Revenue Ky GovForms4972 K 2021FORM 4972 K from Qualified Plans of Participants Kentucky 2022

Understanding the Kentucky 4972 K Form

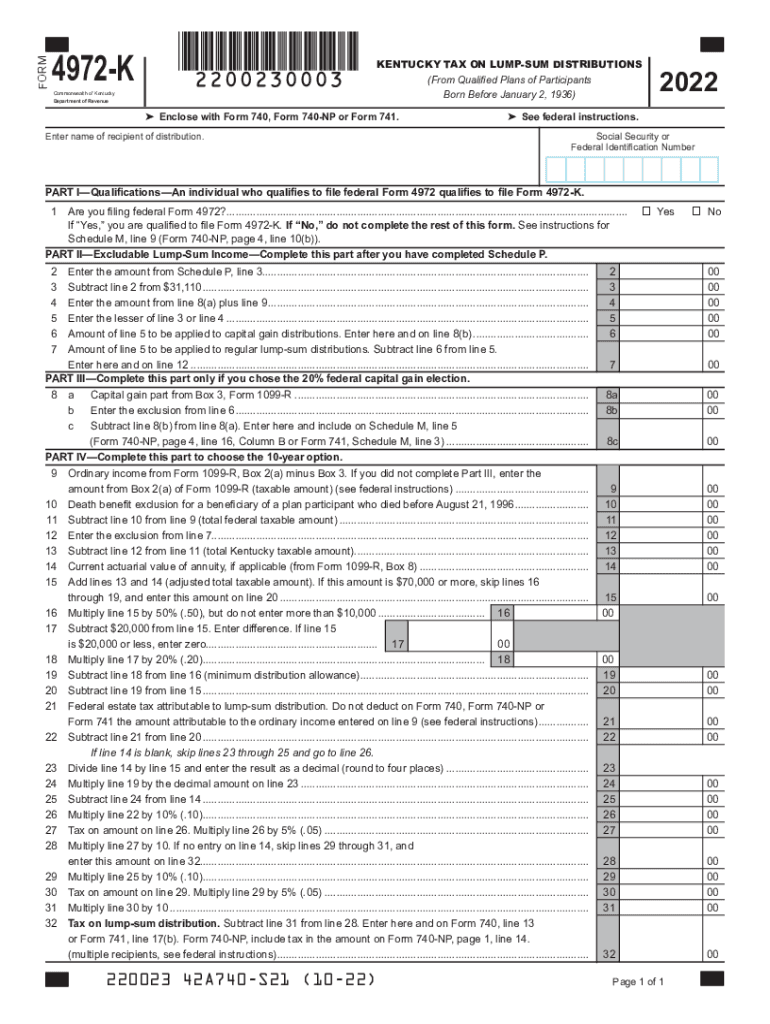

The Kentucky 4972 K form is essential for reporting distributions from qualified plans of participants. This form is specifically designed for individuals receiving lump-sum distributions from retirement plans, allowing them to report these distributions accurately for state tax purposes. It ensures compliance with Kentucky tax regulations and helps taxpayers manage their tax liabilities effectively.

Steps to Complete the Kentucky 4972 K Form

Completing the Kentucky 4972 K form involves several key steps:

- Gather necessary information, including personal details and specifics about the qualified plan.

- Accurately fill out each section of the form, ensuring all required fields are completed.

- Calculate the total amount of the distribution and any applicable taxes.

- Review the completed form for accuracy before submission.

Legal Use of the Kentucky 4972 K Form

The Kentucky 4972 K form is legally binding when completed according to state regulations. To ensure its validity, it must be signed and dated by the taxpayer. Utilizing a reliable electronic signature platform can enhance the legal standing of the document, as it provides a digital certificate and complies with the ESIGN and UETA acts, confirming the authenticity of the signature.

Required Documents for Filing the Kentucky 4972 K Form

Before filing the Kentucky 4972 K form, gather the following documents:

- Taxpayer identification information, such as Social Security number.

- Details of the qualified plan from which the distribution was made.

- Any previous tax documents that may impact the current filing.

Filing Deadlines for the Kentucky 4972 K Form

It is crucial to be aware of the filing deadlines for the Kentucky 4972 K form to avoid penalties. Generally, the form must be submitted by the same deadline as the federal tax return, which is typically April fifteenth unless an extension is filed. Staying informed about any changes to deadlines is essential for compliance.

Examples of Using the Kentucky 4972 K Form

Individuals may need to use the Kentucky 4972 K form in various scenarios, such as:

- Receiving a lump-sum distribution after retirement from a qualified plan.

- Rolling over funds from one retirement account to another.

- Distributing funds due to a plan participant's separation from service.

State-Specific Rules for the Kentucky 4972 K Form

Each state has unique regulations regarding the taxation of retirement distributions. In Kentucky, it is important to understand how state tax laws apply to the 4972 K form. This includes knowing which types of distributions are taxable and how to report them accurately to avoid issues with the Kentucky Department of Revenue.

Quick guide on how to complete revenuekygovforms4972 k 2021form 4972 k 2021 from qualified plans of participants kentucky

Complete Revenue ky govForms4972 K 2021FORM 4972 K From Qualified Plans Of Participants Kentucky effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the right form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Revenue ky govForms4972 K 2021FORM 4972 K From Qualified Plans Of Participants Kentucky on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign Revenue ky govForms4972 K 2021FORM 4972 K From Qualified Plans Of Participants Kentucky with ease

- Obtain Revenue ky govForms4972 K 2021FORM 4972 K From Qualified Plans Of Participants Kentucky and click on Get Form to begin.

- Use the tools provided to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes just moments and carries the same legal validity as a typical wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks, from any device you prefer. Edit and electronically sign Revenue ky govForms4972 K 2021FORM 4972 K From Qualified Plans Of Participants Kentucky to ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct revenuekygovforms4972 k 2021form 4972 k 2021 from qualified plans of participants kentucky

Create this form in 5 minutes!

People also ask

-

What are Kentucky revenue distributions?

Kentucky revenue distributions refer to the allocation of state funds collected through taxes and other sources to various entities within the state. Understanding these distributions is crucial for businesses and local governments to effectively manage their budgets and resources. airSlate SignNow can help streamline the document signing process related to these financial transactions.

-

How can airSlate SignNow assist with Kentucky revenue distributions?

airSlate SignNow simplifies the process of managing and signing documents related to Kentucky revenue distributions. With our platform, you can easily create, send, and eSign documents necessary for reporting and administrative purposes. This ensures a seamless flow of information and compliance with state regulations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of businesses involved in Kentucky revenue distributions. Our plans vary based on features and user numbers, ensuring that you find an affordable option that fits your budget. With cost-effective solutions, businesses can maximize their productivity and minimize administrative overhead.

-

What features does airSlate SignNow offer for Kentucky revenue-related workflows?

Our platform includes features like document templates, automated workflows, and secure cloud storage, specifically designed to enhance workflows associated with Kentucky revenue distributions. Additionally, our advanced tracking and reporting tools help you maintain oversight of your document processes. These features save time and improve the efficiency of your revenue-related tasks.

-

Are there integrations available for airSlate SignNow?

Yes, airSlate SignNow offers a variety of integrations with popular applications that can facilitate better handling of Kentucky revenue distributions. You can connect with platforms like Google Drive, Salesforce, and more to create a seamless workflow. This interoperability ensures that all aspects of your revenue management process are connected and efficient.

-

What benefits does eSigning provide for Kentucky revenue distributions?

eSigning documents related to Kentucky revenue distributions offers numerous benefits, including faster processing times and reduced paper usage. By adopting airSlate SignNow, businesses can sign documents instantly, which accelerates the entire revenue distribution workflow. This not only enhances efficiency but also helps in maintaining regulatory compliance.

-

Is airSlate SignNow secure for sensitive Kentucky revenue distribution documents?

Absolutely, airSlate SignNow prioritizes the security of your documents, particularly those related to Kentucky revenue distributions. Our platform employs advanced encryption and security protocols to protect sensitive information throughout the signing process. You can trust that your confidential financial documents are safe and secure.

Get more for Revenue ky govForms4972 K 2021FORM 4972 K From Qualified Plans Of Participants Kentucky

- Oregon agreement form

- Amendment to postnuptial property agreement oregon oregon form

- Quitclaim deed from husband and wife to an individual oregon form

- Warranty deed from husband and wife to an individual oregon form

- Assignment of ownership interest in limited liability company by four members to one member oregon form

- Oregon members form

- Notice right form

- Oregon real property form

Find out other Revenue ky govForms4972 K 2021FORM 4972 K From Qualified Plans Of Participants Kentucky

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors