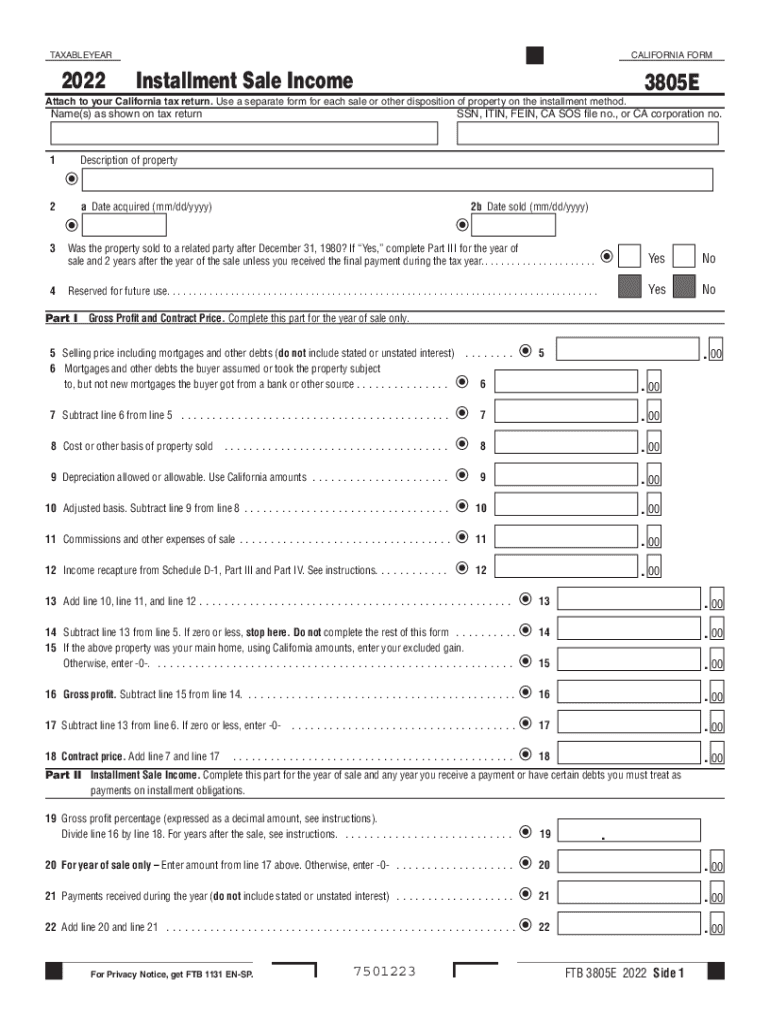

CALIFORNIA Form 3805E Installment Sale Income 2022

What is the California Form 3805E Installment Sale Income

The California Form 3805E is used to report income from an installment sale. An installment sale occurs when a seller allows the buyer to pay for property over time, rather than in a single lump sum. This form is essential for taxpayers who have sold property and received payments in installments, as it helps determine the taxable income for state tax purposes. The income reported on this form is typically derived from the sale of real estate, personal property, or other assets where the payment is spread over multiple years.

Key Elements of the California Form 3805E Installment Sale Income

Understanding the key elements of the California Form 3805E is crucial for accurate reporting. The form requires detailed information about the sale, including:

- Seller Information: Name, address, and taxpayer identification number.

- Property Details: Description of the property sold and the sale date.

- Sale Price: Total selling price of the property and the amount received in the current year.

- Installment Payments: Breakdown of payments received during the tax year.

- Cost Basis: The original cost of the property, including improvements and selling expenses.

These elements help in calculating the gain or loss from the sale and determining the taxable income for the year.

Steps to Complete the California Form 3805E Installment Sale Income

Completing the California Form 3805E involves several steps to ensure accuracy and compliance:

- Gather all necessary documentation related to the sale, including contracts and payment records.

- Fill out the seller information section with accurate personal details.

- Provide a detailed description of the property sold, including the sale date.

- Calculate the total selling price and the amount received during the tax year.

- Determine your cost basis for the property to calculate gain or loss.

- Review the completed form for accuracy before submission.

Following these steps helps ensure that the form is filled out correctly, reducing the risk of errors that could lead to penalties.

Legal Use of the California Form 3805E Installment Sale Income

The California Form 3805E is legally required for individuals and businesses that engage in installment sales. Proper use of this form ensures compliance with state tax laws. Failure to report installment income can result in penalties, interest, and potential audits. It is important to maintain accurate records of all transactions related to the installment sale, as these may be requested by tax authorities during an audit.

Filing Deadlines / Important Dates

Timely filing of the California Form 3805E is essential to avoid penalties. The form is typically due on the same date as your California state income tax return, which is usually April 15 for most taxpayers. If you are unable to file by this date, you may request an extension, but any taxes owed must still be paid by the original deadline to avoid interest and penalties. Keeping track of these important dates can help ensure compliance with state tax obligations.

Examples of Using the California Form 3805E Installment Sale Income

There are various scenarios in which the California Form 3805E is applicable. For instance:

- A homeowner sells their property and agrees to receive payments over five years.

- A business owner sells equipment with a payment plan that extends beyond the current tax year.

- An investor sells a piece of real estate and opts for installment payments to maximize cash flow.

In each of these cases, the seller must report the income received through the installment payments on the Form 3805E, ensuring accurate tax reporting and compliance with California tax laws.

Quick guide on how to complete california form 3805e installment sale income

Complete CALIFORNIA Form 3805E Installment Sale Income effortlessly on any device

Managing documents online has gained traction among enterprises and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle CALIFORNIA Form 3805E Installment Sale Income on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The simplest way to modify and eSign CALIFORNIA Form 3805E Installment Sale Income effortlessly

- Obtain CALIFORNIA Form 3805E Installment Sale Income and click Get Form to initiate.

- Use the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choosing. Edit and eSign CALIFORNIA Form 3805E Installment Sale Income and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california form 3805e installment sale income

Create this form in 5 minutes!

How to create an eSignature for the california form 3805e installment sale income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FTB installment income feature in airSlate SignNow?

The FTB installment income feature in airSlate SignNow allows users to handle and document income from installment sales efficiently. This feature simplifies the process of recording, managing, and tracking installment payments, ensuring compliance with California FTB regulations.

-

How does airSlate SignNow help manage FTB installment income?

AirSlate SignNow provides tools to create and send legally binding agreements that can include terms around FTB installment income. By using our platform, businesses can ensure that their installment agreements are properly formatted and signed, facilitating smoother transactions and compliance.

-

Is there a cost to use the FTB installment income feature?

AirSlate SignNow offers various pricing plans that include access to features for managing FTB installment income. The pricing is competitive and designed to fit businesses of all sizes, ensuring you have the tools you need for effective document management.

-

What benefits does airSlate SignNow provide for handling FTB installment income?

Using airSlate SignNow for FTB installment income management can streamline your document workflows and reduce the risk of errors. The platform’s user-friendly interface helps businesses to create, send, and manage their installment agreements efficiently while keeping everything secure.

-

Can I integrate airSlate SignNow with other accounting tools for FTB installment income?

Yes, airSlate SignNow can be integrated with various accounting software to enhance your management of FTB installment income. These integrations allow for seamless data transfer and better tracking of your financial documents, providing a comprehensive solution to your business needs.

-

What types of businesses benefit from using airSlate SignNow for FTB installment income?

Both small businesses and larger enterprises can benefit from using airSlate SignNow for FTB installment income management. Regardless of the industry, any business that deals in installment sales will find our platform helps streamline their documentation processes and maintain compliance.

-

Is training available for using the FTB installment income feature?

Absolutely! AirSlate SignNow offers resources and training to help users understand how to effectively utilize the FTB installment income feature. This support ensures that your team can maximize the benefits of our platform and manage your income-related documents efficiently.

Get more for CALIFORNIA Form 3805E Installment Sale Income

- Pd551 clamped or impounded vehicle early release application form

- Six month report form for food stamps alabama

- Mod form 1154 mod

- Pro se petition for removal of disabilities of minority test janesdueprocess form

- Power of attorney poa pbgc form 715

- Sample complaint letter to bar association form

- Cover letter bformb daca renewal 10 undocumedia undocumedia

- Officer ngin form 113 in ng

Find out other CALIFORNIA Form 3805E Installment Sale Income

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free