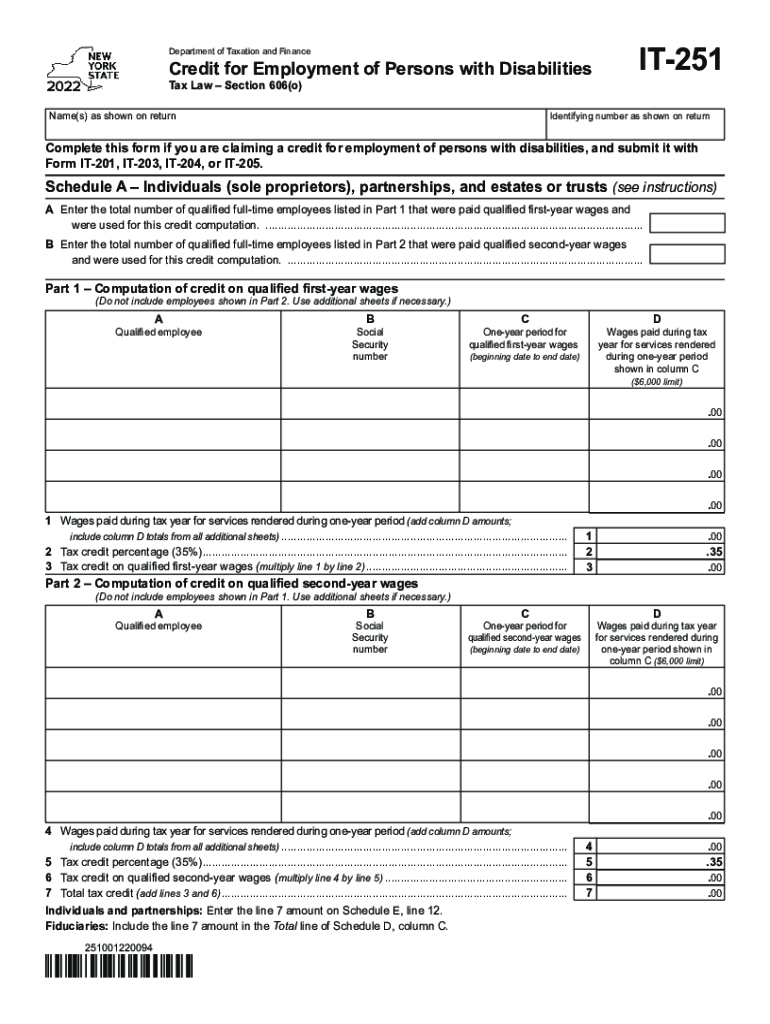

Form it 251 Credit for Employment of Persons Tax NY Gov 2022-2026

What is the IT 229 Form?

The IT 229 form, officially known as the Real Property Tax Relief Credit form, is a tax document used in New York State. This form allows eligible homeowners to claim a credit against their property taxes. The credit is designed to provide relief to those who qualify based on their income and property value. Understanding the purpose and eligibility criteria for the IT 229 is crucial for taxpayers looking to benefit from this program.

Eligibility Criteria for the IT 229 Form

To qualify for the IT 229 form, applicants must meet specific income and property ownership criteria. Typically, homeowners must be residents of New York State and occupy their property as their primary residence. The income limits are set annually, and applicants should ensure they fall within these limits to be eligible for the credit. Additionally, the property must meet certain valuation thresholds to qualify for the tax relief.

Steps to Complete the IT 229 Form

Completing the IT 229 form involves several straightforward steps. First, gather all necessary documentation, including proof of income and property ownership. Next, fill out the form accurately, ensuring that all personal and financial information is correctly entered. Pay special attention to the income section, as errors here can affect eligibility. After completing the form, review it for accuracy before submission.

Form Submission Methods for the IT 229

The IT 229 form can be submitted through various methods. Taxpayers have the option to file the form online through the New York State Department of Taxation and Finance website. Alternatively, the form can be printed and mailed to the appropriate tax office. In-person submissions may also be possible at designated tax offices, depending on local regulations and availability.

Filing Deadlines for the IT 229 Form

It is essential to be aware of the filing deadlines for the IT 229 form to ensure timely submission. Typically, the deadline aligns with the annual tax filing date, which is usually April fifteenth. However, taxpayers should verify any changes to deadlines each tax year, as extensions or adjustments may occur. Filing on time is crucial to avoid penalties and ensure eligibility for the credit.

Required Documents for the IT 229 Form

When completing the IT 229 form, several documents are required to support the application. These typically include proof of income, such as W-2 forms or tax returns, and documentation proving property ownership, like a deed or mortgage statement. Having these documents ready will streamline the process and help ensure that the form is completed accurately.

Quick guide on how to complete form it 251 credit for employment of persons taxnygov

Effortlessly Prepare Form IT 251 Credit For Employment Of Persons Tax NY gov on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing for easy access to the correct form and secure online storage. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any delays. Handle Form IT 251 Credit For Employment Of Persons Tax NY gov on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Edit and Electronically Sign Form IT 251 Credit For Employment Of Persons Tax NY gov with Ease

- Find Form IT 251 Credit For Employment Of Persons Tax NY gov and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form: via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form IT 251 Credit For Employment Of Persons Tax NY gov to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 251 credit for employment of persons taxnygov

Create this form in 5 minutes!

How to create an eSignature for the form it 251 credit for employment of persons taxnygov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 229 feature in airSlate SignNow?

The it 229 feature in airSlate SignNow refers to our comprehensive eSignature solution that enables users to sign documents electronically with legal compliance. This feature streamlines the signing process, making it faster and more efficient for businesses of all sizes.

-

How does pricing work for the it 229 feature?

Pricing for the it 229 feature varies based on the subscription plan you choose. We offer flexible pricing options that cater to different business needs, ensuring you get the best value for our eSigning capabilities while utilizing the it 229 feature.

-

What benefits does using it 229 provide for my business?

Utilizing the it 229 feature allows your business to enhance productivity by reducing the time spent on document signing. Additionally, this feature ensures compliance with eSignature laws, which can signNowly improve your workflow and customer satisfaction.

-

Can I integrate it 229 with other applications?

Yes, the it 229 feature can be easily integrated with various applications and platforms. This flexibility allows businesses to incorporate our eSignature solution into their existing workflows, enhancing overall operational efficiency.

-

Is the it 229 feature secure?

Absolutely! The it 229 feature in airSlate SignNow implements top-notch security protocols to protect your sensitive information. Our eSignature solution complies with stringent security standards to ensure that documents are safe and that signatures are trustworthy.

-

How does the it 229 feature improve document workflows?

The it 229 feature streamlines document workflows by automating the signing process and reducing the need for physical paperwork. This leads to quicker turnaround times and enhanced collaboration among team members, making it an essential tool for modern businesses.

-

What types of documents can I sign with it 229?

You can use the it 229 feature to sign a wide variety of documents, including contracts, agreements, and invoices. This versatility makes airSlate SignNow a valuable tool for any business that requires efficient and secure document signing.

Get more for Form IT 251 Credit For Employment Of Persons Tax NY gov

- Tenants maintenance repair request form tennessee

- Guaranty attachment to lease for guarantor or cosigner tennessee form

- Amendment to lease or rental agreement tennessee form

- Warning notice due to complaint from neighbors tennessee form

- Lease subordination agreement tennessee form

- Apartment rules and regulations tennessee form

- Agreed cancellation of lease tennessee form

- Amendment of residential lease tennessee form

Find out other Form IT 251 Credit For Employment Of Persons Tax NY gov

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer