New York State Department of Taxation and Finance Passive Activity Loss 2022

What is the New York State Department of Taxation and Finance Passive Activity Loss?

The New York State Department of Taxation and Finance defines passive activity loss as losses incurred from passive activities. Passive activities typically include rental activities and businesses in which the taxpayer does not materially participate. Understanding this concept is crucial for taxpayers, especially those involved in real estate or certain business investments. The passive activity loss rules aim to limit the ability of taxpayers to offset non-passive income with passive losses, thereby influencing tax liabilities.

Steps to Complete the New York State Department of Taxation and Finance Passive Activity Loss

Completing the New York passive activity loss form involves several key steps:

- Gather all necessary documentation related to your passive activities, including income and expenses.

- Determine your material participation in each activity to classify them correctly.

- Calculate your total passive losses and any passive income for the tax year.

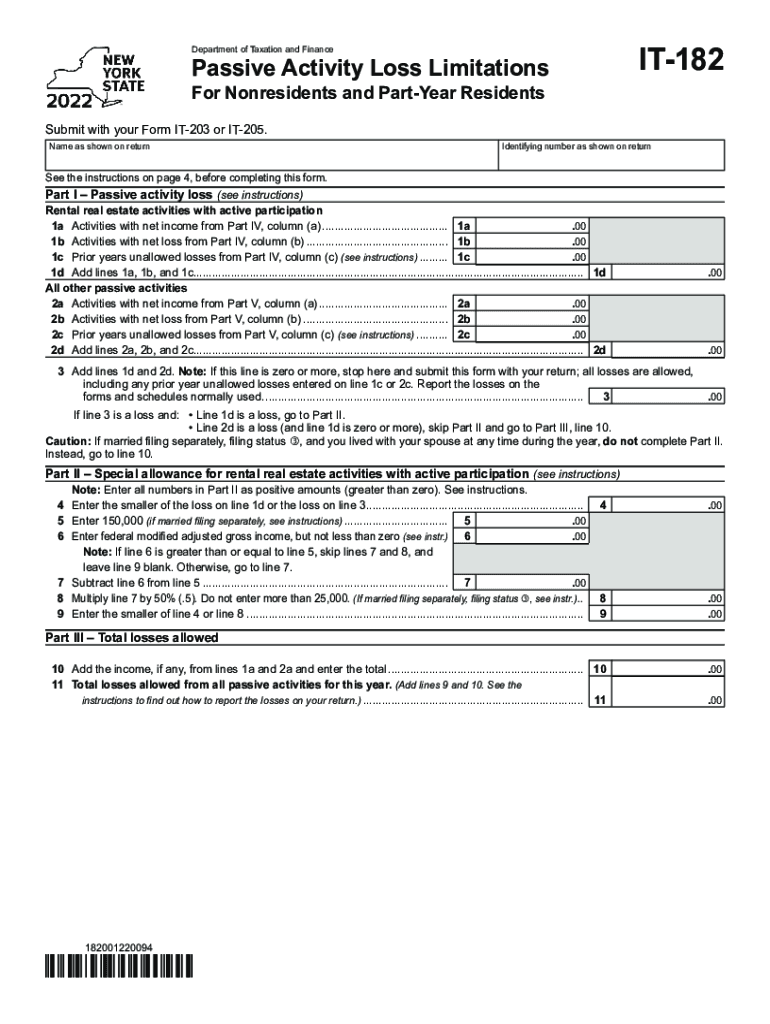

- Fill out the appropriate sections of the NY IT-182 form, ensuring accuracy in reporting your passive activities.

- Review the form for completeness and correctness before submission.

Key Elements of the New York State Department of Taxation and Finance Passive Activity Loss

Key elements of the passive activity loss rules include:

- Material Participation: Taxpayers must evaluate their level of involvement in the activity to determine if it qualifies as passive.

- Loss Limitation: Passive losses can only offset passive income, limiting their use against other income types.

- Carryover Rules: Unused passive losses can be carried forward to future tax years, allowing for potential future deductions.

Eligibility Criteria for Passive Activity Loss in New York

To qualify for passive activity loss deductions in New York, taxpayers must meet specific eligibility criteria:

- Taxpayers must have losses from passive activities, such as rental properties or businesses where they do not materially participate.

- Taxpayers must accurately report all income and losses associated with these activities on their tax returns.

- Compliance with both federal and state tax regulations is necessary to utilize passive activity losses effectively.

Filing Deadlines for Passive Activity Loss Forms

Filing deadlines for the New York passive activity loss forms align with the general tax filing deadlines. Typically, individual taxpayers must file their returns by April fifteenth of each year. However, extensions may be available, allowing for additional time to submit the necessary forms. It is essential for taxpayers to stay informed about any changes to these deadlines to ensure compliance.

Examples of Using the New York State Department of Taxation and Finance Passive Activity Loss

Examples of passive activity loss scenarios include:

- A taxpayer who owns rental properties but does not actively manage them may incur passive losses from those properties.

- A business owner who invests in a partnership but does not participate in daily operations may face limitations on using losses from that partnership against other income.

Quick guide on how to complete new york state department of taxation and finance passive activity loss

Complete New York State Department Of Taxation And Finance Passive Activity Loss effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly and without delays. Manage New York State Department Of Taxation And Finance Passive Activity Loss on any device using airSlate SignNow applications for Android or iOS, simplifying any document-related process today.

How to edit and eSign New York State Department Of Taxation And Finance Passive Activity Loss effortlessly

- Obtain New York State Department Of Taxation And Finance Passive Activity Loss and click Get Form to begin.

- Make use of the tools we supply to complete your form.

- Mark important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for such purposes.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you select. Edit and eSign New York State Department Of Taxation And Finance Passive Activity Loss while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york state department of taxation and finance passive activity loss

Create this form in 5 minutes!

People also ask

-

What is new york passive activity loss?

New York passive activity loss refers to a tax provision that limits the ability to deduct losses from certain passive activities against regular income. These losses typically arise from investments in rental properties or businesses in which the taxpayer does not materially participate. Understanding how new york passive activity loss applies can help you efficiently manage your tax obligations.

-

How does airSlate SignNow help with new york passive activity loss documentation?

AirSlate SignNow offers a streamlined way to manage and eSign necessary documentation related to new york passive activity loss. By digitizing your paperwork, you can easily keep track of rental agreements, income statements, and other relevant documents. This organized approach helps ensure that you meet New York's tax regulations effectively.

-

Are there specific features in airSlate SignNow that cater to real estate professionals focused on new york passive activity loss?

Yes, airSlate SignNow includes features such as customizable templates and secure cloud storage, which are ideal for real estate professionals dealing with new york passive activity loss. These tools simplify the process of managing multiple documents while ensuring that sensitive information remains secure. This efficiency ultimately saves time and improves compliance.

-

What is the pricing structure for airSlate SignNow for users interested in new york passive activity loss management?

AirSlate SignNow offers various pricing plans tailored to meet the needs of businesses focused on new york passive activity loss documentation. Customers can choose from basic to advanced plans depending on their feature requirements and budget. This flexibility ensures you can find a suitable solution that enhances your document management process.

-

How can integrations with other tools enhance my experience managing new york passive activity loss?

Integrations with tools such as accounting software and CRMs make airSlate SignNow an even more powerful solution for managing new york passive activity loss. These integrations allow for seamless sharing of data across platforms, which helps maintain accurate records and simplifies tax reporting. Streamlining workflows will enable you to focus on your core business activities.

-

Does airSlate SignNow provide resources or support for understanding new york passive activity loss regulations?

Yes, airSlate SignNow offers various resources, including guides and customer support, to help users understand new york passive activity loss regulations. This educational support can assist you in navigating the complexities of passive activity loss and maximize your tax benefits. Consulting with professionals who can interpret these regulations may also be beneficial.

-

Can airSlate SignNow assist with remote signing of documents related to new york passive activity loss?

Absolutely! AirSlate SignNow allows for remote signing of documents, making it easy to handle paperwork associated with new york passive activity loss from anywhere. This feature is particularly useful for real estate professionals and investors who require quick and efficient document execution, regardless of their location.

Get more for New York State Department Of Taxation And Finance Passive Activity Loss

- New mexico name change 497320257 form

- New mexico unsecured installment payment promissory note for fixed rate new mexico form

- New mexico installments fixed rate promissory note secured by residential real estate new mexico form

- New mexico note form

- Nm note form

- Notice of option for recording new mexico form

- Life documents 497320267 form

- Essential legal life documents for baby boomers new mexico form

Find out other New York State Department Of Taxation And Finance Passive Activity Loss

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now