How to Fill Out IRS Form 5695 to Claim the Solar Tax Credit 2022

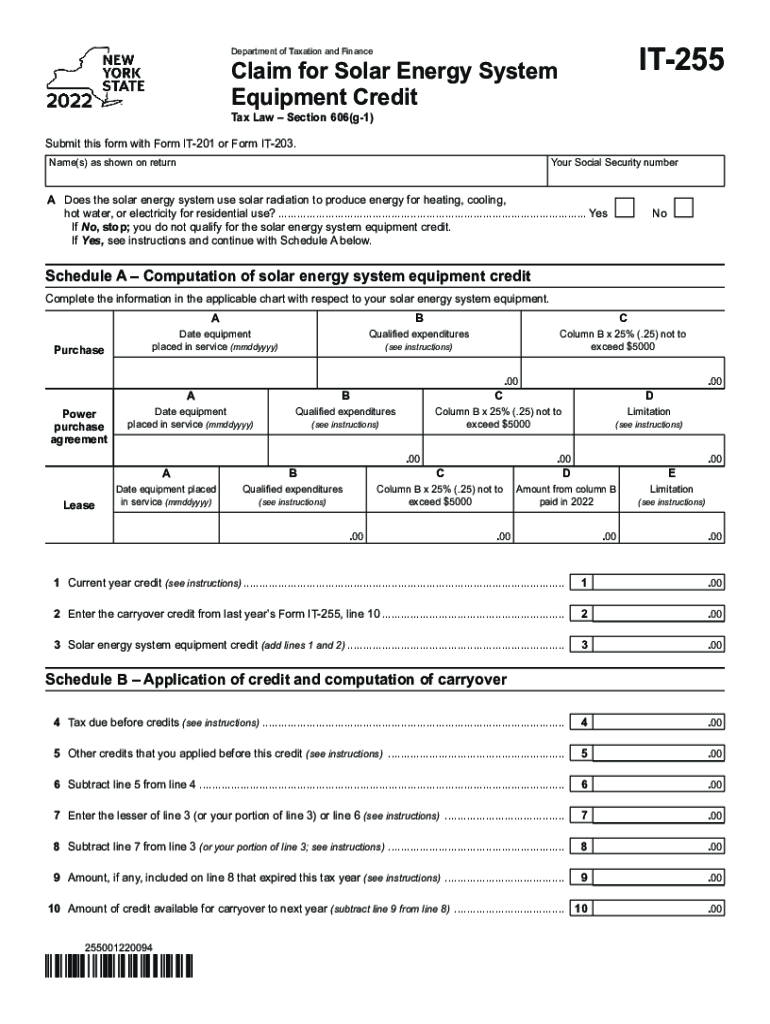

Understanding the IT-255 Form

The IT-255 form is a crucial document for taxpayers in New York who wish to claim a solar energy system credit. This form allows individuals and businesses to receive tax credits for the installation of solar energy equipment. It is essential to understand the specific requirements and eligibility criteria associated with this form to maximize potential benefits. The IT-255 form is designed to facilitate the claiming process for renewable energy investments, promoting sustainable practices while providing financial incentives.

How to Complete the IT-255 Form

Filling out the IT-255 form involves several steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including receipts for solar energy system purchases and installation. Clearly indicate the total cost of the solar energy system, as well as any applicable credits from previous tax years. Each section of the form must be completed methodically, providing precise figures and information as required. It is advisable to review the instructions carefully to avoid common mistakes that could delay processing or lead to denials.

Eligibility Criteria for the IT-255 Form

To qualify for the solar energy credit using the IT-255 form, certain eligibility criteria must be met. Taxpayers must have installed a solar energy system that meets specific performance and quality standards. Additionally, the system must be located in New York State and used primarily for the taxpayer's personal use or business operations. Understanding these criteria is vital for ensuring that the claim is valid and that the taxpayer can benefit from the associated tax credits.

Required Documents for the IT-255 Form

When completing the IT-255 form, it is important to have all required documents on hand. This includes proof of purchase for the solar energy system, installation contracts, and any previous tax documents that may support the claim. Receipts and invoices should clearly detail the costs incurred, as these will be necessary for substantiating the credit amount claimed. Organizing these documents ahead of time can streamline the filing process and reduce the likelihood of errors.

Filing Deadlines for the IT-255 Form

Timely submission of the IT-255 form is essential to ensure that taxpayers can take advantage of available credits. The form must be filed along with the annual tax return by the designated deadline, typically April 15 for most taxpayers. However, those who file for extensions should be aware of the extended deadlines and ensure that the IT-255 form is included in their submissions. Missing the filing deadline could result in forfeiting the tax credit, making it crucial to stay informed about important dates.

Legal Use of the IT-255 Form

The IT-255 form is legally recognized as a means for claiming tax credits related to solar energy systems in New York. Compliance with all relevant tax laws and guidelines is necessary to ensure that the form is accepted by the New York State Department of Taxation and Finance. Understanding the legal implications of the information provided on the form can help taxpayers avoid potential penalties or issues during the review process.

Form Submission Methods for the IT-255

Taxpayers have several options for submitting the IT-255 form. The form can be filed electronically through approved tax software or submitted via mail. For those opting for electronic filing, ensure that the software used is compatible with the IT-255 requirements. If submitting by mail, it is advisable to send the form via certified mail to confirm receipt by the tax authorities. Each submission method has its own advantages, and choosing the right one can facilitate a smoother filing experience.

Quick guide on how to complete how to fill out irs form 5695 to claim the solar tax credit

Effortlessly prepare How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit on any gadget

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and safely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and electronically sign your documents swiftly and without delays. Handle How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest way to modify and electronically sign How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit with ease

- Obtain How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight critical sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal standing as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or unaccounted documents, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and electronically sign How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to fill out irs form 5695 to claim the solar tax credit

Create this form in 5 minutes!

How to create an eSignature for the how to fill out irs form 5695 to claim the solar tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 255 form used for?

The IT 255 form is primarily used for claiming the New York City personal income tax credit for individuals. By using IT 255, taxpayers can ensure they are receiving all available tax benefits, which can lead to signNow savings when eSigning and submitting important tax documents with airSlate SignNow.

-

How does airSlate SignNow support IT 255 e-signatures?

airSlate SignNow allows users to easily eSign the IT 255 form and any other tax documents securely and efficiently. The platform’s user-friendly interface ensures that you can complete your IT 255 submissions swiftly, improving workflow and minimizing the hassle of traditional signatures.

-

What are the pricing options for using airSlate SignNow for IT 255 e-signatures?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes looking to facilitate document management, including the IT 255 form. The pricing structures are designed to provide cost-effective solutions, making eSigning seamless and affordable without compromising on features.

-

Can airSlate SignNow be integrated with accounting software for filing IT 255?

Yes, airSlate SignNow seamlessly integrates with various accounting and financial software, allowing users to manage their IT 255 submissions alongside other financial documents. This integration simplifies the eSigning process and ensures that all relevant data is easily accessible.

-

What security features does airSlate SignNow offer for IT 255 e-signatures?

When using airSlate SignNow for eSigning the IT 255 form, users benefit from top-notch security features, including encryption and secure access controls. These measures protect your documents and personal information, ensuring that your data remains confidential and secure throughout the process.

-

How does airSlate SignNow simplify the process of submitting the IT 255 form?

airSlate SignNow simplifies IT 255 submissions by allowing users to prepare, send, and eSign documents all within one platform. This streamlined process reduces time and errors, making it easier for businesses and individuals to ensure compliance and timely submissions.

-

What benefits does airSlate SignNow provide for businesses submitting the IT 255 form?

Businesses using airSlate SignNow to submit the IT 255 form enjoy increased efficiency, reduced processing time, and improved accuracy in document handling. The platform’s features enhance productivity and reliability, helping organizations to manage their tax obligations more effectively.

Get more for How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit

- Tennessee about law form

- Tennessee tenant landlord 497326763 form

- Letter from tenant to landlord about insufficient notice of rent increase tennessee form

- Tennessee landlord rental form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant tennessee form

- Tenant notice rent 497326767 form

- Tennessee tenant landlord 497326768 form

- Temporary lease agreement to prospective buyer of residence prior to closing tennessee form

Find out other How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile