Form 3805E Installment Sale Income 2024-2026

What is the Form 3805E Installment Sale Income

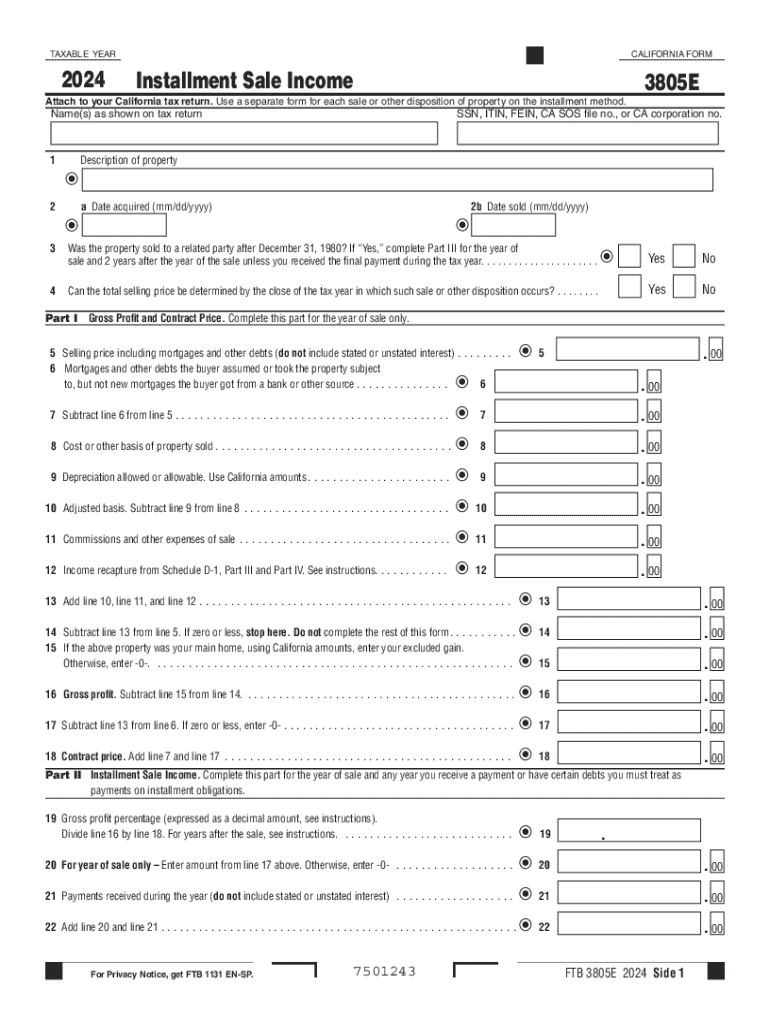

The Form 3805E is a tax form used in California to report income from an installment sale. An installment sale occurs when a seller allows a buyer to make payments over time instead of paying the full purchase price upfront. This form is essential for reporting the income received in installments and helps taxpayers comply with state tax regulations. It is particularly relevant for individuals and businesses engaged in selling property or assets under installment agreements.

How to use the Form 3805E Installment Sale Income

To use the Form 3805E, taxpayers must first determine if their sale qualifies as an installment sale. If it does, they should gather all relevant information about the sale, including the total sale price, down payment, and payment schedule. The form requires details about the buyer, the property sold, and the income received during the tax year. Once completed, the form must be submitted with the taxpayer's California state income tax return.

Steps to complete the Form 3805E Installment Sale Income

Completing the Form 3805E involves several steps:

- Gather all necessary information about the installment sale, including the sale price and payment terms.

- Fill out the taxpayer's personal information at the top of the form.

- Provide details about the property sold, including its description and sale date.

- Report the total income received from the sale and calculate the taxable portion based on the installment method.

- Review the completed form for accuracy before submission.

Key elements of the Form 3805E Installment Sale Income

Key elements of the Form 3805E include:

- Taxpayer Information: Personal details of the seller, including name, address, and Social Security number.

- Property Details: Description and sale date of the property involved in the installment sale.

- Income Reporting: Total income received and the amount taxable for the year.

- Payment Schedule: Information on the payment terms agreed upon with the buyer.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Form 3805E. The form should be submitted along with the California state income tax return, typically due on April 15 each year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It is crucial to stay informed about any changes in tax regulations that may affect filing dates.

Legal use of the Form 3805E Installment Sale Income

The legal use of the Form 3805E is governed by California tax laws. Taxpayers must ensure that their installment sale complies with state regulations to avoid penalties. Properly reporting income from an installment sale is essential for maintaining compliance with tax obligations. Failure to accurately report can lead to audits or additional tax liabilities.

Create this form in 5 minutes or less

Find and fill out the correct form 3805e installment sale income

Create this form in 5 minutes!

How to create an eSignature for the form 3805e installment sale income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a California installment sale?

A California installment sale is a method of selling property where the seller receives payments over time rather than a lump sum. This approach can provide tax benefits and help manage cash flow. Understanding the nuances of a California installment sale is crucial for both buyers and sellers.

-

How does airSlate SignNow facilitate California installment sales?

airSlate SignNow streamlines the process of executing California installment sales by allowing users to easily create, send, and eSign documents. This ensures that all agreements are legally binding and securely stored. With our platform, you can manage your installment sale documents efficiently.

-

What are the pricing options for using airSlate SignNow for California installment sales?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you are a small business or a large enterprise, you can find a plan that suits your needs for managing California installment sales. Our cost-effective solution ensures you get the best value for your investment.

-

What features does airSlate SignNow offer for managing California installment sales?

Our platform includes features such as customizable templates, automated reminders, and secure eSigning, all designed to simplify the management of California installment sales. These tools help ensure that your transactions are efficient and compliant with legal standards. You can also track the status of your documents in real-time.

-

What are the benefits of using airSlate SignNow for California installment sales?

Using airSlate SignNow for California installment sales offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our solution allows you to close deals faster while ensuring that all parties are informed and engaged throughout the process. This can lead to improved customer satisfaction and repeat business.

-

Can airSlate SignNow integrate with other tools for California installment sales?

Yes, airSlate SignNow seamlessly integrates with various business tools and applications, enhancing your workflow for California installment sales. Whether you use CRM systems, accounting software, or other platforms, our integrations help streamline your processes. This ensures that all your data is synchronized and easily accessible.

-

Is airSlate SignNow compliant with California laws regarding installment sales?

Absolutely! airSlate SignNow is designed to comply with California laws and regulations concerning installment sales. Our platform ensures that all documents are legally binding and adhere to state requirements, providing peace of mind for both buyers and sellers. You can trust that your transactions are handled with the utmost care.

Get more for Form 3805E Installment Sale Income

- Template sampul duit raya pdf form

- Form ta 1 rev where can i print form

- Penndot sight distance form

- Massachusetts general durable power of attorney for property and finances or financial effective immediately form

- Var form 200 55074793

- Cra form

- Special accommodation requirements form

- Iso 18593 pdf download form

Find out other Form 3805E Installment Sale Income

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online