities enhance user experience, making document signing more efficient and organized, ultimately benefiting your business operations.

-

Can I integrate it 255 with other software?

Yes, airSlate SignNow's it 255 feature seamlessly integrates with various software and applications. Whether you're using CRM systems, cloud storage, or productivity tools, these integrations help centralize your document management process, increasing overall efficiency.

-

What benefits does it 255 offer for businesses?

Utilizing it 255 with airSlate SignNow provides businesses with faster workflows, reduced operational costs, and improved compliance with legal standards. By automating the signing process, companies can focus on core tasks, leading to greater productivity and resource allocation.

-

Is it easy to use it 255 for eSigning documents?

Absolutely! It 255 in airSlate SignNow is designed with user-friendliness in mind, making it simple for anyone to eSign documents. The intuitive interface ensures that even users with limited technical skills can navigate the platform and manage their signing needs efficiently.

-

What support options are available for it 255 users?

airSlate SignNow offers comprehensive support for it 255 users, including live chat, email support, and access to a detailed knowledge base. Whether you have questions about features or need help troubleshooting issues, the support team is ready to assist you promptly.

Get more for Form IT 255 Claim For Solar Energy System Equipment Credit

- Excavator contract for contractor colorado form

- Renovation contract for contractor colorado form

- Demolition contract for contractor colorado form

- Framing contract for contractor colorado form

- Security contract for contractor colorado form

- Insulation contract for contractor colorado form

- Paving contract for contractor colorado form

- Site work contract for contractor colorado form

Find out other Form IT 255 Claim For Solar Energy System Equipment Credit

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online