Tax Credits and Deductions for Individual TaxpayersTax Credit Programs MarylandTax Credits and Deductions for Individual Taxpaye 2020

Understanding Tax Credits and Deductions for Individual Taxpayers

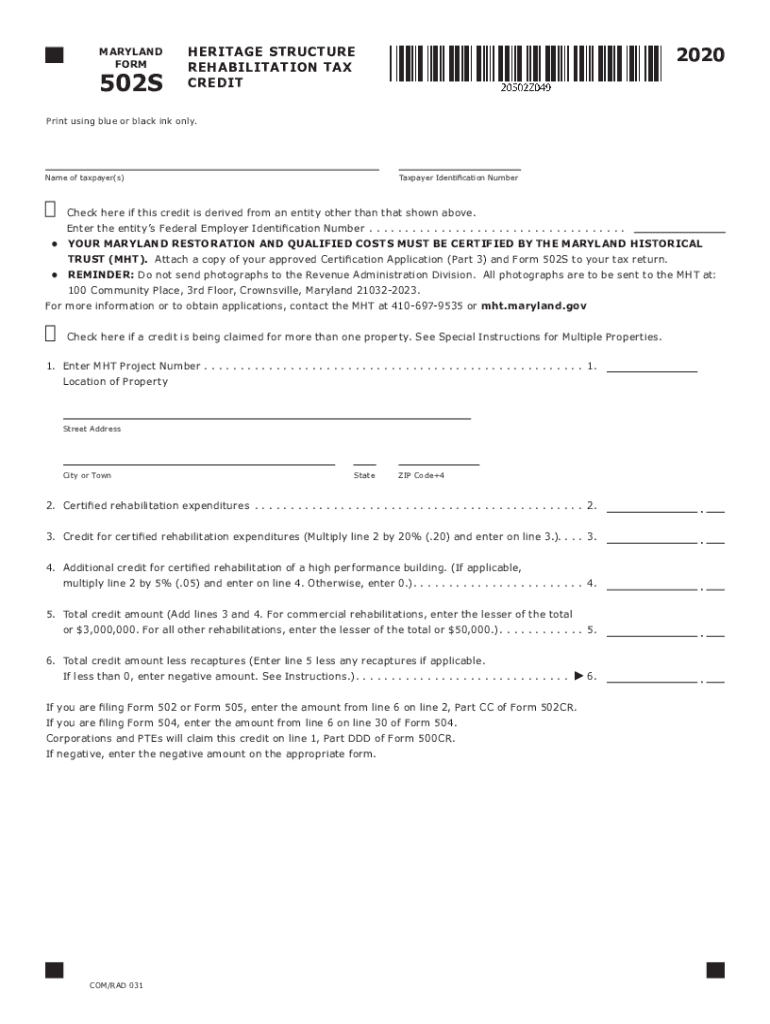

Tax credits and deductions are essential components of the tax system that can significantly reduce the amount of tax owed by individual taxpayers. In Maryland, various tax credit programs are available to assist residents in maximizing their financial benefits. These programs may include credits for low-income earners, education expenses, and specific deductions related to home ownership and medical expenses. Understanding the eligibility criteria and the types of credits available can help taxpayers take full advantage of these financial opportunities.

How to Use Tax Credits and Deductions

Utilizing tax credits and deductions effectively requires careful planning and documentation. Taxpayers should begin by identifying which credits and deductions they qualify for based on their income level, filing status, and specific circumstances. It is advisable to gather all necessary documentation, such as income statements, receipts for deductible expenses, and any relevant tax forms. By accurately completing the required forms and including all eligible deductions, taxpayers can ensure they receive the maximum benefit from available tax credits.

Steps to Complete the Tax Credits and Deductions Form

Completing the tax credits and deductions form in Maryland involves several key steps. First, taxpayers should download the appropriate form from the Maryland state tax website. Next, they should carefully read the instructions provided to understand the information required. It is important to fill out the form accurately, ensuring that all personal information, income details, and deductions are correctly entered. After completing the form, taxpayers should review it for any errors before submitting it electronically or via mail.

Eligibility Criteria for Tax Credits and Deductions

Eligibility for tax credits and deductions varies depending on the specific program and individual circumstances. Generally, factors such as income level, filing status, and residency in Maryland will influence eligibility. For instance, certain credits may be available only to low-income taxpayers or those with dependents. It is crucial for individuals to review the specific requirements for each credit or deduction to determine their eligibility and ensure compliance with state tax laws.

Required Documents for Filing

When filing for tax credits and deductions, taxpayers must prepare several key documents. Commonly required documents include W-2 forms, 1099 forms, receipts for deductible expenses, and proof of residency. Additionally, taxpayers may need to provide documentation related to specific credits, such as education expenses or childcare costs. Organizing these documents in advance can streamline the filing process and help avoid delays in receiving any potential refunds.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is essential for taxpayers looking to claim credits and deductions. In Maryland, the tax filing deadline typically aligns with the federal deadline, which is usually April 15. However, taxpayers should verify any changes or extensions that may apply in a given year. Marking important dates on a calendar can help ensure that all forms are submitted on time, avoiding potential penalties or missed opportunities for tax credits.

Quick guide on how to complete tax credits and deductions for individual taxpayerstax credit programs marylandtax credits and deductions for individual

Prepare Tax Credits And Deductions For Individual TaxpayersTax Credit Programs MarylandTax Credits And Deductions For Individual Taxpaye effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed files, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Tax Credits And Deductions For Individual TaxpayersTax Credit Programs MarylandTax Credits And Deductions For Individual Taxpaye on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

How to alter and eSign Tax Credits And Deductions For Individual TaxpayersTax Credit Programs MarylandTax Credits And Deductions For Individual Taxpaye with ease

- Obtain Tax Credits And Deductions For Individual TaxpayersTax Credit Programs MarylandTax Credits And Deductions For Individual Taxpaye and click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or black out sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as an ink signature.

- Confirm the details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Stop worrying about misplaced or lost documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Modify and eSign Tax Credits And Deductions For Individual TaxpayersTax Credit Programs MarylandTax Credits And Deductions For Individual Taxpaye to ensure excellent communication at every phase of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax credits and deductions for individual taxpayerstax credit programs marylandtax credits and deductions for individual

Create this form in 5 minutes!

How to create an eSignature for the tax credits and deductions for individual taxpayerstax credit programs marylandtax credits and deductions for individual

The best way to generate an electronic signature for your PDF in the online mode

The best way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What are the tax credits and deductions available for individual taxpayers in Maryland?

The 'Tax Credits And Deductions For Individual Taxpayers in Maryland' includes various programs designed to assist residents in reducing their taxable income. Common deductions can include the standard deduction, personal exemptions, and specific credits available through the state. For further details, refer to the 2020 Individual Income Tax Forms available at 'Marylandtaxes.gov'.

-

How can I maximize my savings with tax credits and deductions?

To maximize your savings, keep track of all eligible expenses throughout the year that can be claimed under the 'Tax Credits And Deductions For Individual Taxpayers in Maryland'. Using the 2020 Individual Income Tax Forms from 'Marylandtaxes.gov' can help identify what is deductible. Consider consulting a tax professional to ensure you don't miss any opportunities.

-

Are there specific tax credit programs for individuals in Maryland?

Yes, Maryland offers several 'Tax Credit Programs' aimed at individual taxpayers, which include credits for contributions to retirement accounts and other eligible expenses. These credits can signNowly lower your overall tax burden. For detailed information, check the resources available on 'Marylandtaxes.gov'.

-

How often do tax credit programs change in Maryland?

Tax credit programs in Maryland can change annually based on new legislation and budget decisions. It is essential for taxpayers to stay updated with the latest information provided on 'Marylandtaxes.gov', especially as they prepare to file using the 2020 Individual Income Tax Forms.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers a user-friendly platform to eSign and manage documents efficiently, making it easier to handle tax-related paperwork. Features include cloud storage, customizable templates, and integrations with popular accounting software, which can simplify the process of applying for 'Tax Credits And Deductions For Individual Taxpayers'.

-

Is airSlate SignNow suitable for individual taxpayers?

Absolutely. airSlate SignNow provides an easy-to-use, cost-effective solution for individual taxpayers looking to handle their tax documents and agreements. Its features streamline the management of information related to 'Tax Credits And Deductions For Individual Taxpayers', ensuring a smooth process for filing taxes.

-

How can I integrate airSlate SignNow with my existing tax software?

airSlate SignNow offers several integrations with trusted accounting and tax software, allowing for seamless data transfer and document handling. This ensures that when you're dealing with 'Tax Credits And Deductions For Individual Taxpayers' and the necessary forms, everything is organized and efficient. Check the integration section on our website for more details.

Get more for Tax Credits And Deductions For Individual TaxpayersTax Credit Programs MarylandTax Credits And Deductions For Individual Taxpaye

- 300 baldwin road form

- Public notification certification form state nj

- Security drill record form

- New jersey department of environmental protection division of water supply and geoscience form

- Nebraska subcontractor agreement template form

- Users guide for 13 14 finaldoc form

- Guilford county gun permit form

- Crossbow application form

Find out other Tax Credits And Deductions For Individual TaxpayersTax Credit Programs MarylandTax Credits And Deductions For Individual Taxpaye

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed