3805e 2020

What is the 3805e?

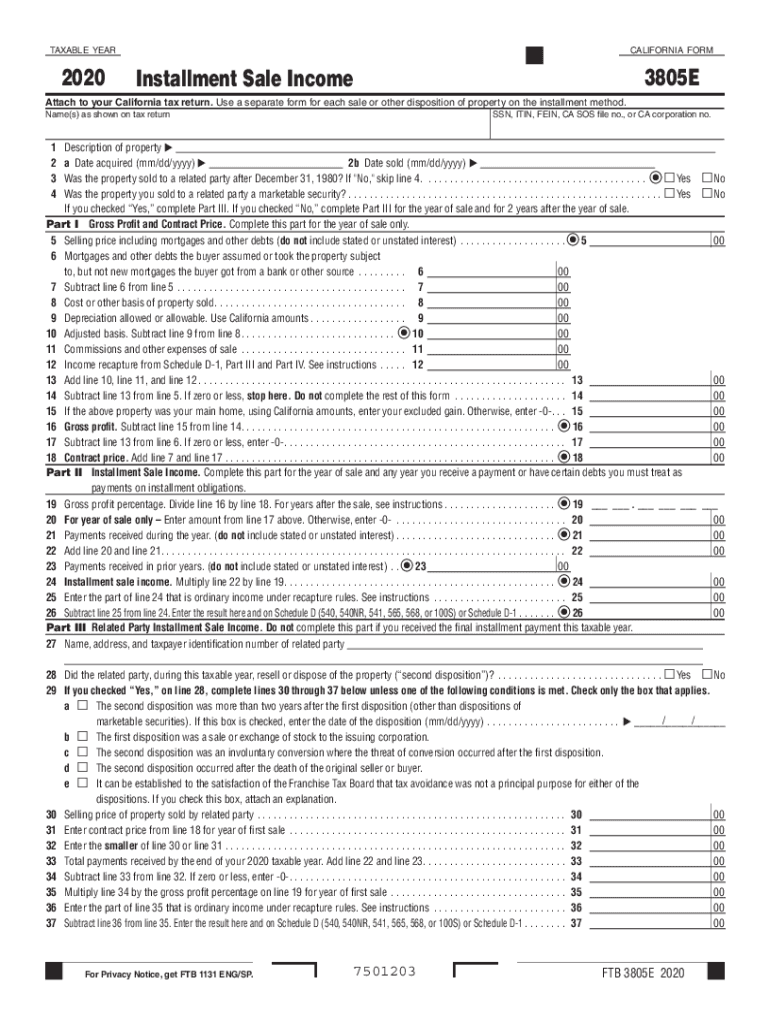

The 3805e form, also known as FTB 3805e, is a California tax form used for reporting the sale of a business entity or the transfer of a business interest. This form is essential for taxpayers who need to disclose information regarding the sale or transfer to the California Franchise Tax Board (FTB). It helps ensure compliance with state tax laws and facilitates the accurate assessment of any tax liabilities associated with the transaction.

How to use the 3805e

To effectively use the 3805e form, you should first gather all necessary documentation related to the sale or transfer of the business. This includes financial statements, sales agreements, and any other relevant records. Once you have the required information, fill out the form accurately, ensuring that all sections are completed. After completing the form, review it for accuracy before submitting it to the FTB, either electronically or via mail, based on your preference.

Steps to complete the 3805e

Completing the 3805e form involves several key steps:

- Gather necessary documents, including financial records and sales agreements.

- Access the 3805e form from the California FTB website or through authorized tax software.

- Fill in the required fields, ensuring all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form to the FTB either electronically or by mailing a printed copy.

Legal use of the 3805e

The 3805e form is legally binding when completed and submitted in accordance with California tax regulations. To ensure its legal standing, it is crucial to provide accurate information and comply with all relevant tax laws. Failure to do so may result in penalties or legal repercussions. The form must be signed by the appropriate parties involved in the transaction, affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the 3805e form are typically aligned with the California state tax return deadlines. It is important to be aware of these dates to avoid penalties. Generally, the form must be filed by the due date of your tax return for the year in which the sale or transfer occurred. Keeping track of these deadlines ensures compliance and helps manage any potential tax liabilities effectively.

Required Documents

When completing the 3805e form, several documents are required to support the information provided. These may include:

- Sales agreements detailing the terms of the transaction.

- Financial statements reflecting the business's performance.

- Tax returns from previous years, if applicable.

- Any additional documentation that verifies the legitimacy of the sale or transfer.

Quick guide on how to complete 3805e

Effortlessly prepare 3805e on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage 3805e on any device using airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign 3805e with ease

- Locate 3805e and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to submit your form, either via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 3805e and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 3805e

Create this form in 5 minutes!

How to create an eSignature for the 3805e

The best way to create an electronic signature for a PDF in the online mode

The best way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is 3805e and how does it benefit my business?

The 3805e is an innovative solution offered by airSlate SignNow that streamlines the document signing process. It empowers businesses to send and eSign documents efficiently, saving time and reducing paperwork. By implementing the 3805e, companies can enhance productivity and improve workflow management.

-

What pricing options are available for 3805e?

airSlate SignNow provides flexible pricing plans for the 3805e, designed to fit the needs of businesses of all sizes. You can choose from monthly or annual subscriptions and benefit from tiered pricing based on the number of users. This cost-effective solution ensures that organizations can access the features they need without overspending.

-

What features does the 3805e offer?

The 3805e encompasses a range of features including customizable templates, document tracking, and secure storage options. Additionally, it allows for team collaboration and integrates seamlessly with popular applications. These features ensure that users can manage their documents efficiently and securely.

-

How does 3805e integrate with other software?

The 3805e is designed for compatibility with various software and applications, enhancing its usability. It easily integrates with popular platforms such as Google Drive, Dropbox, and Salesforce. This integration capability allows businesses to streamline their workflows and manage documents in one centralized location.

-

Is the 3805e secure for sensitive documents?

Absolutely! The 3805e implements robust security measures, including encryption and secure user authentication, to protect sensitive documents. Compliance with industry standards ensures that your data is safe and confidential during the signing process. Trusting the 3805e means securing your business’s critical information.

-

Can I customize my documents with 3805e?

Yes, the 3805e allows users to create and customize documents to meet their specific needs. You can add fields such as signatures, dates, and checkboxes to streamline the signing process. This flexibility makes the 3805e ideal for various types of agreements and contracts.

-

What are the benefits of using the 3805e for my team?

Utilizing the 3805e offers numerous benefits, including increased efficiency and better team collaboration. It simplifies the document management process, allowing teams to send and receive documents faster. Furthermore, the ease-of-use promotes user adoption among team members, maximizing productivity.

Get more for 3805e

Find out other 3805e

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy