Form it 603 "Claim for Ez Investment Tax Credit 2021

What is the Form IT 603 "Claim For EZ Investment Tax Credit"

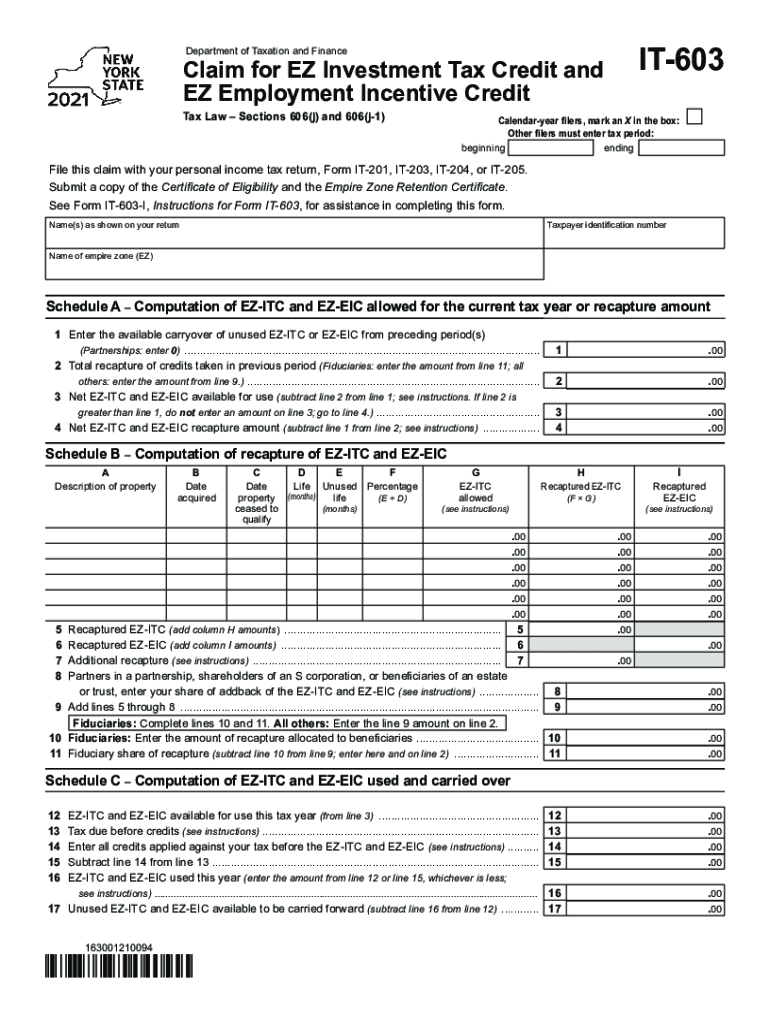

The Form IT 603, known as the "Claim For EZ Investment Tax Credit," is a tax document used by businesses in the United States to claim a credit for certain investments. This form is specifically designed for eligible businesses that have made qualifying investments in qualified property within the state. The EZ Investment Tax Credit aims to encourage business growth and development by providing tax relief for investments that can stimulate economic activity.

How to use the Form IT 603 "Claim For EZ Investment Tax Credit"

Using the Form IT 603 involves several steps to ensure accurate completion and submission. First, gather all necessary information regarding your business and the investments made. This includes details about the property, the amount invested, and any supporting documentation. Once you have all required information, fill out the form carefully, ensuring that all sections are completed accurately. After completing the form, review it for any errors before submission to avoid delays in processing your claim.

Steps to complete the Form IT 603 "Claim For EZ Investment Tax Credit"

Completing the Form IT 603 requires attention to detail. Follow these steps:

- Obtain the form from the appropriate state tax authority or download it from their website.

- Fill in your business information, including name, address, and tax identification number.

- Provide details about the qualifying investments, including the type of property and the investment amount.

- Attach any required documentation, such as receipts or proof of purchase.

- Review the form for accuracy and completeness.

- Submit the form according to the instructions provided, either electronically or by mail.

Legal use of the Form IT 603 "Claim For EZ Investment Tax Credit"

The legal use of the Form IT 603 is governed by state tax regulations. To ensure compliance, businesses must adhere to the eligibility criteria outlined by the state tax authority. This includes verifying that the investments made qualify for the EZ Investment Tax Credit and that all information provided on the form is accurate. Failure to comply with these regulations can result in penalties or denial of the tax credit.

Eligibility Criteria

To qualify for the EZ Investment Tax Credit, businesses must meet specific eligibility criteria. These criteria typically include:

- The business must be located within the state offering the tax credit.

- Investments must be made in qualified property as defined by state regulations.

- The business must be in good standing with state tax authorities.

- All required documentation must be submitted with the Form IT 603.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 603 vary by state and can change annually. It is important for businesses to be aware of these deadlines to ensure timely submission. Generally, forms must be filed by the tax return due date for the year in which the investment was made. Checking with the state tax authority for the most current deadlines is advisable to avoid any penalties.

Quick guide on how to complete form it 603 ampampampquotclaim for ez investment tax credit

Complete Form IT 603 "Claim For Ez Investment Tax Credit effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary for you to generate, modify, and eSign your documents quickly without delays. Manage Form IT 603 "Claim For Ez Investment Tax Credit on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to alter and eSign Form IT 603 "Claim For Ez Investment Tax Credit effortlessly

- Obtain Form IT 603 "Claim For Ez Investment Tax Credit and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form IT 603 "Claim For Ez Investment Tax Credit to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 603 ampampampquotclaim for ez investment tax credit

Create this form in 5 minutes!

How to create an eSignature for the form it 603 ampampampquotclaim for ez investment tax credit

The best way to generate an e-signature for a PDF online

The best way to generate an e-signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The way to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

The way to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to it 603?

airSlate SignNow is a comprehensive eSigning solution that allows businesses to send and electronically sign documents seamlessly. It 603 refers specifically to the functionality and benefits associated with our platform, improving workflow efficiency and document management.

-

What are the key features of airSlate SignNow that involve it 603?

The key features of airSlate SignNow include easy document signing, customizable templates, and real-time tracking. The it 603 integration allows users to seamlessly connect with their existing systems, enhancing productivity and ensuring compliance.

-

How does airSlate SignNow's pricing structure work for it 603?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. The it 603 options include monthly and annual subscriptions, ensuring that businesses can choose a plan that fits their budget without compromising on essential features.

-

Can airSlate SignNow integrate with other software tools under it 603?

Yes, airSlate SignNow easily integrates with a variety of software tools, making it ideal for businesses using systems like CRM, ERP, and project management solutions. The it 603 integration boosts your overall efficiency by eliminating data silos and streamlining processes.

-

What benefits does airSlate SignNow provide for businesses using it 603?

Businesses using airSlate SignNow can expect improved turnaround times for document signing and increased operational efficiency. The it 603 solution simplifies complex workflows, reducing the risk of errors and ensuring faster transaction completion.

-

Is airSlate SignNow secure and compliant in relation to it 603?

Absolutely, airSlate SignNow is committed to providing a secure eSigning experience. Regarding it 603, our platform adheres to industry regulations and employs advanced security measures, such as encryption and secure access controls, to protect your documents.

-

What type of customer support does airSlate SignNow offer for it 603 users?

airSlate SignNow provides comprehensive customer support for users utilizing it 603. Our support team is available via chat, email, or phone to assist with any queries, ensuring you have the help you need at every step of your eSigning journey.

Get more for Form IT 603 "Claim For Ez Investment Tax Credit

- Quitclaim deed two individuals to one individual colorado form

- Colorado general deed 497299818 form

- Colorado construction performance bond colorado

- Colorado corporation search form

- Quitclaim deed trust to an individual colorado form

- General warranty deed from a trust to a trust colorado form

- Quitclaim deed two individuals or husband and wife to limited liability company colorado form

- Colorado special warranty 497299826 form

Find out other Form IT 603 "Claim For Ez Investment Tax Credit

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF