Form MO 3NR Partnership or S Corporation Withholding Exemption or Revocation Agreement 2024-2026

What is the Form MO 3NR Partnership Or S Corporation Withholding Exemption Or Revocation Agreement

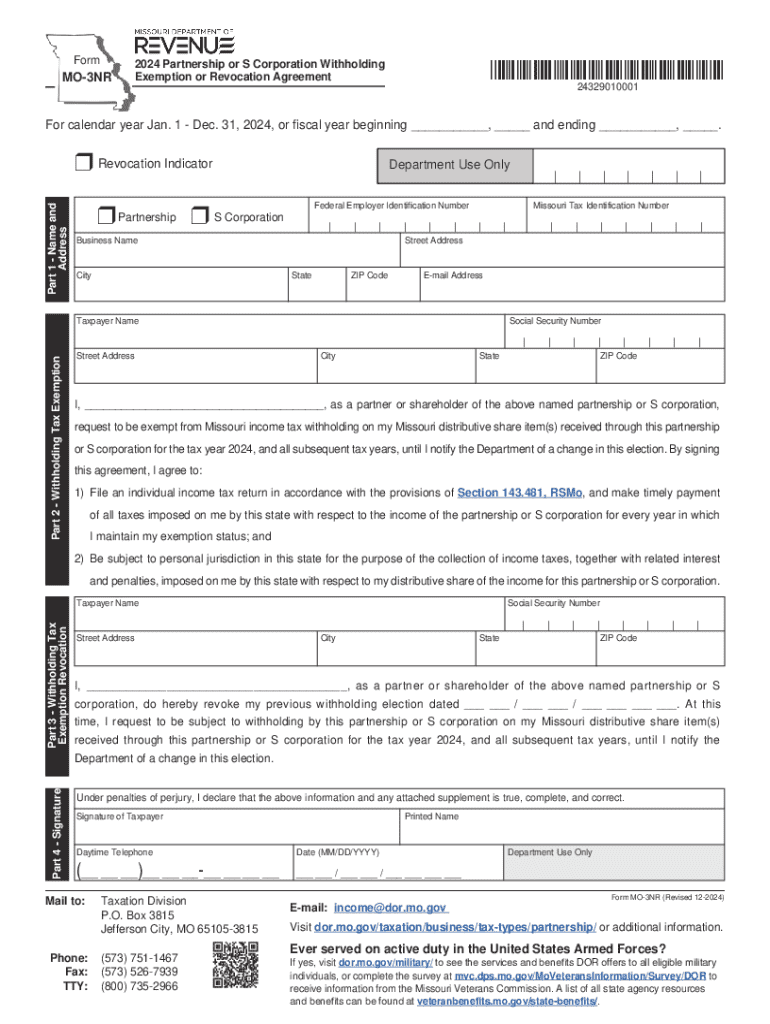

The Form MO 3NR is a crucial document used by partnerships and S corporations in Missouri to request a withholding exemption or to revoke a previously granted exemption. This form is designed to ensure that the appropriate tax obligations are met while allowing eligible entities to avoid unnecessary withholding on income distributions. Understanding the purpose of this form is essential for businesses operating within the state, as it helps to clarify tax responsibilities and compliance requirements.

How to use the Form MO 3NR Partnership Or S Corporation Withholding Exemption Or Revocation Agreement

Using the Form MO 3NR involves a straightforward process. Entities must first determine their eligibility for withholding exemption based on their business structure and income distribution methods. Once eligibility is confirmed, the form must be filled out accurately, providing necessary information about the entity and its tax status. After completing the form, it should be submitted to the appropriate state tax authority for processing. This ensures that the entity is recognized as exempt from withholding, streamlining tax obligations.

Steps to complete the Form MO 3NR Partnership Or S Corporation Withholding Exemption Or Revocation Agreement

Completing the Form MO 3NR requires careful attention to detail. Follow these steps:

- Gather necessary information about the partnership or S corporation, including the entity's name, address, and tax identification number.

- Indicate whether you are requesting an exemption or revocation of a previous exemption.

- Provide details regarding the income distributions and the reasons for the exemption request.

- Review the completed form for accuracy and completeness.

- Submit the form to the appropriate state tax authority, ensuring it is filed by any applicable deadlines.

Key elements of the Form MO 3NR Partnership Or S Corporation Withholding Exemption Or Revocation Agreement

The Form MO 3NR includes several key elements that are vital for proper completion and submission. These elements typically include:

- Entity identification information, such as name and address.

- Tax identification number of the partnership or S corporation.

- Specific details about the withholding exemption being requested or revoked.

- Signature of an authorized representative of the entity, affirming the accuracy of the information provided.

Legal use of the Form MO 3NR Partnership Or S Corporation Withholding Exemption Or Revocation Agreement

The legal use of the Form MO 3NR is governed by Missouri tax laws and regulations. This form is recognized as an official request for withholding exemption, and its proper completion is essential for compliance. Entities that fail to submit this form when required may face penalties or increased tax liabilities. Therefore, it is important for businesses to understand their obligations under state law and to utilize this form correctly to avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form MO 3NR are crucial for maintaining compliance with state tax regulations. Typically, the form should be submitted prior to the distribution of income to ensure that the withholding exemption is applied correctly. It is advisable for entities to check with the Missouri Department of Revenue for specific deadlines, as these may vary based on the entity's tax situation or any changes in state law.

Create this form in 5 minutes or less

Find and fill out the correct form mo 3nr partnership or s corporation withholding exemption or revocation agreement

Create this form in 5 minutes!

How to create an eSignature for the form mo 3nr partnership or s corporation withholding exemption or revocation agreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mo 3nr and how does it relate to airSlate SignNow?

Mo 3nr is a key feature of airSlate SignNow that enhances document management and eSigning capabilities. It allows users to streamline their workflows, making it easier to send and sign documents efficiently. By utilizing mo 3nr, businesses can improve their overall productivity and reduce turnaround times.

-

How much does airSlate SignNow cost with the mo 3nr feature?

The pricing for airSlate SignNow varies based on the plan you choose, but it remains cost-effective even with the mo 3nr feature included. Users can select from different subscription tiers that best fit their needs, ensuring they get the most value for their investment. For detailed pricing, visit our website.

-

What are the main benefits of using mo 3nr in airSlate SignNow?

Using mo 3nr in airSlate SignNow offers numerous benefits, including enhanced efficiency in document handling and improved collaboration among team members. It simplifies the eSigning process, making it accessible for all users. Additionally, it helps businesses maintain compliance and security in their document transactions.

-

Can I integrate mo 3nr with other applications?

Yes, airSlate SignNow with mo 3nr can be easily integrated with various applications such as CRM systems, cloud storage services, and productivity tools. This flexibility allows businesses to create a seamless workflow that enhances their existing processes. Check our integration options to see how mo 3nr can fit into your tech stack.

-

Is mo 3nr suitable for small businesses?

Absolutely! Mo 3nr is designed to cater to businesses of all sizes, including small businesses. Its user-friendly interface and cost-effective pricing make it an ideal choice for small teams looking to optimize their document management and eSigning processes without breaking the bank.

-

How secure is the mo 3nr feature in airSlate SignNow?

The mo 3nr feature in airSlate SignNow is built with security in mind, employing advanced encryption and compliance measures to protect your documents. Users can trust that their sensitive information is safeguarded throughout the eSigning process. We prioritize security to ensure peace of mind for all our customers.

-

What types of documents can I send using mo 3nr?

With mo 3nr, you can send a wide variety of documents, including contracts, agreements, and forms. The versatility of airSlate SignNow allows you to customize your document workflows to suit your specific needs. Whether it's legal documents or internal memos, mo 3nr can handle it all.

Get more for Form MO 3NR Partnership Or S Corporation Withholding Exemption Or Revocation Agreement

- Homemaker personal care hpcwaiver service form

- Googlecom cyberdrive illinois dah form

- Pentair warranty registration form

- Garden home management form

- Costume design template form

- Small business investment agreement template form

- Small business business agreement template form

- Small business investor agreement template form

Find out other Form MO 3NR Partnership Or S Corporation Withholding Exemption Or Revocation Agreement

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed