State Residential Historic Rehabilitation Tax Credit 2022

What is the State Residential Historic Rehabilitation Tax Credit

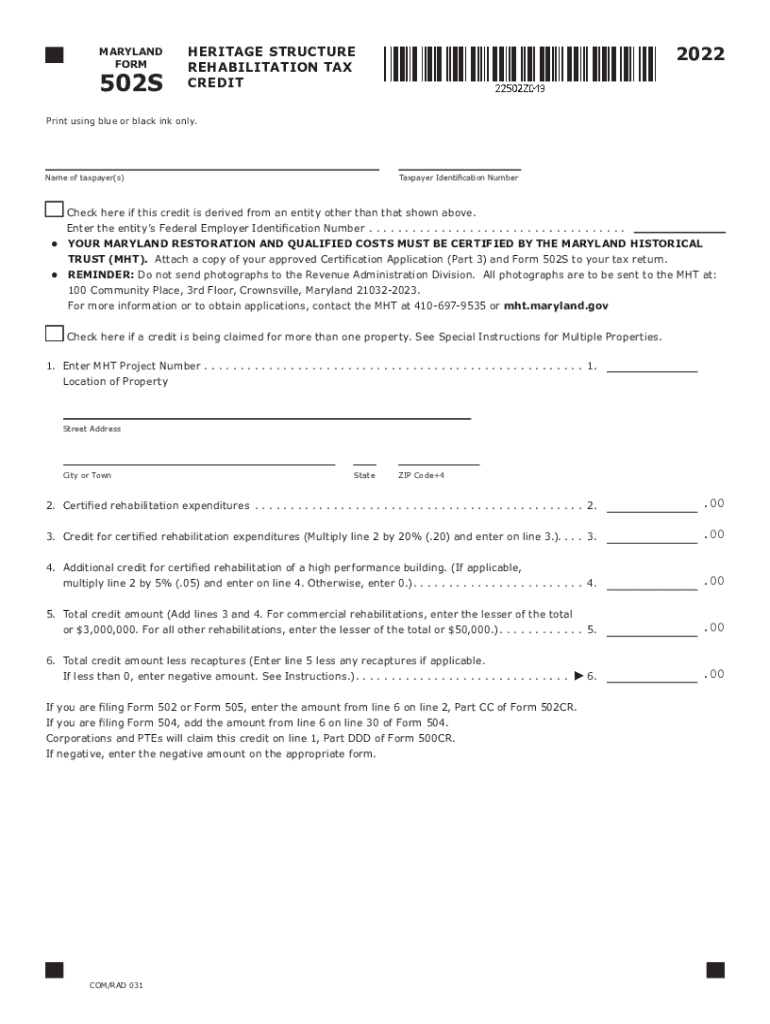

The State Residential Historic Rehabilitation Tax Credit is a financial incentive designed to encourage the preservation and rehabilitation of historic residential properties. This credit allows property owners to receive a percentage of their rehabilitation expenses back as a tax credit, effectively reducing their overall tax liability. The program aims to promote the conservation of historical architecture while revitalizing communities and enhancing property values.

Eligibility Criteria

To qualify for the State Residential Historic Rehabilitation Tax Credit, property owners must meet specific criteria. The property must be a certified historic structure, typically listed on the National Register of Historic Places or located within a designated historic district. Additionally, the rehabilitation work must adhere to the Secretary of the Interior's Standards for Rehabilitation, ensuring that the historical integrity of the property is maintained. Property owners should also have a minimum expenditure threshold to qualify for the credit.

Steps to Complete the State Residential Historic Rehabilitation Tax Credit

Completing the process for the State Residential Historic Rehabilitation Tax Credit involves several key steps. First, property owners should verify their eligibility by confirming the historic status of their property. Next, they must prepare a detailed rehabilitation plan that outlines the proposed work and its compliance with preservation standards. After completing the rehabilitation, owners should gather all necessary documentation, including receipts and photographs of the work done. Finally, they can submit their application along with the required forms to the appropriate state agency for review.

Required Documents

When applying for the State Residential Historic Rehabilitation Tax Credit, several documents are essential for a successful submission. These typically include:

- A completed application form specific to the tax credit program.

- Documentation proving the property's historic status, such as a National Register listing or local historic designation.

- A detailed description of the rehabilitation work performed, including plans and specifications.

- Receipts and invoices for all eligible rehabilitation expenses.

- Photographic evidence of the property before, during, and after the rehabilitation process.

How to Obtain the State Residential Historic Rehabilitation Tax Credit

Obtaining the State Residential Historic Rehabilitation Tax Credit involves a structured process. Property owners should begin by researching their state's specific program requirements, as these can vary. After confirming eligibility, they should prepare the necessary documentation and rehabilitation plans. Submitting the application to the designated state agency is the next step, followed by a review period during which the agency may request additional information. Once approved, property owners can apply the tax credit to their state tax return, effectively reducing their tax liability.

Legal Use of the State Residential Historic Rehabilitation Tax Credit

The legal use of the State Residential Historic Rehabilitation Tax Credit is governed by state laws and regulations. Property owners must ensure that their rehabilitation work complies with local, state, and federal preservation standards. Additionally, it is crucial to maintain accurate records of all expenditures and documentation related to the rehabilitation process. Non-compliance with these legal requirements can result in the disqualification of the tax credit and potential penalties.

Quick guide on how to complete state residential historic rehabilitation tax credit

Effortlessly Prepare State Residential Historic Rehabilitation Tax Credit on Any Device

The management of documents online has gained popularity among businesses and individuals alike. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, enabling you to find the appropriate form and safely store it on the internet. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly and without delays. Manage State Residential Historic Rehabilitation Tax Credit on any platform with the airSlate SignNow applications for Android or iOS, and enhance any document-oriented process today.

How to edit and eSign State Residential Historic Rehabilitation Tax Credit With Ease

- Obtain State Residential Historic Rehabilitation Tax Credit and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize key sections of your documents or obscure sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your alterations.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Leave behind concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Modify and eSign State Residential Historic Rehabilitation Tax Credit while ensuring seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state residential historic rehabilitation tax credit

Create this form in 5 minutes!

How to create an eSignature for the state residential historic rehabilitation tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the State Residential Historic Rehabilitation Tax Credit?

The State Residential Historic Rehabilitation Tax Credit is a financial incentive provided to homeowners restoring historic properties. This tax credit can signNowly reduce renovation costs by allowing taxpayers to receive a percentage of qualified rehabilitation expenses. By utilizing this credit, homeowners can preserve their property's historic value while benefiting financially.

-

How can the State Residential Historic Rehabilitation Tax Credit benefit my renovation project?

Utilizing the State Residential Historic Rehabilitation Tax Credit can drastically lower your renovation expenses. Depending on your state, you may receive a substantial percentage of your renovation costs back in tax credits. This financial relief not only enhances your budget but also encourages the preservation of historical architecture.

-

Are there specific requirements to qualify for the State Residential Historic Rehabilitation Tax Credit?

Yes, to qualify for the State Residential Historic Rehabilitation Tax Credit, your property must be designated as historic by the state or listed on the National Register of Historic Places. Additionally, the renovations must meet certain standards to ensure the restoration maintains the historical integrity of the property. It’s vital to check with your state’s guidelines for complete eligibility criteria.

-

How do I apply for the State Residential Historic Rehabilitation Tax Credit?

To apply for the State Residential Historic Rehabilitation Tax Credit, you'll need to submit an application through your state's historic preservation office. This typically involves a detailed description of your renovation plans and expenses. It's recommended to consult with a tax professional or local preservationist to ensure your application meets all necessary requirements.

-

Can I combine the State Residential Historic Rehabilitation Tax Credit with other financial incentives?

Yes, in many cases, you can combine the State Residential Historic Rehabilitation Tax Credit with other financial incentives like federal tax credits, grants, or local funding programs. This can greatly enhance your overall savings on your renovation project. However, it’s essential to verify the specific regulations and eligibility for each program in your area.

-

How does the State Residential Historic Rehabilitation Tax Credit differ from federal tax credits?

The State Residential Historic Rehabilitation Tax Credit is typically designed for specific state historical properties, while federal tax credits apply to properties on the National Register of Historic Places nationwide. The percentage offered and the application processes can also differ. Homeowners should consider both options to maximize their potential tax savings.

-

What types of renovations are covered by the State Residential Historic Rehabilitation Tax Credit?

The State Residential Historic Rehabilitation Tax Credit generally covers a wide range of renovation activities, including structural repairs, exterior restoration, and necessary upgrades to plumbing and electrical systems. However, cosmetic changes may not qualify, emphasizing the importance of adhering to historical preservation standards. Homeowners should consult their state guidelines for specifics on eligible renovations.

Get more for State Residential Historic Rehabilitation Tax Credit

- South carolina legal form

- Essential legal life documents for new parents south carolina form

- General power of attorney for care and custody of child or children south carolina form

- Small business accounting package south carolina form

- Company employment policies and procedures package south carolina form

- Sc revocation form

- Newly divorced individuals package south carolina form

- Contractors forms package south carolina

Find out other State Residential Historic Rehabilitation Tax Credit

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document