Form it 182 Passive Activity Loss Limitations Tax NY Gov 2023-2026

Understanding the IT 182 Form for Passive Activity Loss Limitations

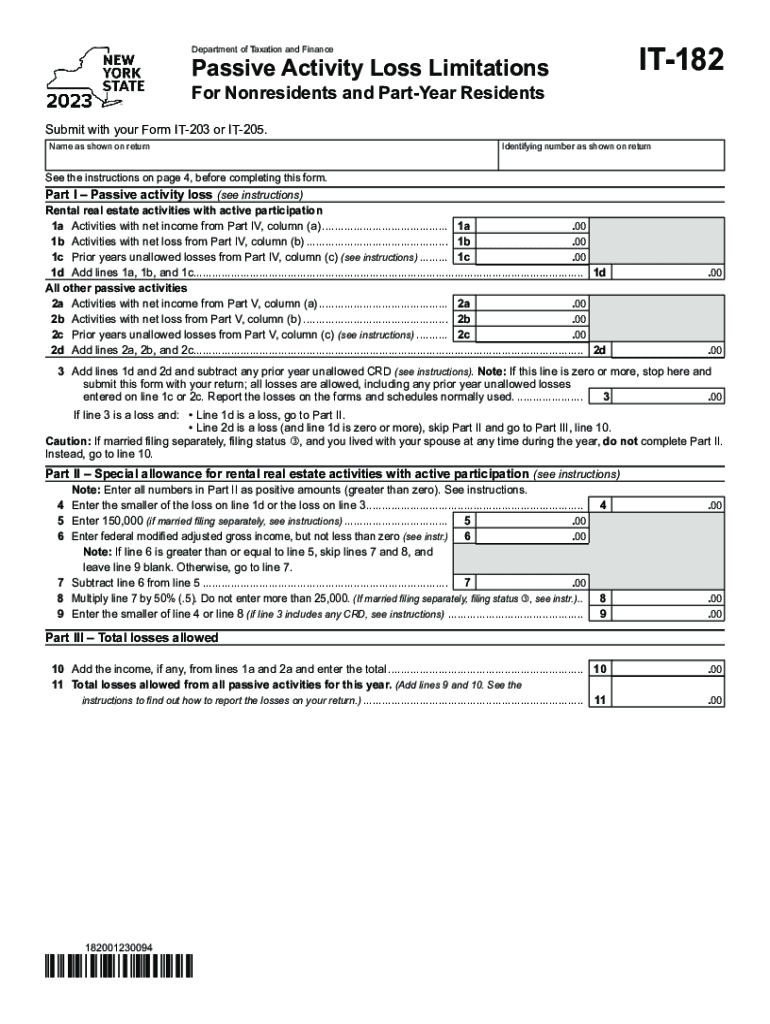

The IT 182 form is a crucial document for taxpayers in New York who are dealing with passive activity loss limitations. This form allows individuals to report losses from passive activities, which can include rental properties and other investments where the taxpayer does not materially participate. Understanding the purpose of this form is essential for accurately reporting income and losses, ensuring compliance with state tax laws.

Steps to Complete the IT 182 Form

Completing the IT 182 form involves several key steps:

- Gather necessary information, including details of passive activities and any related income or losses.

- Fill out the identification section, providing your name, address, and Social Security number.

- Report the passive activity income and losses in the designated sections of the form.

- Calculate the allowable passive loss based on the state guidelines.

- Review the completed form for accuracy before submission.

Each step is vital to ensure that the form is filled out correctly and that you are claiming the appropriate losses.

Key Elements of the IT 182 Form

The IT 182 form includes several important sections that taxpayers must complete:

- Identification Information: This section requires personal details, including your name and tax identification number.

- Passive Activity Income: Report all income derived from passive activities.

- Passive Activity Losses: Document all losses incurred from passive activities.

- Limitations Calculation: This section helps determine the allowable losses based on state regulations.

Understanding these elements is essential for accurate completion and compliance with tax laws.

Eligibility Criteria for Using the IT 182 Form

To utilize the IT 182 form, taxpayers must meet specific eligibility criteria. Generally, this form is intended for individuals who have incurred passive losses from activities such as rental properties or investments where they do not materially participate. Additionally, nonresidents who have passive activity losses in New York may also be eligible to use this form. It is important to review the criteria carefully to ensure that you qualify for reporting losses.

Filing Deadlines for the IT 182 Form

Timely filing of the IT 182 form is crucial to avoid penalties. The form must be submitted by the annual tax filing deadline, which is typically April fifteenth for individual taxpayers. If you are unable to file by this date, you may request an extension, but it is essential to ensure that any taxes owed are paid by the original deadline to avoid interest and penalties.

Examples of Using the IT 182 Form

There are various scenarios in which taxpayers might need to use the IT 182 form. For instance, if an individual owns a rental property and incurs losses due to repairs or vacancies, they can report these losses using the IT 182 form. Similarly, investors who have passive losses from limited partnerships or other investment vehicles can also utilize this form to claim their losses. Understanding these examples helps clarify the practical applications of the IT 182 form.

Quick guide on how to complete form it 182 passive activity loss limitations tax ny gov

Accomplish Form IT 182 Passive Activity Loss Limitations Tax NY gov effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents rapidly without delays. Handle Form IT 182 Passive Activity Loss Limitations Tax NY gov on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to alter and eSign Form IT 182 Passive Activity Loss Limitations Tax NY gov without hassle

- Obtain Form IT 182 Passive Activity Loss Limitations Tax NY gov and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you prefer to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your choice. Modify and eSign Form IT 182 Passive Activity Loss Limitations Tax NY gov and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 182 passive activity loss limitations tax ny gov

Create this form in 5 minutes!

How to create an eSignature for the form it 182 passive activity loss limitations tax ny gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 182 form and who needs it?

The it 182 form is a document used for filing personal income tax returns in specific jurisdictions. It is essential for individuals who earn income and need to report their earnings accurately. By using the it 182 form, users can ensure compliance and avoid penalties.

-

How can airSlate SignNow help me with my it 182 form?

airSlate SignNow simplifies the process of preparing and submitting your it 182 form by allowing you to eSign documents quickly and securely. With our platform, you can easily fill out your form electronically, reducing the need for printing and manual signatures. This makes managing your tax documents much more efficient.

-

What are the pricing plans for airSlate SignNow related to the it 182 form?

airSlate SignNow offers flexible pricing plans that cater to different business needs when handling documents like the it 182 form. Our plans include features that allow unlimited signing and cloud storage, ensuring you have all the tools necessary for managing your tax forms at an affordable price.

-

Are there any features specifically designed for the it 182 form?

Yes, airSlate SignNow includes specific features to enhance your experience with documents like the it 182 form. These features include customizable templates, eSigning capabilities, and secure sharing options, making it easier to collaborate and manage your tax-related files efficiently.

-

Can I integrate airSlate SignNow with other applications for the it 182 form?

Absolutely! airSlate SignNow offers seamless integrations with popular applications such as Dropbox, Google Drive, and more. This means you can easily access and manage your it 182 form alongside other essential tools, streamlining your workflow.

-

Is airSlate SignNow secure for submitting my it 182 form?

Yes, security is a top priority at airSlate SignNow. Our platform uses advanced encryption methods and complies with various regulations to ensure that your it 182 form and other sensitive documents are protected during transmission and storage.

-

How does airSlate SignNow improve the efficiency of managing my it 182 form?

With airSlate SignNow, managing your it 182 form becomes more efficient through features like automated workflows and reminders. This reduces the time spent on document preparation, allowing you more time to focus on other important tasks related to your business or personal finances.

Get more for Form IT 182 Passive Activity Loss Limitations Tax NY gov

Find out other Form IT 182 Passive Activity Loss Limitations Tax NY gov

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast