Instructions for Form 540 Personal Income Tax BookletRevised 2021

Understanding the California 3805E Form

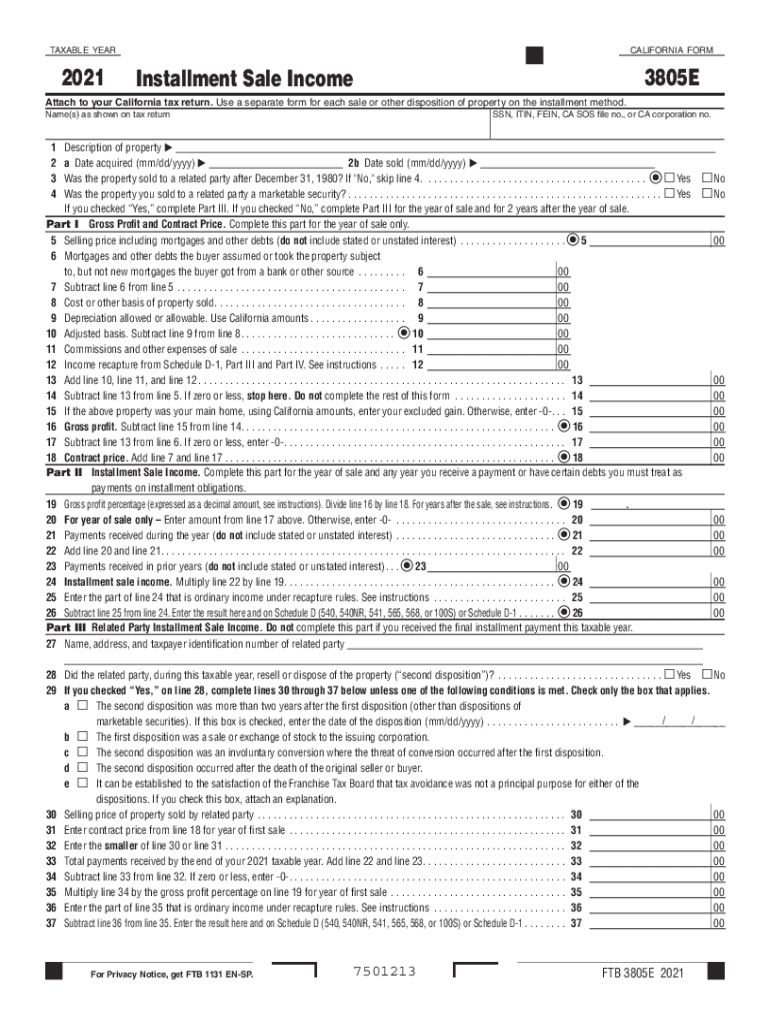

The California 3805E form, known as the California Installment Sale form, is essential for taxpayers who have sold property and are receiving payments over time. This form allows sellers to report income from an installment sale, which can have significant tax implications. It is crucial to accurately complete the 3805E to ensure compliance with state tax regulations and to take advantage of potential tax benefits associated with installment sales.

Steps to Complete the California 3805E Form

Completing the California 3805E form involves several key steps:

- Gather necessary documentation, including details of the sale, payment schedules, and any relevant tax records.

- Fill out the seller's information, including name, address, and taxpayer identification number.

- Provide details about the property sold, including its description, sale date, and selling price.

- Calculate the gain from the sale and determine the amount to report for the current tax year.

- Review the completed form for accuracy before submission.

Legal Use of the California 3805E Form

The California 3805E form is legally recognized for reporting installment sales, provided it is completed accurately and submitted on time. The form must comply with California tax laws, ensuring that all income from installment sales is reported correctly. Using a reliable eSignature tool can enhance the legal validity of the form, ensuring that signatures are secure and compliant with eSignature regulations.

Filing Deadlines for the 3805E Form

It is important to be aware of filing deadlines for the California 3805E form. Typically, the form must be filed along with your annual California income tax return. For most taxpayers, this means the deadline is April 15 of the following year. However, if you are unable to meet this deadline, you may request an extension, but ensure to check specific state guidelines for any changes or updates regarding deadlines.

Required Documents for the 3805E Form

When preparing to file the California 3805E form, gather the following documents:

- Sale agreement or contract for the property sold.

- Payment schedule detailing the amounts and dates of payments received.

- Records of any expenses related to the sale that may be deductible.

- Previous tax returns that may provide context for your current filing.

Examples of Using the California 3805E Form

Consider a scenario where a taxpayer sells a rental property for a total of $300,000, receiving $50,000 upfront and agreeing to annual payments of $25,000 over the next ten years. In this case, the taxpayer would use the California 3805E form to report the income from the installment sale, detailing the payments received each year and calculating the taxable income accordingly. This form helps ensure that the taxpayer complies with state tax laws while accurately reporting income.

Quick guide on how to complete 2020 instructions for form 540 personal income tax bookletrevised

Easily Prepare Instructions For Form 540 Personal Income Tax BookletRevised on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Instructions For Form 540 Personal Income Tax BookletRevised on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centered task today.

How to Alter and eSign Instructions For Form 540 Personal Income Tax BookletRevised with Ease

- Obtain Instructions For Form 540 Personal Income Tax BookletRevised and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the specialized tools that airSlate SignNow provides for this purpose.

- Craft your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misfiled documents, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Instructions For Form 540 Personal Income Tax BookletRevised to ensure clear communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 instructions for form 540 personal income tax bookletrevised

Create this form in 5 minutes!

How to create an eSignature for the 2020 instructions for form 540 personal income tax bookletrevised

How to generate an e-signature for your PDF file online

How to generate an e-signature for your PDF file in Google Chrome

How to make an e-signature for signing PDFs in Gmail

How to make an e-signature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

How to make an e-signature for a PDF document on Android devices

People also ask

-

What is the 3805e and how does it work with airSlate SignNow?

The 3805e is an advanced document management tool integrated with airSlate SignNow, allowing users to send and eSign documents seamlessly. With a user-friendly interface, the 3805e simplifies the signing process, making it easy for both senders and recipients to digitally sign documents in real-time.

-

What are the pricing options for the 3805e within airSlate SignNow?

Pricing for the 3805e varies depending on the selected plan within airSlate SignNow. Generally, it offers flexible subscription models, catering to individual users and larger teams. Customers can choose a plan that best fits their business needs and budget.

-

What features does the 3805e offer?

The 3805e comes with a range of features, including customizable templates, secure data storage, and advanced authentication options. It also integrates seamlessly with other tools in airSlate SignNow, enhancing document workflows and improving productivity.

-

How does the 3805e improve workflow efficiency?

By utilizing the 3805e in airSlate SignNow, businesses can streamline document processes, reducing the time spent on manual signing. It automates repetitive tasks, allowing teams to focus on more critical activities and ensuring documents are processed quickly and accurately.

-

Can the 3805e integrate with other platforms?

Yes, the 3805e integrates smoothly with various platforms and applications that are part of the airSlate SignNow ecosystem. This interoperability allows businesses to connect their existing tools and create a more efficient document management process without extra hassle.

-

What are the security measures in place for the 3805e?

The 3805e complies with industry-standard security protocols to ensure that all documents are protected during transmission and storage. airSlate SignNow employs encryption and secure access controls, safeguarding sensitive information while using the 3805e.

-

What benefits can businesses expect when using the 3805e?

Businesses using the 3805e can expect faster turnaround times for documents, reduced operational costs, and increased customer satisfaction. With its efficient eSignature capabilities, the 3805e helps organizations close deals quicker and improve overall productivity.

Get more for Instructions For Form 540 Personal Income Tax BookletRevised

- Revocation of health care proxy massachusetts form

- Commercial property sales package massachusetts form

- General partnership package massachusetts form

- Contract for deed package massachusetts form

- Power of attorney forms package massachusetts

- Massachusetts anatomical gift form

- Massachusetts process form

- Revocation of anatomical gift donation massachusetts form

Find out other Instructions For Form 540 Personal Income Tax BookletRevised

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy