Complete Form 4972 Tax on Lump Sum Distributions 2023-2026

Understanding Form 4972: Tax on Lump Sum Distributions

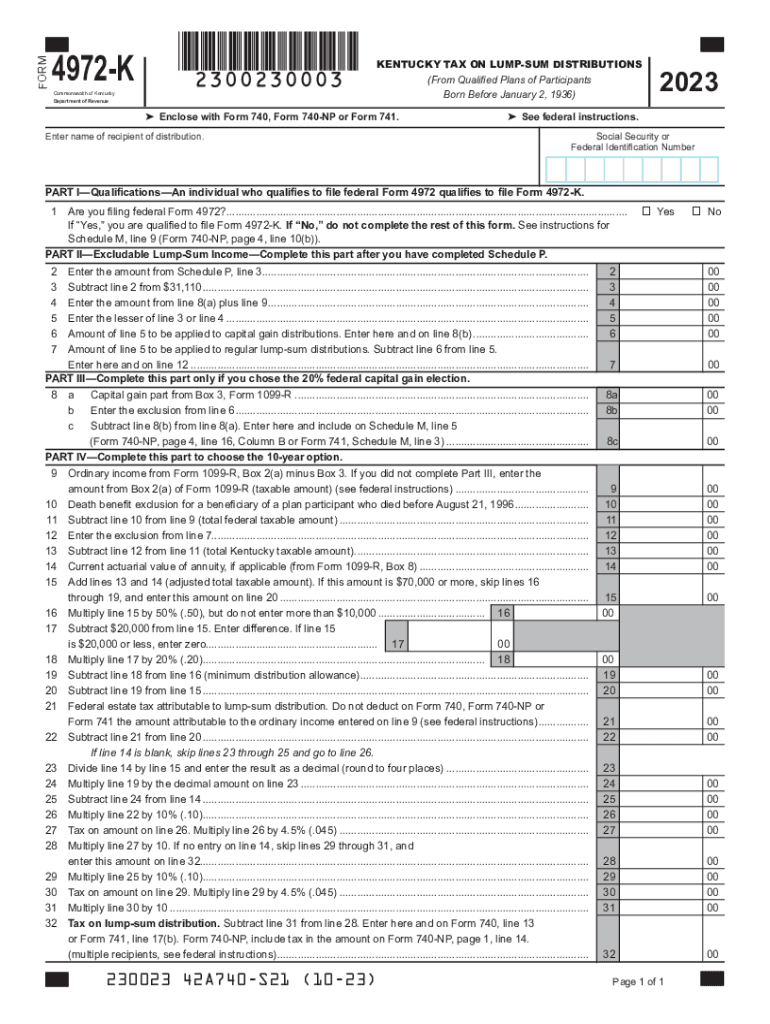

Form 4972 is used to report tax on lump sum distributions from retirement plans. This form is essential for individuals who receive a one-time payment from a qualified retirement plan, such as a pension or an individual retirement account (IRA). The tax implications can vary significantly based on the amount received and the taxpayer's overall income. Properly completing this form ensures compliance with IRS regulations and helps in accurately calculating the tax owed.

Steps to Complete Form 4972

Completing Form 4972 involves several key steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Report the total amount of the lump sum distribution received in the appropriate section.

- Calculate the tax using the provided worksheets to determine the applicable tax rate based on your income.

- Complete any additional sections that apply to your specific situation, such as special tax treatment options.

- Review the form for accuracy before submission.

Obtaining Form 4972

Form 4972 can be obtained directly from the IRS website or through various tax preparation software programs. It is available in both printable and fillable formats, allowing users to complete the form digitally or by hand. For those who prefer a physical copy, it can also be requested by mail from the IRS.

IRS Guidelines for Form 4972

The IRS provides specific guidelines for completing Form 4972, including instructions on how to calculate the tax owed and the eligibility criteria for using this form. It is crucial to follow these guidelines closely to avoid errors that could lead to penalties or delayed processing. The IRS also updates these guidelines periodically, so staying informed about any changes is important.

Filing Deadlines for Form 4972

Filing deadlines for Form 4972 typically align with the general tax filing deadlines. For most taxpayers, this means the form must be submitted by April 15 of the year following the tax year in which the lump sum distribution was received. If you need more time, you can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties.

Eligibility Criteria for Using Form 4972

To use Form 4972, you must meet certain eligibility criteria. Primarily, this form is intended for individuals who have received a lump sum distribution from a qualified retirement plan. Additionally, specific rules apply regarding the age of the taxpayer and the nature of the distribution, such as whether it is eligible for special tax treatment under the IRS guidelines.

Quick guide on how to complete complete form 4972 tax on lump sum distributions

Effortlessly Prepare Complete Form 4972 Tax On Lump sum Distributions on Any Gadget

Digital document management has gained traction among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without interruptions. Manage Complete Form 4972 Tax On Lump sum Distributions on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to Edit and eSign Complete Form 4972 Tax On Lump sum Distributions Effortlessly

- Obtain Complete Form 4972 Tax On Lump sum Distributions and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to deliver your form, whether by email, text message (SMS), or invite link, or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Complete Form 4972 Tax On Lump sum Distributions and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct complete form 4972 tax on lump sum distributions

Create this form in 5 minutes!

How to create an eSignature for the complete form 4972 tax on lump sum distributions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are ky revenue distributions?

KY revenue distributions refer to the allocation of revenue generated in Kentucky to various state and local entities. Understanding these distributions is crucial for businesses operating in Kentucky to ensure compliance and maximize their financial strategies.

-

How can airSlate SignNow assist with managing ky revenue distributions?

AirSlate SignNow simplifies the process of managing KY revenue distributions by allowing businesses to eSign and send necessary documents quickly. With its user-friendly interface, you can ensure that all your revenue distribution documents are processed efficiently and securely.

-

Are there any specific features for tracking ky revenue distributions in airSlate SignNow?

Yes, airSlate SignNow provides features that allow you to track and manage your documents related to KY revenue distributions. With real-time status updates and audit trails, you can ensure that all documents are accounted for and meet regulatory requirements.

-

What are the pricing options for using airSlate SignNow for ky revenue distributions?

AirSlate SignNow offers flexible pricing plans tailored to the needs of your business concerning KY revenue distributions. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while providing necessary features.

-

Can I integrate airSlate SignNow with other software for managing ky revenue distributions?

Absolutely! AirSlate SignNow integrates seamlessly with various software applications, which can enhance your management of KY revenue distributions. Integrating it with your existing systems allows you to streamline workflows and improve efficiency.

-

What benefits does airSlate SignNow provide for businesses handling ky revenue distributions?

Using airSlate SignNow for ky revenue distributions offers several benefits, including saving time on document management, reducing the risk of errors, and ensuring compliance with state regulations. The platform's security features also protect your sensitive information during transactions.

-

Is airSlate SignNow suitable for both small and large businesses managing ky revenue distributions?

Yes, airSlate SignNow is designed to cater to businesses of all sizes managing KY revenue distributions. Its scalable solutions ensure that every business can optimize its document processes, regardless of its operational scale.

Get more for Complete Form 4972 Tax On Lump sum Distributions

Find out other Complete Form 4972 Tax On Lump sum Distributions

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple