Kentucky Form 4972 K Kentucky Tax on Lump Sum Distributions 2020

What is the Kentucky Form 4972 K Kentucky Tax On Lump Sum Distributions

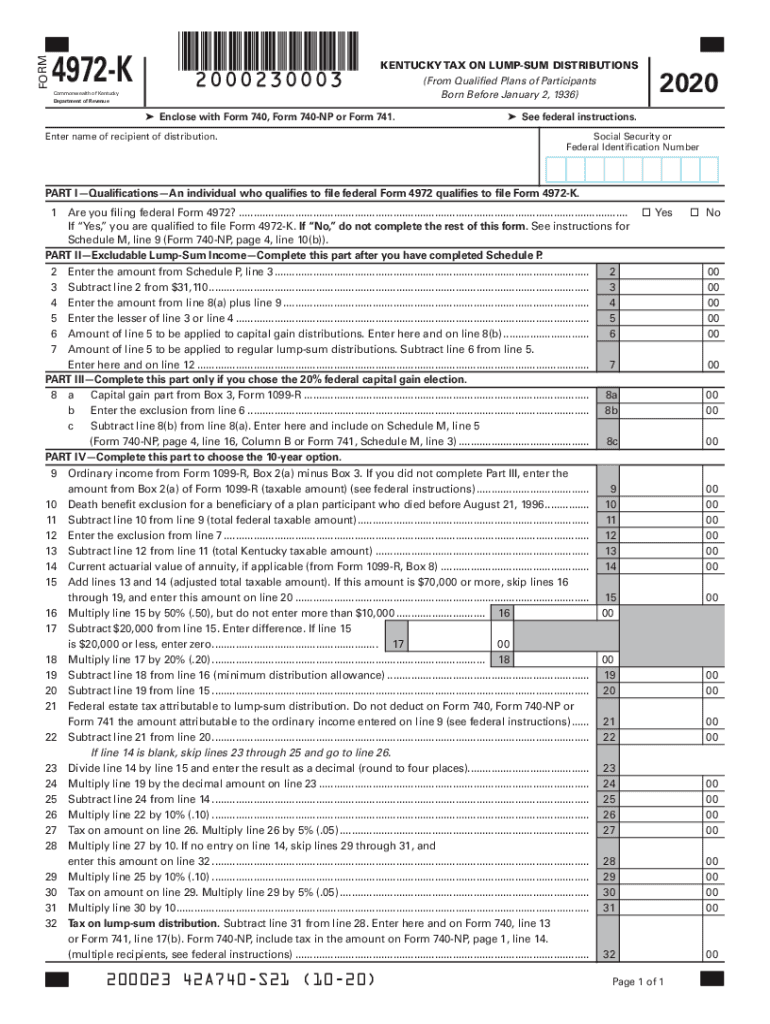

The Kentucky Form 4972 K is a tax form used to report and calculate the tax on lump sum distributions from retirement plans. This form is specifically designed for taxpayers who receive a lump sum payment from a qualified retirement plan, such as a pension or 401(k). The tax implications of these distributions can vary, making it essential for individuals to understand the form's requirements and how it affects their overall tax liability. By completing the form accurately, taxpayers can ensure compliance with Kentucky tax laws while potentially minimizing their tax burden.

Steps to complete the Kentucky Form 4972 K Kentucky Tax On Lump Sum Distributions

Completing the Kentucky Form 4972 K involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the lump sum distribution, including the amount received and any tax withheld. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report the total amount of the lump sum distribution in the designated section. Calculate the tax owed using the provided instructions, ensuring you account for any applicable deductions or credits. Finally, review the form for accuracy before submitting it to the appropriate tax authority.

Legal use of the Kentucky Form 4972 K Kentucky Tax On Lump Sum Distributions

The Kentucky Form 4972 K is legally recognized for reporting tax obligations associated with lump sum distributions. To be valid, the form must be completed in accordance with Kentucky state tax laws and regulations. This includes providing accurate information regarding the distribution and adhering to filing deadlines. Failure to comply with these legal requirements may result in penalties or additional tax liabilities. Therefore, understanding the legal framework surrounding the form is crucial for taxpayers to ensure their submissions are accepted and processed correctly.

Filing Deadlines / Important Dates

Filing deadlines for the Kentucky Form 4972 K are critical for taxpayers to observe. Generally, the form must be submitted by the same date as your federal tax return, typically April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to stay informed about any changes to these deadlines, as late submissions can result in penalties and interest on unpaid taxes. Taxpayers should also consider any extensions they may file for their federal tax return, as this can affect the timing of their Kentucky tax obligations.

Required Documents

To complete the Kentucky Form 4972 K, several documents are necessary. These include the Form 1099-R, which reports the amount of the lump sum distribution, and any documentation related to tax withholding. Additionally, taxpayers should have their previous year's tax return on hand to reference any carryover amounts or deductions that may apply. Having these documents readily available can streamline the completion process and ensure that all necessary information is accurately reported on the form.

Examples of using the Kentucky Form 4972 K Kentucky Tax On Lump Sum Distributions

Examples of using the Kentucky Form 4972 K can provide clarity on its application. For instance, if an individual retires and receives a lump sum payment from their pension plan, they would use this form to report the distribution and calculate any tax owed. Another scenario could involve a beneficiary receiving a lump sum from a deceased relative's retirement account. In both cases, accurately completing the form is essential to meet tax obligations and avoid penalties. These examples highlight the form's importance in various financial situations involving retirement distributions.

Quick guide on how to complete kentucky form 4972 k kentucky tax on lump sum distributions

Complete Kentucky Form 4972 K Kentucky Tax On Lump Sum Distributions effortlessly on any device

Online document management has gained traction with companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can find the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Kentucky Form 4972 K Kentucky Tax On Lump Sum Distributions on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Kentucky Form 4972 K Kentucky Tax On Lump Sum Distributions with minimal effort

- Find Kentucky Form 4972 K Kentucky Tax On Lump Sum Distributions and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal significance as a typical wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Kentucky Form 4972 K Kentucky Tax On Lump Sum Distributions and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kentucky form 4972 k kentucky tax on lump sum distributions

Create this form in 5 minutes!

How to create an eSignature for the kentucky form 4972 k kentucky tax on lump sum distributions

The best way to generate an eSignature for a PDF document online

The best way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

The way to create an eSignature for a PDF file on Android OS

People also ask

-

What are KY distributions and how do they work with airSlate SignNow?

KY distributions refer to the allocation of funds or resources among stakeholders typically following specific guidelines. With airSlate SignNow, businesses can streamline the process of managing these distributions by using eSignature capabilities to ensure all necessary documents are signed quickly and securely.

-

How does airSlate SignNow improve the KY distribution process?

airSlate SignNow offers a user-friendly platform that simplifies the KY distribution process. By enabling electronic signatures on key documents, businesses can reduce delays, maintain compliance, and improve overall efficiency in handling distributions.

-

Is pricing for airSlate SignNow suitable for businesses managing KY distributions?

Yes, airSlate SignNow provides flexible pricing plans that cater to various business needs, including those handling KY distributions. The cost-effective solution allows organizations to scale their usage based on their specific requirements without overspending.

-

What features does airSlate SignNow offer for managing KY distributions?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure document storage, all beneficial for managing KY distributions. These features help optimize the entire process, ensuring accuracy and timeliness.

-

Can airSlate SignNow integrate with other tools for KY distributions?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easier to manage KY distributions alongside other business processes. This integration ensures a cohesive workflow for document management and eSignature functionalities.

-

What are the benefits of using airSlate SignNow for KY distributions?

Using airSlate SignNow for KY distributions offers several benefits, including enhanced compliance and a streamlined workflow. By digitizing the distribution process, businesses can eliminate paper-based inefficiencies and reduce turnaround times signNowly.

-

How secure is airSlate SignNow for handling KY distribution documents?

airSlate SignNow prioritizes security, employing advanced encryption and authentication technologies to protect documents related to KY distributions. This ensures that sensitive information remains confidential and accessible only to authorized personnel.

Get more for Kentucky Form 4972 K Kentucky Tax On Lump Sum Distributions

Find out other Kentucky Form 4972 K Kentucky Tax On Lump Sum Distributions

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure

- eSign Tennessee Mechanic's Lien Later

- eSign Iowa Revocation of Power of Attorney Online

- How Do I eSign Maine Revocation of Power of Attorney

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture