Passive Activity Loss Internal Revenue Service Fill Out 2021

Understanding the Passive Activity Loss Form

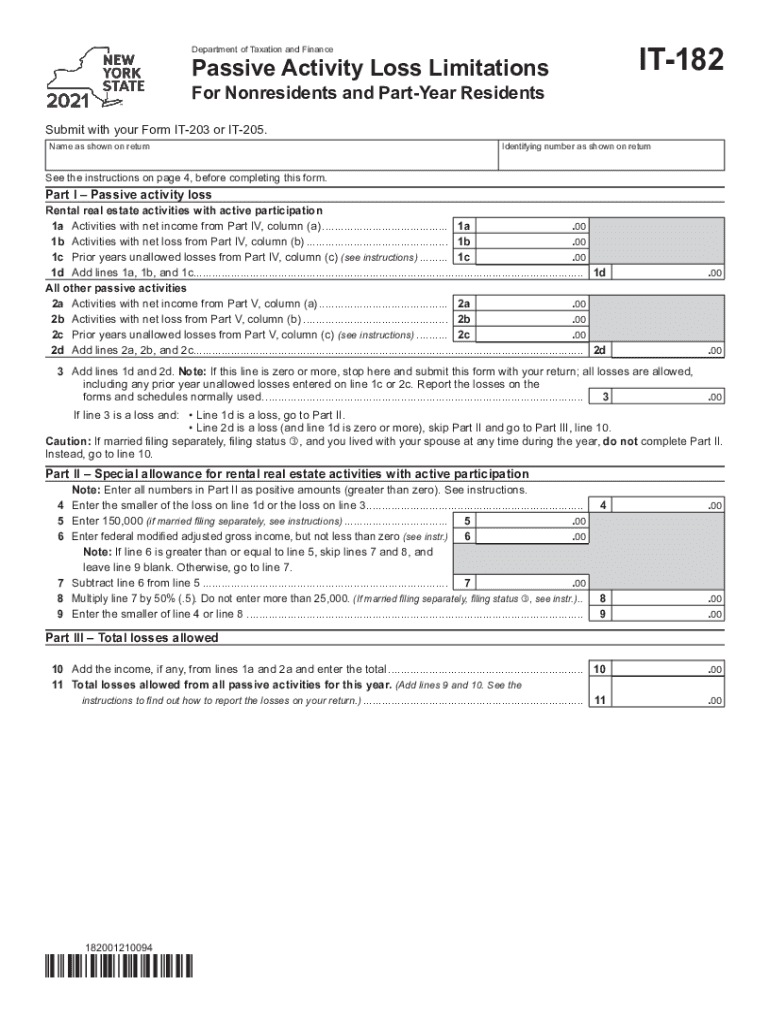

The ny IT 182 form is essential for reporting passive activity losses for individuals and entities engaged in passive activities in New York. Passive activities generally include rental activities and businesses in which the taxpayer does not materially participate. This form allows taxpayers to calculate the amount of passive losses they can deduct against other income, ensuring compliance with IRS regulations. Understanding the nuances of this form is crucial for accurate tax reporting and maximizing potential deductions.

Steps to Complete the ny IT 182 Form

Completing the ny IT 182 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents related to your passive activities, including income statements and expense records. Follow these steps:

- Identify your passive activities and determine the losses incurred during the tax year.

- Fill out your personal information at the top of the form, including your name, address, and Social Security number.

- Report your passive activity income and losses in the appropriate sections, ensuring that all figures are accurate and supported by documentation.

- Calculate the allowable passive activity loss based on IRS guidelines and any applicable state-specific rules.

- Review the form for completeness and accuracy before submission.

Legal Use of the ny IT 182 Form

The ny IT 182 form is legally recognized as a valid document for reporting passive activity losses in New York. It complies with IRS regulations, ensuring that taxpayers can substantiate their claims for deductions. To be considered valid, the form must be filled out correctly and submitted by the appropriate deadlines. Keeping a copy of the completed form and all supporting documents is advisable for record-keeping and potential audits.

Filing Deadlines for the ny IT 182 Form

Timely filing of the ny IT 182 form is crucial to avoid penalties and ensure compliance with tax regulations. The deadline for submitting this form typically aligns with the federal tax return due date, which is usually April fifteenth. However, if you file for an extension, be sure to check the specific dates for your situation, as they may vary. Staying informed about these deadlines helps in planning and ensures that you do not miss out on potential deductions.

Required Documents for Completing the ny IT 182 Form

When preparing to complete the ny IT 182 form, it is essential to gather all relevant documentation to support your claims. Required documents may include:

- Income statements from passive activities, such as rental income.

