Passive Activity Loss Internal Revenue Service 2020

What is the Passive Activity Loss Internal Revenue Service

The Passive Activity Loss (PAL) rules, established by the Internal Revenue Service (IRS), are designed to limit the ability of taxpayers to use losses from passive activities to offset income from non-passive sources. Passive activities typically include rental properties and businesses in which the taxpayer does not materially participate. Understanding these rules is crucial for taxpayers who engage in activities that may generate passive losses, as they can impact tax liabilities significantly.

Steps to complete the Passive Activity Loss Internal Revenue Service

Completing the Passive Activity Loss form involves several key steps to ensure accuracy and compliance with IRS regulations. Begin by gathering all relevant financial information related to your passive activities, including income, expenses, and any prior losses. Next, fill out the necessary sections of the form, detailing your passive income and losses. It is essential to calculate your allowable losses correctly, as these will determine how much you can deduct. Finally, review your completed form for accuracy before submission to the IRS.

Key elements of the Passive Activity Loss Internal Revenue Service

Several key elements define the Passive Activity Loss rules. First, the distinction between passive and non-passive activities is critical. Passive activities include those where the taxpayer does not materially participate, while non-passive activities involve active participation. Additionally, the IRS allows taxpayers to offset passive income with passive losses, but not with income from active participation. Understanding these distinctions helps taxpayers navigate their tax obligations effectively.

IRS Guidelines

The IRS provides specific guidelines regarding the treatment of passive activity losses. These guidelines outline how to classify activities as passive or non-passive, the limitations on loss deductions, and the reporting requirements for taxpayers. Familiarizing oneself with these guidelines is essential for compliance and to maximize potential tax benefits. Taxpayers should refer to IRS publications and resources for detailed information on the current rules and regulations surrounding passive activity losses.

Filing Deadlines / Important Dates

Filing deadlines for the Passive Activity Loss form align with the general tax filing deadlines set by the IRS. Typically, individual taxpayers must file their returns by April 15 of each year. However, extensions may be available, allowing additional time for filing. It is important to stay informed about any changes to deadlines and ensure timely submission to avoid penalties.

Eligibility Criteria

Eligibility for claiming passive activity losses depends on specific criteria set forth by the IRS. Taxpayers must determine whether their activities qualify as passive based on their level of participation. Additionally, certain income thresholds and filing statuses may affect eligibility. Understanding these criteria is essential for taxpayers to accurately report their passive activity losses and comply with IRS regulations.

Quick guide on how to complete passive activity loss internal revenue service

Effortlessly Prepare Passive Activity Loss Internal Revenue Service on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documentation, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage Passive Activity Loss Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

Efficiently Modify and eSign Passive Activity Loss Internal Revenue Service with Ease

- Find Passive Activity Loss Internal Revenue Service and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a handwritten signature.

- Review all information and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Edit and eSign Passive Activity Loss Internal Revenue Service to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct passive activity loss internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the passive activity loss internal revenue service

The best way to generate an eSignature for a PDF in the online mode

The best way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

The way to create an eSignature for a PDF on Android OS

People also ask

-

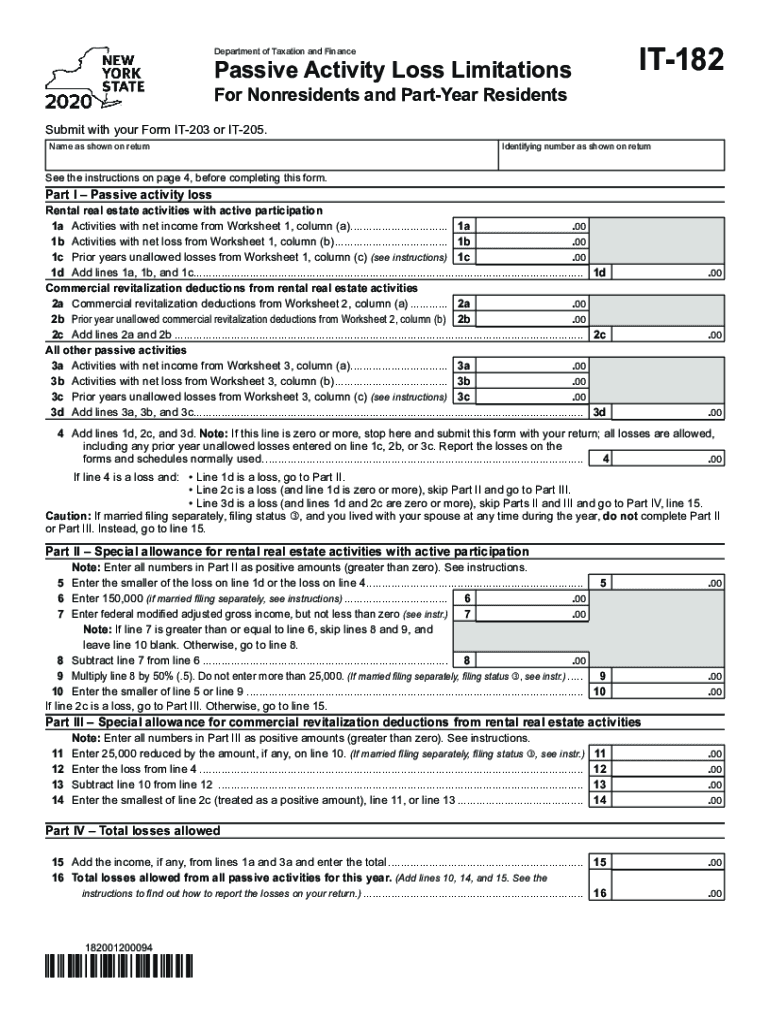

What is ny it 182 and how does it relate to airSlate SignNow?

ny it 182 refers to a specific designation related to document and signature management. airSlate SignNow provides a streamlined eSigning solution, making it easier for businesses to manage their documents efficiently under guidelines like ny it 182.

-

What features does airSlate SignNow include for compliance with ny it 182?

AirSlate SignNow offers a variety of features that support compliance with ny it 182, including audit trails, secure cloud storage, and easy document sharing. These features ensure that all parties can trust the authenticity and integrity of their electronic signatures.

-

How does pricing for airSlate SignNow align with the needs for ny it 182?

Pricing for airSlate SignNow is competitive and designed to offer excellent value, particularly for those needing to comply with ny it 182 regulations. Plans are flexible and cater to businesses of all sizes, allowing for affordable access to essential eSign services.

-

What are the benefits of using airSlate SignNow for documents related to ny it 182?

The benefits of using airSlate SignNow include enhanced productivity, reduced turnaround times for document signing, and compliance with standards such as ny it 182. Businesses can streamline their workflow and ensure legal validity with every eSignature.

-

Can airSlate SignNow integrate with other software applications in the context of ny it 182?

Yes, airSlate SignNow offers robust integrations with various applications and platforms, which is essential for businesses dealing with documents related to ny it 182. This interoperability allows users to maintain a seamless workflow across different systems.

-

Is airSlate SignNow secure for handling documents related to ny it 182?

Absolutely, airSlate SignNow prioritizes security and offers end-to-end encryption to protect sensitive information. Compliance with ny it 182 requires robust security measures, which we ensure through our industry-leading practices.

-

How can businesses ensure compliance with ny it 182 when using airSlate SignNow?

Businesses can ensure compliance with ny it 182 by utilizing airSlate SignNow's comprehensive features, such as authentication options, audit trails, and legally binding eSignatures. These elements help users adhere to necessary compliance standards.

Get more for Passive Activity Loss Internal Revenue Service

Find out other Passive Activity Loss Internal Revenue Service

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement