How to Claim the Historic Tax Credit 2023-2026

Understanding the Historic Tax Credit

The Historic Tax Credit (HTC) is a federal incentive designed to encourage the preservation of historic buildings. This credit allows taxpayers to receive a percentage of the rehabilitation costs as a credit against their federal income tax. The HTC is applicable to certified historic structures, which can include commercial properties, residential buildings, and certain income-producing properties. Understanding the eligibility criteria is crucial for maximizing the benefits of this program.

Eligibility Criteria for the Historic Tax Credit

To qualify for the Historic Tax Credit, properties must meet specific criteria. The property must be listed on the National Register of Historic Places or be located in a registered historic district. Additionally, the rehabilitation work must meet the Secretary of the Interior's Standards for Rehabilitation. This ensures that the historical integrity of the building is preserved during renovations.

Steps to Complete the Historic Tax Credit Application

Applying for the Historic Tax Credit involves several key steps:

- Determine eligibility based on property status and planned renovations.

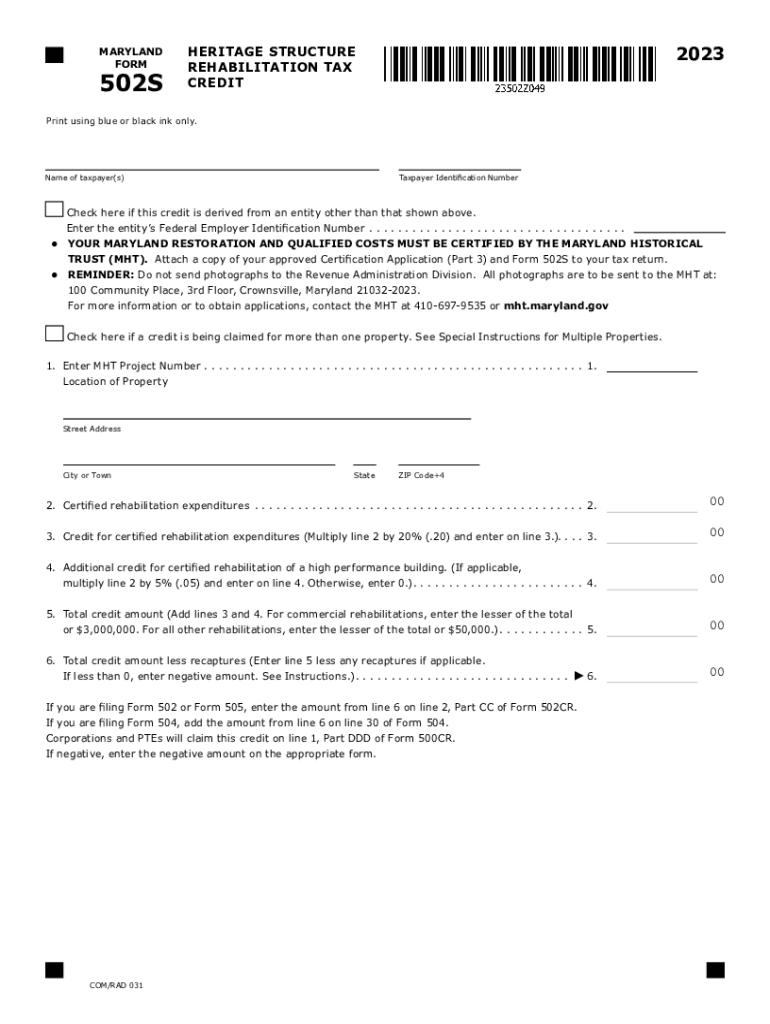

- Complete the necessary forms, including the Part 1 application to establish the property's historic status.

- Submit the Part 2 application, detailing the proposed rehabilitation work.

- After completing the work, file the Part 3 application to claim the credit.

Each part of the application must be submitted to the appropriate state historic preservation office for review and approval.

Required Documents for the Historic Tax Credit

When applying for the Historic Tax Credit, several documents are necessary to support the application:

- Proof of property ownership, such as a deed.

- Detailed plans and specifications for the rehabilitation work.

- Photographs of the property before, during, and after rehabilitation.

- Documentation of all expenses incurred during the renovation process.

Gathering these documents ahead of time can streamline the application process.

Filing Deadlines for the Historic Tax Credit

Timely submission of applications is essential to benefit from the Historic Tax Credit. Generally, the Part 1 application should be submitted before any rehabilitation work begins. The Part 2 application must be submitted after the work is completed but before claiming the credit on your tax return. It is advisable to check specific deadlines with the local historic preservation office, as they can vary by state.

IRS Guidelines for the Historic Tax Credit

The Internal Revenue Service (IRS) provides specific guidelines for claiming the Historic Tax Credit. Taxpayers must follow these guidelines to ensure compliance and avoid penalties. Key points include maintaining accurate records of all expenses and ensuring that the rehabilitation meets the required standards. Familiarizing oneself with IRS publications related to the HTC can provide valuable insights into the process.

Quick guide on how to complete how to claim the historic tax credit

Prepare How To Claim The Historic Tax Credit effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed paperwork, allowing you to locate the correct template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Manage How To Claim The Historic Tax Credit on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign How To Claim The Historic Tax Credit with ease

- Obtain How To Claim The Historic Tax Credit and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Mark important sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and electronically sign How To Claim The Historic Tax Credit to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to claim the historic tax credit

Create this form in 5 minutes!

How to create an eSignature for the how to claim the historic tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are 502s in the context of eSigning documents?

In the context of eSigning documents, 502s refer to specific error codes that may arise during the electronic signing process. Understanding 502s helps troubleshoot issues related to document transmission and ensure a smooth signing experience.

-

How does airSlate SignNow handle 502s during document signing?

airSlate SignNow provides robust error handling for 502s, ensuring that users receive notifications if any issues arise during the signing process. This feature allows businesses to quickly address and resolve problems, minimizing delays in document execution.

-

What features does airSlate SignNow offer to mitigate 502 issues?

airSlate SignNow includes features such as automatic retries and real-time status updates that help prevent and mitigate 502 issues. By ensuring that users are informed and that the system can handle errors efficiently, workflows remain uninterrupted.

-

Is there a pricing structure for businesses using airSlate SignNow that deals with 502s?

Yes, airSlate SignNow offers various pricing plans tailored for businesses of all sizes, allowing organizations to select a plan that fits their needs while addressing any potential 502 issues. Each plan provides access to essential features that enhance the signing experience.

-

How does airSlate SignNow integrate with other tools to manage 502s?

airSlate SignNow seamlessly integrates with several popular applications, allowing users to connect their tools for a cohesive workflow. These integrations can also help reduce occurrences of 502s by improving overall system communication.

-

What are the benefits of using airSlate SignNow in relation to 502s?

Using airSlate SignNow reduces the likelihood of encountering 502s during document signing, thanks to its user-friendly interface and reliable performance. This ensures a smoother experience in document workflows, ultimately supporting business efficiency.

-

Can I get support for 502s from airSlate SignNow?

Absolutely! airSlate SignNow offers dedicated customer support to assist users in troubleshooting 502s and any other issues. Their support team is equipped to provide solutions that ensure a seamless eSigning experience.

Get more for How To Claim The Historic Tax Credit

- Standing vehicle permit renewal application illinois dnr form

- Control number il 029 78 form

- Including but not limited to any implied warranty of fitness implied form

- The grantors and two form

- Unmarried of the of county of form

- Al form subcontractor interim waiver and release upon

- Hereby convey and quitclaim unto a corporation organized under the state form

- Management is hereby authorized to obtain any and all medical treatment management form

Find out other How To Claim The Historic Tax Credit

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile