Fillable Online Tax Ny N Ew York State Department 2023-2026

Understanding the Fillable Online Tax Form for New York State

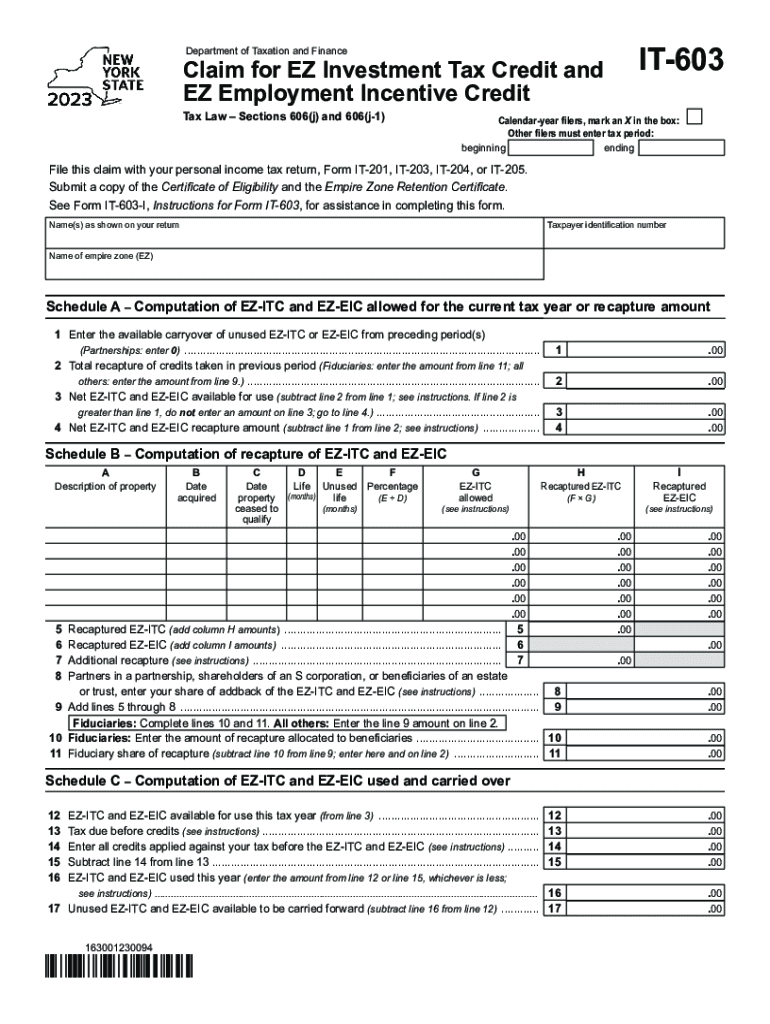

The Fillable Online Tax form provided by the New York State Department is designed for taxpayers to report their income and calculate their tax obligations efficiently. This digital form simplifies the tax filing process, allowing users to complete and submit their tax returns online. It is essential for individuals and businesses to understand the specific requirements and features of this form to ensure compliance with state tax laws.

Steps to Complete the Fillable Online Tax Form

Completing the Fillable Online Tax form involves several key steps:

- Gather necessary documents, such as W-2s, 1099s, and other income statements.

- Access the Fillable Online Tax form on the New York State Department's website.

- Fill in personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring all figures match your documents.

- Calculate your deductions and credits based on your eligibility.

- Review your entries for accuracy before submission.

- Submit the form electronically and save a copy for your records.

Required Documents for Filing

To successfully complete the Fillable Online Tax form, you will need to gather several important documents:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of other income, such as interest or dividends.

- Receipts for deductible expenses.

- Any relevant tax credit documentation.