- Expense records related to passive activities, including maintenance costs and property management fees.

- Any previous year tax returns that may provide context for current losses.

- Documentation of any passive activity participation, such as logs or records of time spent.

Having these documents ready will facilitate the completion of the form and help substantiate your claims if questioned by tax authorities.

IRS Guidelines for Passive Activity Losses

The IRS provides specific guidelines regarding passive activity losses, which are crucial for accurately completing the ny IT 182 form. According to IRS regulations, passive losses can only offset passive income, and any excess losses may be carried forward to future tax years. Understanding these guidelines helps taxpayers navigate the complexities of passive activity rules and ensures compliance with federal tax laws. Familiarizing yourself with these regulations can enhance your ability to maximize deductions while adhering to legal requirements.

Quick guide on how to complete passive activity loss internal revenue service fill out

Facilitate Passive Activity Loss Internal Revenue Service Fill Out seamlessly on any gadget

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents swiftly without holdups. Manage Passive Activity Loss Internal Revenue Service Fill Out on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

How to modify and electronically sign Passive Activity Loss Internal Revenue Service Fill Out with ease

- Obtain Passive Activity Loss Internal Revenue Service Fill Out and click on Get Form to begin.

- Employ the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details thoroughly and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your requirements in document management with just a few clicks from any device you choose. Edit and electronically sign Passive Activity Loss Internal Revenue Service Fill Out to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct passive activity loss internal revenue service fill out

Create this form in 5 minutes!

How to create an eSignature for the passive activity loss internal revenue service fill out

The best way to make an electronic signature for a PDF file online

The best way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

How to generate an e-signature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is NY IT 182 and how does it relate to airSlate SignNow?

NY IT 182 is a New York state tax form that businesses may use for various documentation needs. airSlate SignNow provides an efficient way to electronically sign and send NY IT 182 forms, ensuring compliance and a streamlined process for business transactions.

-

What features does airSlate SignNow offer for managing NY IT 182 documents?

airSlate SignNow offers robust features such as document templates, custom workflows, and secure eSignature solutions specifically for NY IT 182. These features simplify the document management process, making it easy for businesses to handle tax forms electronically.

-

Is there a pricing plan available for using airSlate SignNow for NY IT 182 forms?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs for handling NY IT 182. Each plan includes essential features like unlimited eSignatures and document storage, allowing businesses to choose an option that best aligns with their budget.

-

How does airSlate SignNow ensure the security of my NY IT 182 documents?

airSlate SignNow takes security seriously with features like data encryption and compliance with regulatory standards. When you manage your NY IT 182 forms through airSlate SignNow, you can rest assured that your documents are protected against unauthorized access.

-

Can I integrate airSlate SignNow with other software when handling NY IT 182?

Absolutely! airSlate SignNow provides integration capabilities with popular software applications, enhancing your workflow for handling NY IT 182. This means you can connect your existing systems seamlessly for a more efficient document management experience.

-

How can airSlate SignNow help speed up the process of completing NY IT 182?

By using airSlate SignNow, businesses can quickly create, send, and eSign NY IT 182 documents, signNowly reducing turnaround time. Automated reminders and real-time tracking keep the process efficient, ensuring that important tax forms are completed and submitted on time.

-

What benefits does airSlate SignNow provide for small businesses dealing with NY IT 182?

For small businesses, airSlate SignNow offers a cost-effective solution to manage NY IT 182 forms without extensive administrative overhead. Its user-friendly interface and time-saving features help small teams stay compliant while focusing on their core business operations.

Get more for Passive Activity Loss Internal Revenue Service Fill Out

Find out other Passive Activity Loss Internal Revenue Service Fill Out

- Sign West Virginia Postnuptial Agreement Template Myself

- How Do I Sign Indiana Divorce Settlement Agreement Template

- Sign Indiana Child Custody Agreement Template Now

- Sign Minnesota Divorce Settlement Agreement Template Easy

- How To Sign Arizona Affidavit of Death

- Sign Nevada Divorce Settlement Agreement Template Free

- Sign Mississippi Child Custody Agreement Template Free

- Sign New Jersey Child Custody Agreement Template Online

- Sign Kansas Affidavit of Heirship Free

- How To Sign Kentucky Affidavit of Heirship

- Can I Sign Louisiana Affidavit of Heirship

- How To Sign New Jersey Affidavit of Heirship

- Sign Oklahoma Affidavit of Heirship Myself

- Sign Washington Affidavit of Death Easy

- Help Me With Sign Pennsylvania Cohabitation Agreement

- Sign Montana Child Support Modification Online

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple