New York Form it 112 R New York State Resident Credit Resident Credit Government of New YorkNew York Form it 112 R New York Stat 2020

What is the New York Form IT 112 R?

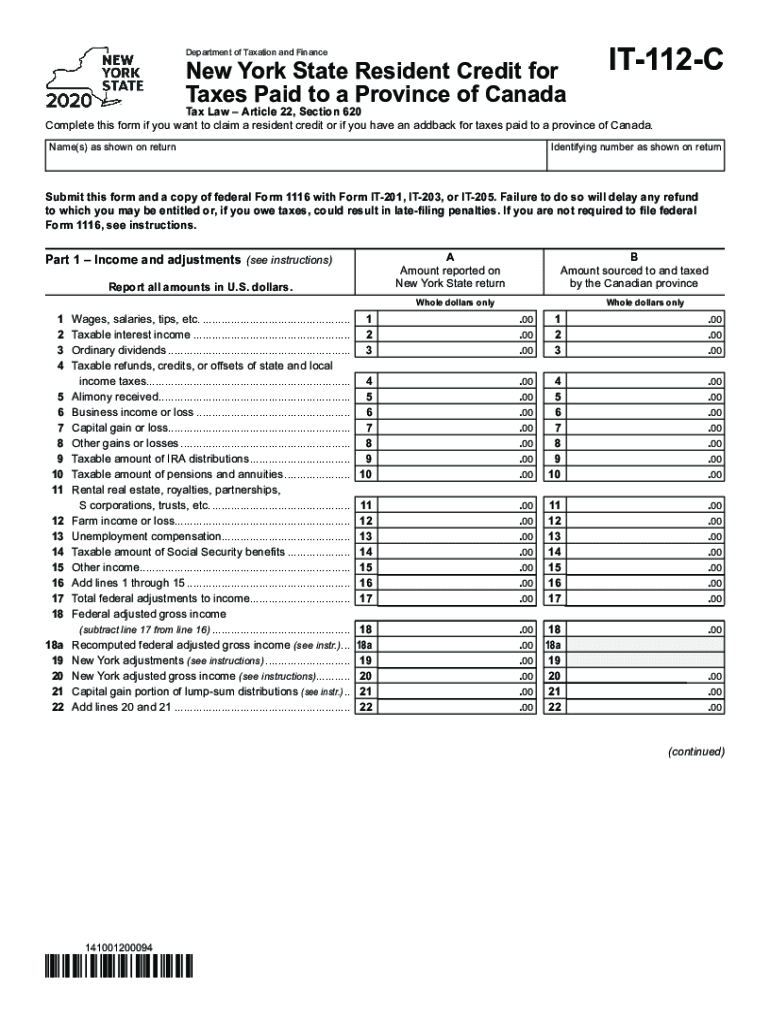

The New York Form IT 112 R is a tax document used by residents of New York State to claim a resident credit. This credit is designed to reduce the tax burden for individuals who have paid taxes to another state while also being residents of New York. The form ensures that taxpayers do not face double taxation on the same income, providing a fair approach to state tax obligations.

Steps to complete the New York Form IT 112 R

Completing the New York Form IT 112 R involves several key steps to ensure accuracy and compliance with state tax regulations. Here is a simplified process:

- Gather necessary documentation, including W-2 forms and any tax returns from other states.

- Fill out personal information, including your name, address, and Social Security number.

- Detail your income sources and the taxes paid to other states.

- Calculate the amount of credit you are eligible for based on your tax situation.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the New York Form IT 112 R

To qualify for the resident credit using the New York Form IT 112 R, taxpayers must meet specific eligibility requirements. These include:

- You must be a resident of New York State for the entire tax year.

- You must have paid income taxes to another state on income that is also taxable in New York.

- Documentation of taxes paid to the other state must be provided.

Required Documents for the New York Form IT 112 R

When filing the New York Form IT 112 R, it is essential to include certain documents to support your claim. Required documents typically include:

- Copies of W-2 forms showing income earned.

- Tax returns from the other state where taxes were paid.

- Any additional documentation that verifies the taxes paid and income earned.

Legal Use of the New York Form IT 112 R

The New York Form IT 112 R is legally binding when completed accurately and submitted according to state regulations. It is important to ensure that all information provided is truthful and verifiable, as inaccuracies may lead to penalties or delays in processing. The form must be filed with the New York State Department of Taxation and Finance by the designated filing deadline.

How to obtain the New York Form IT 112 R

The New York Form IT 112 R can be obtained through various channels. Taxpayers can download the form directly from the New York State Department of Taxation and Finance website. Additionally, physical copies may be available at local tax offices or public libraries. It is advisable to ensure that you are using the most current version of the form to avoid any issues during submission.

Quick guide on how to complete new york form it 112 r new york state resident credit resident credit government of new yorknew york form it 112 r new york

Manage New York Form IT 112 R New York State Resident Credit Resident Credit Government Of New YorkNew York Form IT 112 R New York Stat seamlessly on any device

Digital document oversight has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Handle New York Form IT 112 R New York State Resident Credit Resident Credit Government Of New YorkNew York Form IT 112 R New York Stat on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign New York Form IT 112 R New York State Resident Credit Resident Credit Government Of New YorkNew York Form IT 112 R New York Stat with ease

- Obtain New York Form IT 112 R New York State Resident Credit Resident Credit Government Of New YorkNew York Form IT 112 R New York Stat and click Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Craft your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your edits.

- Select your preferred method to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow meets all your requirements in document management within just a few clicks from any device you choose. Modify and electronically sign New York Form IT 112 R New York State Resident Credit Resident Credit Government Of New YorkNew York Form IT 112 R New York Stat to ensure exceptional communication at every stage of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york form it 112 r new york state resident credit resident credit government of new yorknew york form it 112 r new york

Create this form in 5 minutes!

How to create an eSignature for the new york form it 112 r new york state resident credit resident credit government of new yorknew york form it 112 r new york

The way to create an eSignature for a PDF file online

The way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the it 112 r and how does it work?

The it 112 r is a document management tool integrated within airSlate SignNow that streamlines the process of sending and eSigning documents. It allows users to create, send, and manage documents electronically, ensuring a seamless workflow for businesses. This cost-effective solution makes it easy to track document status and gather signatures in real-time.

-

How much does airSlate SignNow with it 112 r cost?

The pricing for airSlate SignNow features various plans, depending on your business needs. Each plan includes access to the it 112 r functionality, ensuring you get a comprehensive eSigning solution at an affordable price. Businesses can choose a plan that best fits their volume of usage and budget.

-

What are the key features of the it 112 r within airSlate SignNow?

The it 112 r includes features such as document templates, automated workflows, and real-time tracking of document status. It also supports various file formats and provides robust security measures for storing and sharing documents. These features help enhance productivity and reduce turnaround times.

-

How can the it 112 r benefit my business?

Implementing the it 112 r can signNowly improve your business's efficiency by simplifying the document signing process. It helps reduce paper usage and minimizes the risk of errors associated with traditional signing methods. As a result, businesses can save time and increase overall productivity.

-

Can the it 112 r integrate with other software applications?

Yes, the it 112 r can easily integrate with various third-party software applications, enhancing its functionality. Popular integrations include CRM systems, project management tools, and other document management solutions. This flexibility allows businesses to maintain their existing workflows while leveraging airSlate SignNow's eSigning capabilities.

-

Is the it 112 r secure for sensitive documents?

Absolutely, the it 112 r is designed with security in mind. airSlate SignNow employs advanced encryption and authentication methods to protect sensitive documents during transmission and storage. This ensures that your documents remain secure, complying with industry standards.

-

What types of documents can I send using the it 112 r?

You can send a wide variety of documents using the it 112 r, including contracts, agreements, forms, and more. The platform supports multiple file formats, allowing businesses to use the tool for nearly any document-based workflow. This versatility helps cater to a diverse range of industry needs.

Get more for New York Form IT 112 R New York State Resident Credit Resident Credit Government Of New YorkNew York Form IT 112 R New York Stat

- Revocable living trust form wwwlapakonlineindonesiaid

- Justia petition for name change tennessee form

- Paperwork to terminate parental rights form

- Motion to enforce settlement agreementsmall claims case motion to enforce settlement agreementsmall claims case form

- My name address city state zip phone e mail i am the form

- Local utah bankruptcy forms united states bankruptcy

- Consent to minors name change consent to minors name change form

- Pdf summons to be served outside utah utah courts form

Find out other New York Form IT 112 R New York State Resident Credit Resident Credit Government Of New YorkNew York Form IT 112 R New York Stat

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed