Form it 603 Claim for EZ Investment Tax Credit and EZ 2022

What is the Form IT 603 Claim For EZ Investment Tax Credit And EZ

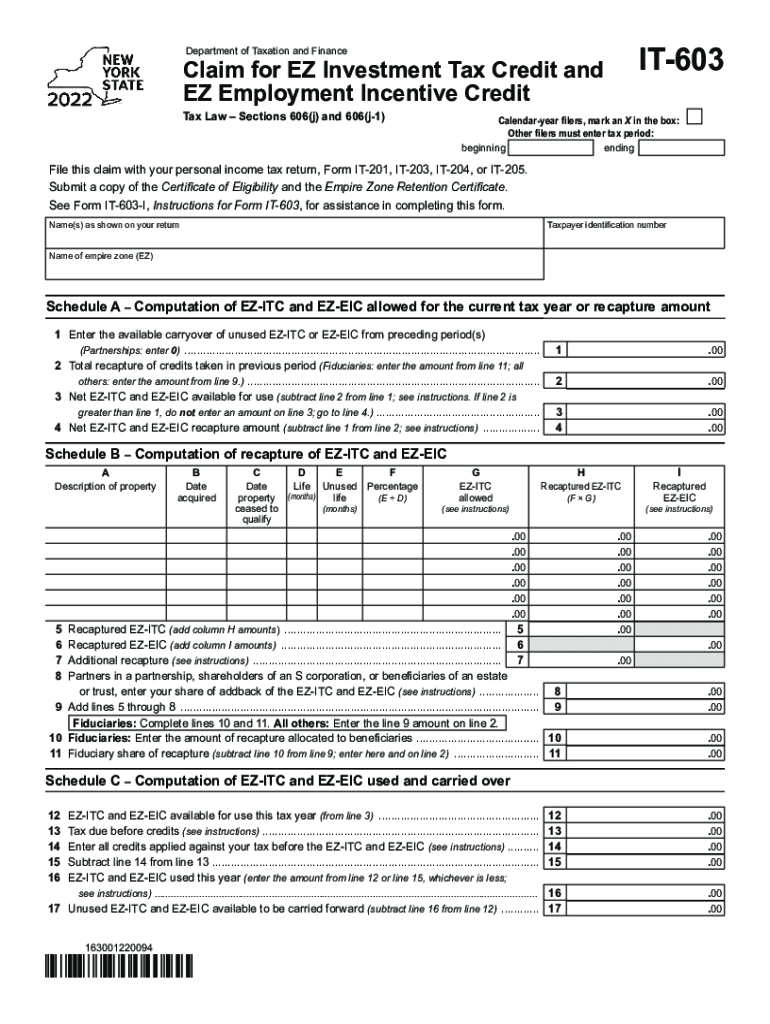

The Form IT 603 is a crucial document used by businesses in the United States to claim the EZ Investment Tax Credit. This tax credit is designed to incentivize investment in qualified property and encourage economic growth. By filing this form, eligible businesses can reduce their tax liability, thereby enhancing cash flow and promoting further investment. Understanding the specifics of the IT 603 is essential for businesses looking to maximize their tax benefits.

Steps to complete the Form IT 603 Claim For EZ Investment Tax Credit And EZ

Completing the Form IT 603 involves several important steps to ensure accuracy and compliance. First, gather all necessary financial documents and records related to the investment. Next, accurately fill out the form by providing details about the investment property, including its location and type. It is also essential to calculate the credit amount correctly based on the investment made. Finally, review the form for any errors before submission to avoid delays or rejections.

Legal use of the Form IT 603 Claim For EZ Investment Tax Credit And EZ

The legal validity of the Form IT 603 hinges on compliance with federal and state regulations governing tax credits. To ensure that the form is legally binding, it must be signed and dated appropriately. Additionally, the information provided must be accurate and verifiable. Utilizing a reliable eSignature solution can enhance the legal standing of the document, ensuring that all signatures meet the requirements set forth by the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws.

Eligibility Criteria

Eligibility for claiming the EZ Investment Tax Credit through Form IT 603 is primarily based on the type of business and the nature of the investment. Generally, businesses must operate within specific industries and meet certain size criteria. Additionally, the investment must be made in qualified property, which includes tangible assets used in the business. It is important for businesses to review the eligibility requirements thoroughly to ensure compliance and avoid penalties.

Filing Deadlines / Important Dates

Timely filing of the Form IT 603 is critical to securing the EZ Investment Tax Credit. Businesses should be aware of specific deadlines, which typically coincide with the tax filing season. It is advisable to check the latest IRS guidelines for any updates on filing dates. Missing these deadlines may result in the inability to claim the credit, impacting the overall financial health of the business.

Form Submission Methods (Online / Mail / In-Person)

The Form IT 603 can be submitted through various methods, providing flexibility for businesses. Online submission is often the quickest option, allowing for immediate processing. Alternatively, businesses may choose to mail the completed form to the appropriate tax authority. In-person submission may also be available at designated locations, offering another avenue for ensuring the form is received. Each method has its own advantages, and businesses should select the one that best fits their needs.

Quick guide on how to complete form it 603 claim for ez investment tax credit and ez

Easily Prepare Form IT 603 Claim For EZ Investment Tax Credit And EZ on Any Device

Digital document management has become increasingly popular with businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents swiftly without any delays. Manage Form IT 603 Claim For EZ Investment Tax Credit And EZ on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

How to Edit and eSign Form IT 603 Claim For EZ Investment Tax Credit And EZ Effortlessly

- Obtain Form IT 603 Claim For EZ Investment Tax Credit And EZ and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the frustration of lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form IT 603 Claim For EZ Investment Tax Credit And EZ and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 603 claim for ez investment tax credit and ez

Create this form in 5 minutes!

How to create an eSignature for the form it 603 claim for ez investment tax credit and ez

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 603 feature in airSlate SignNow?

The it 603 feature in airSlate SignNow allows users to streamline the electronic signing process efficiently. This feature enables businesses to create, send, and manage documents securely while minimizing manual paperwork. It is designed to enhance productivity and ensure compliance.

-

How much does airSlate SignNow with it 603 cost?

The pricing for airSlate SignNow with the it 603 feature is competitive and varies based on the plan selected. Customers can choose from various subscription options, tailored to fit different business sizes and needs. Visit our pricing page to find the perfect plan for you.

-

What are the key benefits of using it 603 with airSlate SignNow?

Using the it 603 feature with airSlate SignNow provides numerous benefits, including increased efficiency and faster turnaround times for document signing. Moreover, it offers robust security measures to protect sensitive information. This leads to improved client satisfaction and trust.

-

Can I integrate it 603 into my existing systems?

Yes, airSlate SignNow with the it 603 feature easily integrates with many popular applications and services. This seamless integration allows businesses to enhance their workflows without disrupting existing processes. Check our integration options for more details.

-

Is the it 603 feature user-friendly for all business types?

Absolutely! The it 603 feature in airSlate SignNow is designed to be user-friendly, catering to businesses of all sizes and industries. With an intuitive interface, even users with minimal technical skills can efficiently navigate and utilize the platform.

-

What types of documents can I handle with it 603?

With the it 603 feature in airSlate SignNow, you can handle various document types, including contracts, agreements, and forms. This versatility makes it suitable for legal, financial, and administrative applications, ensuring that your documents are securely signed and managed.

-

Does airSlate SignNow offer support for using it 603?

Yes, airSlate SignNow provides dedicated support for customers using the it 603 feature. Our support team is available to assist you with any questions or concerns, ensuring that you maximize the benefits of the platform. You can access resources, tutorials, and live support.

Get more for Form IT 603 Claim For EZ Investment Tax Credit And EZ

Find out other Form IT 603 Claim For EZ Investment Tax Credit And EZ

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation