Form it 603 'Claim for Ez Investment Tax Credit and Ez 2020

What is the Form IT 603 'Claim For Ez Investment Tax Credit And Ez

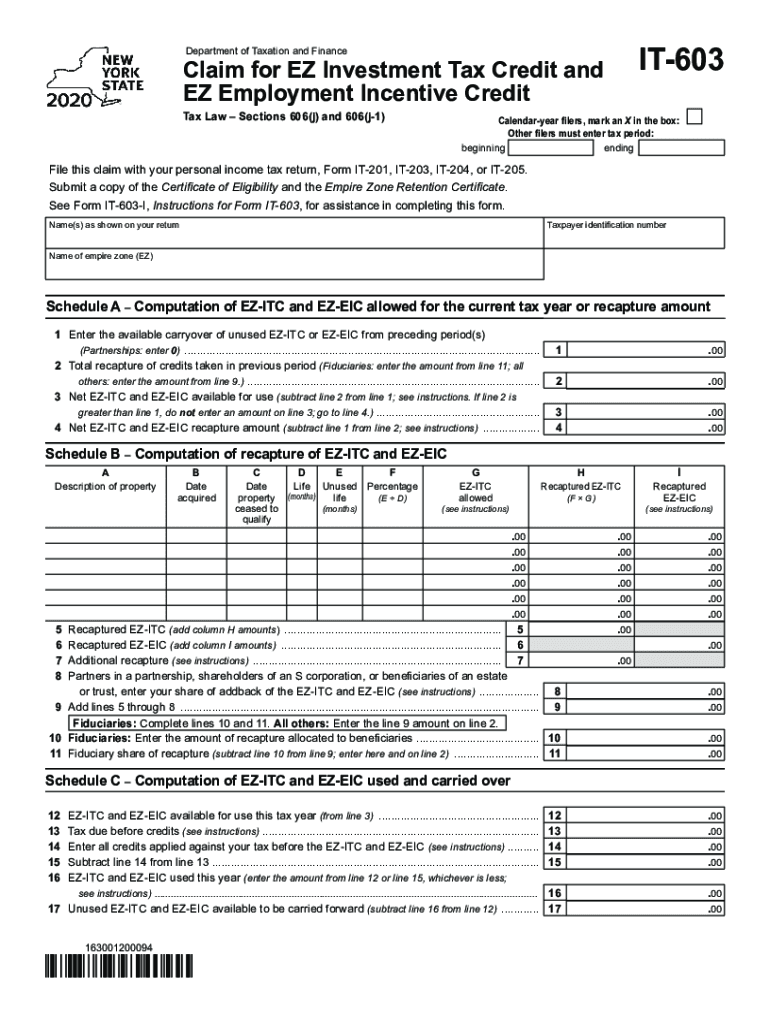

The Form IT 603, known as the 'Claim For Ez Investment Tax Credit And Ez', is a tax form used by eligible individuals and businesses in the United States to claim tax credits related to investments. This form is specifically designed to facilitate the process of applying for the EZ Investment Tax Credit, which is aimed at encouraging economic development and investment in certain areas. The form captures essential information about the taxpayer, the investment, and the nature of the claim being made, ensuring compliance with IRS regulations.

Steps to complete the Form IT 603 'Claim For Ez Investment Tax Credit And Ez

Completing the Form IT 603 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to your investment, including receipts and proof of payment. Next, fill out the form with your personal information, including your name, address, and taxpayer identification number. Be sure to provide detailed information about the investment, including the type, amount, and date of the investment. After completing the form, review it for any errors or omissions before submitting it to the appropriate tax authority.

Eligibility Criteria

To qualify for the EZ Investment Tax Credit and successfully use Form IT 603, applicants must meet specific eligibility criteria. Generally, the investment must be made in designated areas or sectors that the IRS identifies as eligible for this credit. Additionally, the taxpayer must be in good standing with the IRS and have no outstanding tax liabilities. It is essential to review the latest IRS guidelines to confirm that your investment meets all necessary requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 603 are crucial for ensuring that your claim is processed in a timely manner. Typically, the form must be submitted by the tax filing deadline for the year in which the investment was made. For most taxpayers, this means the form should be filed by April fifteenth of the following year. However, extensions may be available under certain circumstances, so it is advisable to check the IRS website for the most current information regarding deadlines.

Legal use of the Form IT 603 'Claim For Ez Investment Tax Credit And Ez

The legal use of Form IT 603 is governed by IRS regulations and guidelines. To be considered valid, the form must be completed accurately and submitted within the specified timeframes. Additionally, the information provided must be truthful and substantiated by appropriate documentation. Failure to comply with these legal requirements can result in penalties, including denial of the tax credit or additional fines.

Form Submission Methods (Online / Mail / In-Person)

Form IT 603 can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the IRS. The most common submission methods include online filing through authorized e-file providers, mailing a paper copy of the form to the appropriate IRS address, or, in some cases, submitting the form in person at designated IRS offices. Each method has its own advantages, such as speed and convenience, so it's essential to choose the one that best fits your needs.

Quick guide on how to complete form it 603 ampquotclaim for ez investment tax credit and ez

Manage Form IT 603 'Claim For Ez Investment Tax Credit And Ez effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal green alternative to traditional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Manage Form IT 603 'Claim For Ez Investment Tax Credit And Ez on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to adjust and eSign Form IT 603 'Claim For Ez Investment Tax Credit And Ez with ease

- Obtain Form IT 603 'Claim For Ez Investment Tax Credit And Ez and click Access Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight signNow sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes only moments and holds the same legal validity as a conventional handwritten signature.

- Review the information and click the Finish button to save your changes.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form IT 603 'Claim For Ez Investment Tax Credit And Ez to ensure excellent communication at any stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 603 ampquotclaim for ez investment tax credit and ez

Create this form in 5 minutes!

How to create an eSignature for the form it 603 ampquotclaim for ez investment tax credit and ez

The best way to generate an eSignature for a PDF online

The best way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The way to create an eSignature for a PDF on Android

People also ask

-

What is Form IT 603 'Claim For Ez Investment Tax Credit And Ez'?

Form IT 603 'Claim For Ez Investment Tax Credit And Ez' is a crucial document used to apply for certain investment tax credits. This form allows taxpayers to claim credits for specific investments, potentially leading to signNow tax savings. Understanding how to complete this form accurately is essential for maximizing your benefits.

-

How can airSlate SignNow help me with Form IT 603 'Claim For Ez Investment Tax Credit And Ez'?

airSlate SignNow streamlines the process of filling out and eSigning Form IT 603 'Claim For Ez Investment Tax Credit And Ez'. Our platform offers intuitive templates and robust features that simplify document management, ensuring that your claim is processed quickly and accurately. With airSlate SignNow, you can avoid common errors associated with manual submissions.

-

What are the pricing options for airSlate SignNow when submitting Form IT 603 'Claim For Ez Investment Tax Credit And Ez'?

airSlate SignNow offers flexible pricing plans tailored for different business needs, including options that may be ideal for submitting Form IT 603 'Claim For Ez Investment Tax Credit And Ez'. Our plans cater to individuals, small businesses, and larger enterprises, ensuring there is a cost-effective solution for everyone. You can explore our website for detailed pricing information.

-

Are there specific features in airSlate SignNow that assist with Form IT 603 'Claim For Ez Investment Tax Credit And Ez'?

Yes, airSlate SignNow includes features like customizable templates, advanced security options, and audit trails that are particularly beneficial for processing Form IT 603 'Claim For Ez Investment Tax Credit And Ez'. These features help ensure compliance with tax regulations and keep your documents secure. Additionally, our platform allows for easy integration with other tools you may already be using.

-

What benefits can I expect from using airSlate SignNow for Form IT 603 'Claim For Ez Investment Tax Credit And Ez'?

Using airSlate SignNow for Form IT 603 'Claim For Ez Investment Tax Credit And Ez' provides numerous benefits, including enhanced efficiency in document handling and eSigning, as well as reduced turnaround times for your claims. Our platform ensures that you have access to all required documents and can submit them promptly. Furthermore, you can track the status of your submissions in real-time.

-

Can I integrate airSlate SignNow with other software for Form IT 603 'Claim For Ez Investment Tax Credit And Ez'?

Absolutely! airSlate SignNow allows for easy integration with various software and applications, streamlining the process for your Form IT 603 'Claim For Ez Investment Tax Credit And Ez'. By integrating existing tools, you can enhance your workflow, maintain accurate records, and improve overall productivity. Check our integration options to see what suits your needs best.

-

Is there customer support available for help with Form IT 603 'Claim For Ez Investment Tax Credit And Ez' on airSlate SignNow?

Yes, airSlate SignNow provides dedicated customer support to assist you with any questions or issues related to Form IT 603 'Claim For Ez Investment Tax Credit And Ez'. Our support team is available through multiple channels, ensuring you receive timely help. Whether you need assistance with technical issues or general inquiries, we’re here for you.

Get more for Form IT 603 'Claim For Ez Investment Tax Credit And Ez

Find out other Form IT 603 'Claim For Ez Investment Tax Credit And Ez

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast