4972 K 2021

What is the 4972 K

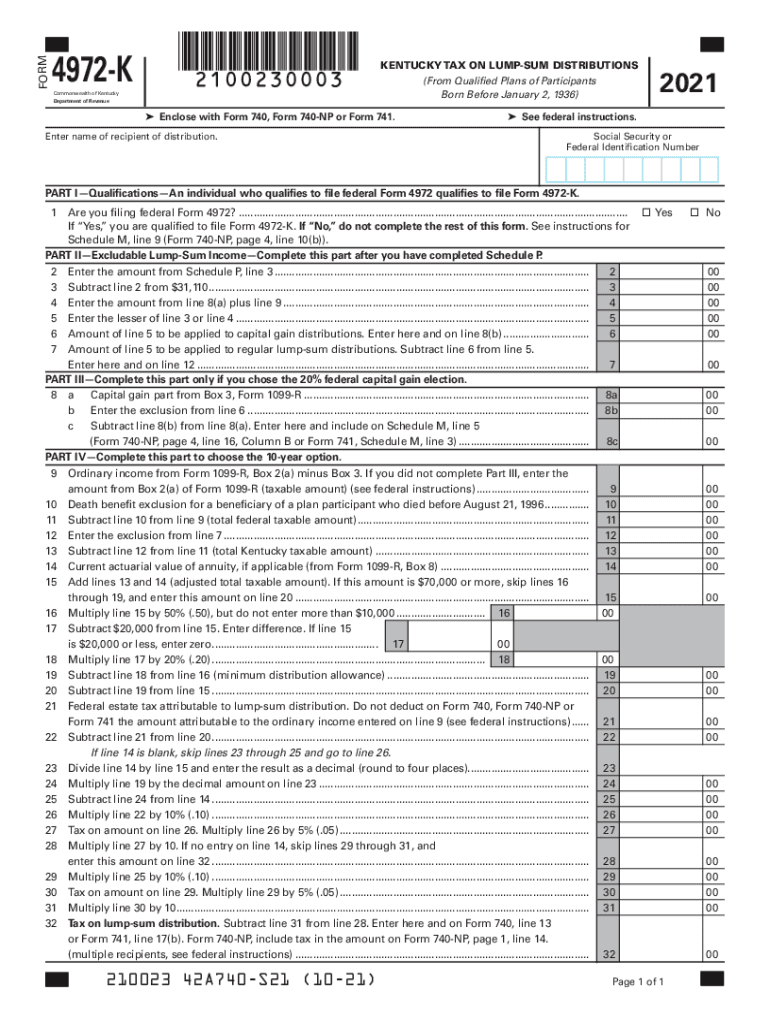

The 4972 K form, also known as the Revenue 4972 K, is a tax document used primarily for reporting distributions from retirement plans and certain other tax-deferred accounts. This form is essential for individuals who have received a lump-sum distribution from these accounts, as it helps determine the tax implications of such distributions. Understanding the 4972 K is crucial for ensuring compliance with IRS regulations and for accurately reporting income on tax returns.

How to use the 4972 K

Utilizing the 4972 K form involves several key steps. First, gather all necessary information regarding the distribution, including the amount received and the type of retirement account involved. Next, complete the form by accurately filling in your personal details and the specifics of the distribution. It is important to follow the instructions provided by the IRS to ensure that all information is reported correctly. Once completed, the form should be submitted with your tax return to report the distribution appropriately.

Steps to complete the 4972 K

Completing the 4972 K form requires careful attention to detail. Begin by entering your name, Social Security number, and address at the top of the form. Next, detail the distribution amount and the type of account from which the funds were withdrawn. Be sure to include any applicable tax withholding information. After filling out all relevant sections, review the form for accuracy before submitting it with your tax return. Keeping a copy for your records is also advisable.

Legal use of the 4972 K

The 4972 K form is legally binding when completed accurately and submitted in compliance with IRS regulations. It is important to ensure that all information provided is truthful and complete, as discrepancies can lead to penalties or audits. The form serves as a formal declaration of income received from retirement accounts, and proper use is essential for maintaining compliance with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the 4972 K form align with the general tax filing deadlines set by the IRS. Typically, individual taxpayers must file their tax returns by April 15 of each year. If you are unable to meet this deadline, you may request an extension, but it is crucial to ensure that any taxes owed are paid by the original due date to avoid penalties. Keeping track of these dates is essential for timely and compliant tax filing.

Required Documents

To complete the 4972 K form, you will need several key documents. These include your previous year's tax return, any statements related to the distribution from your retirement account, and documentation of any taxes withheld. Having these documents on hand will facilitate the accurate completion of the form and ensure that all necessary information is included.

Quick guide on how to complete 4972 k

Effortlessly Prepare 4972 K on Any Device

Web-based document management has gained prominence among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage 4972 K across any platform with airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

Efficiently Modify and Electronically Sign 4972 K with Ease

- Locate 4972 K and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that task.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require new printed copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign 4972 K to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4972 k

Create this form in 5 minutes!

How to create an eSignature for the 4972 k

The best way to generate an electronic signature for a PDF document online

The best way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The way to make an e-signature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to 4972 k?

airSlate SignNow is a powerful eSignature platform designed to streamline document workflows. It allows businesses to easily send, eSign, and manage important documents, making it a cost-effective choice for those interested in 4972 k. By simplifying the signing process, airSlate SignNow helps businesses save time and resources.

-

How much does airSlate SignNow cost for using 4972 k?

The pricing for airSlate SignNow varies based on the plan you choose. Typically, the costs are competitive and cater to businesses looking for features related to 4972 k. You can select from various subscription options to find the best fit for your budget and needs.

-

What are the key features of airSlate SignNow associated with 4972 k?

airSlate SignNow offers an array of features including customizable templates, real-time tracking, and secure storage. These features make handling documents related to 4972 k efficient and reliable. The platform's user-friendly interface ensures that even those unfamiliar with eSignature technology can use it effectively.

-

What benefits can businesses expect from using airSlate SignNow for 4972 k?

By using airSlate SignNow for 4972 k, businesses can enhance their document management processes. The solution not only speeds up the signing process but also increases overall productivity and reduces operational costs. Additionally, it ensures compliance with legal standards, giving users peace of mind.

-

How does airSlate SignNow integrate with other software for 4972 k?

airSlate SignNow seamlessly integrates with various third-party applications, enhancing its functionality for users dealing with 4972 k. Whether you're using CRM systems or project management tools, these integrations help streamline workflows and improve efficiency. This flexibility allows for better adaptability to your business needs.

-

Is airSlate SignNow secure for handling documents related to 4972 k?

Yes, airSlate SignNow prioritizes security, ensuring that documents related to 4972 k are protected. The platform uses advanced encryption and compliance protocols to safeguard your sensitive information. Users can trust that their document management will meet high security standards.

-

Can I use airSlate SignNow on mobile devices for 4972 k?

Absolutely! airSlate SignNow is optimized for mobile use, enabling you to manage documents related to 4972 k on the go. The mobile application provides a user-friendly experience, allowing you to send and sign documents anytime, anywhere, increasing your operational flexibility.

Get more for 4972 K

Find out other 4972 K

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now