Legal Use of the Fillable Online Tax Form

The Fillable Online Tax form is legally recognized by the New York State Department as a valid method for filing state tax returns. Taxpayers must ensure that they complete the form accurately and truthfully to avoid penalties. Using this form helps maintain compliance with state tax laws and facilitates the processing of returns.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the Fillable Online Tax form. Typically, individual tax returns must be filed by April fifteenth each year. However, extensions may be available under specific circumstances. Keeping track of these dates ensures timely submission and helps avoid late fees or penalties.

Examples of Scenarios for Using the Fillable Online Tax Form

The Fillable Online Tax form can be utilized in various taxpayer scenarios, including:

- Individuals filing their annual income tax returns.

- Self-employed individuals reporting business income.

- Students claiming education credits or deductions.

- Retirees reporting pension or Social Security income.

Form Submission Methods

The Fillable Online Tax form can be submitted electronically through the New York State Department's website. This method is secure and efficient. Alternatively, taxpayers may choose to print the completed form and submit it via mail. In-person submissions are also accepted at designated tax offices.

Quick guide on how to complete fillable online tax ny n ew york state department

Complete Fillable Online Tax Ny N Ew York State Department seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Fillable Online Tax Ny N Ew York State Department on any platform using airSlate SignNow's Android or iOS applications and enhance your document-centric process today.

How to modify and electronically sign Fillable Online Tax Ny N Ew York State Department effortlessly

- Find Fillable Online Tax Ny N Ew York State Department and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Fillable Online Tax Ny N Ew York State Department and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online tax ny n ew york state department

Create this form in 5 minutes!

How to create an eSignature for the fillable online tax ny n ew york state department

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Fillable Online Tax Ny N Ew York State Department?

The Fillable Online Tax Ny N Ew York State Department is designed to simplify the tax filing process for New York residents. It allows users to complete their tax forms electronically, making it easier to submit accurate documentation to the state. This method helps reduce errors and improve efficiency in filing taxes.

-

How much does the Fillable Online Tax Ny N Ew York State Department service cost?

The cost associated with using the Fillable Online Tax Ny N Ew York State Department varies based on the services you choose. Generally, airSlate SignNow offers affordable pricing that caters to businesses of all sizes. You can check the pricing plans on our website to find the best option for your needs.

-

Can I integrate Fillable Online Tax Ny N Ew York State Department with other software?

Absolutely! The Fillable Online Tax Ny N Ew York State Department can be easily integrated with various software options, such as accounting tools and CRM systems. This seamless integration improves workflow efficiency, allowing you to manage your tax documentation alongside other essential business functions.

-

What features does the Fillable Online Tax Ny N Ew York State Department offer?

The Fillable Online Tax Ny N Ew York State Department comes packed with features like e-signatures, automated reminders, and real-time tracking. These features enhance the ease of use and speed of the tax filing process, ensuring that you never miss a deadline. Users also benefit from a secure environment to manage their documents.

-

How does Fillable Online Tax Ny N Ew York State Department enhance security?

Security is a top priority for the Fillable Online Tax Ny N Ew York State Department. The platform uses advanced encryption technology to protect sensitive personal and financial information. Additionally, all documents are stored securely, ensuring only authorized users can access them, thereby maintaining confidentiality.

-

Are there any benefits to using Fillable Online Tax Ny N Ew York State Department over traditional methods?

Using the Fillable Online Tax Ny N Ew York State Department offers numerous benefits compared to traditional paper filing. It saves time, reduces physical paperwork, and minimizes the chances of mistakes during tax preparation. Ultimately, it streamlines the entire process, providing a more efficient way to handle tax submissions.

-

Is technical support available for users of Fillable Online Tax Ny N Ew York State Department?

Yes, users of the Fillable Online Tax Ny N Ew York State Department have access to dedicated technical support through various channels, including live chat, email, and phone. Our support team is available to assist with any questions or issues you may encounter, ensuring you can successfully navigate the platform.

Get more for Fillable Online Tax Ny N Ew York State Department

Find out other Fillable Online Tax Ny N Ew York State Department

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form