Facts About Disability Related Tax ProvisionsU S Equal 2020

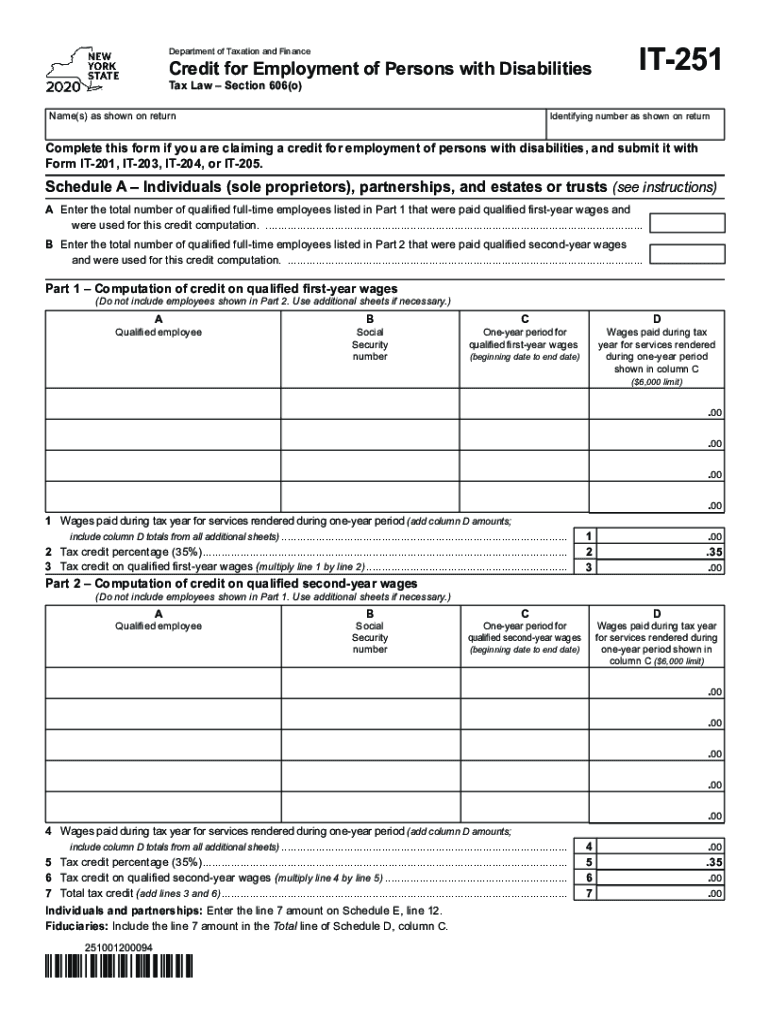

What is the IT 251 Form?

The IT 251 form is a crucial document used for reporting disability-related tax provisions in the United States. This form allows individuals to claim specific deductions or credits related to their disability status. Understanding the purpose and requirements of the IT 251 is essential for ensuring compliance with tax regulations and maximizing potential benefits.

Steps to Complete the IT 251 Form

Completing the IT 251 form involves several key steps to ensure accuracy and compliance. Follow these steps:

- Gather necessary personal information, including your Social Security number and disability details.

- Review the specific tax provisions applicable to your situation, as outlined in the form instructions.

- Fill out the form carefully, ensuring all sections are completed accurately.

- Attach any required documentation that supports your claims, such as medical records or previous tax returns.

- Review the completed form for any errors or omissions before submission.

Legal Use of the IT 251 Form

The IT 251 form is legally recognized for tax purposes, provided it is completed in accordance with IRS guidelines. It is important to ensure that all information is truthful and accurate, as discrepancies can lead to penalties or audits. The form is designed to facilitate the legal claiming of benefits related to disability, making it a vital tool for eligible taxpayers.

IRS Guidelines for the IT 251 Form

To ensure compliance, it is essential to adhere to the IRS guidelines when completing the IT 251 form. These guidelines include:

- Understanding the eligibility criteria for claiming disability-related tax provisions.

- Filing the form by the designated deadlines to avoid penalties.

- Maintaining accurate records and documentation to support claims made on the form.

Required Documents for the IT 251 Form

When filing the IT 251 form, certain documents are required to substantiate your claims. These may include:

- Medical documentation proving your disability status.

- Previous tax returns, if applicable, to show your tax history.

- Any additional forms or schedules that may be relevant to your specific situation.

Filing Methods for the IT 251 Form

The IT 251 form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the IRS e-file system.

- Mailing a paper copy of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, if necessary.

Quick guide on how to complete facts about disability related tax provisionsus equal

Effortlessly Prepare Facts About Disability Related Tax ProvisionsU S Equal on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent eco-conscious alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents quickly without delays. Manage Facts About Disability Related Tax ProvisionsU S Equal on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related operations today.

The Easiest Way to Edit and eSign Facts About Disability Related Tax ProvisionsU S Equal with Ease

- Obtain Facts About Disability Related Tax ProvisionsU S Equal and click on Get Form to begin.

- Use the tools we provide to submit your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form – via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form browsing, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Facts About Disability Related Tax ProvisionsU S Equal while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct facts about disability related tax provisionsus equal

Create this form in 5 minutes!

How to create an eSignature for the facts about disability related tax provisionsus equal

The best way to generate an eSignature for your PDF in the online mode

The best way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the it 251 feature of airSlate SignNow?

The it 251 feature in airSlate SignNow allows users to securely send and eSign documents effortlessly. This functionality is designed to streamline document workflows, making it easier for businesses to manage their signing processes online.

-

How does airSlate SignNow's it 251 pricing compare to competitors?

The it 251 pricing model of airSlate SignNow is highly competitive, providing a cost-effective solution without compromising quality. Businesses can choose from various subscription tiers that fit their budget, allowing flexibility for ongoing document management needs.

-

Can I integrate airSlate SignNow with other software using it 251?

Yes, airSlate SignNow's it 251 supports integrations with popular software platforms to enhance workflow efficiency. This ensures that your document management system can easily sync with your existing tools, fostering a seamless experience for your team.

-

What are the benefits of using the it 251 functionality in airSlate SignNow?

Using the it 251 functionality in airSlate SignNow can signNowly increase productivity by simplifying the eSigning process. Businesses can reduce turnaround times, improve client satisfaction, and maintain compliance with secure, auditable signature options.

-

Is training required to use the it 251 in airSlate SignNow?

No extensive training is required to use the it 251 feature in airSlate SignNow, as it is designed to be user-friendly. New users can quickly grasp the essential functions, enabling them to send and eSign documents with ease right away.

-

What types of documents can be signed using it 251?

With it 251, airSlate SignNow allows users to eSign a variety of document types, including contracts, agreements, and forms. This flexibility accommodates different business needs, ensuring that all critical documents are handled electronically.

-

How secure is the it 251 functionality in airSlate SignNow?

The it 251 functionality in airSlate SignNow adheres to high-security standards, including encryption and compliance with industry regulations. This ensures that all signed documents are protected from unauthorized access, providing peace of mind for businesses.

Get more for Facts About Disability Related Tax ProvisionsU S Equal

Find out other Facts About Disability Related Tax ProvisionsU S Equal

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit