Instructions for Form it 112 C Tax NY Gov 2023

Understanding Form IT-112 C for New York Taxation

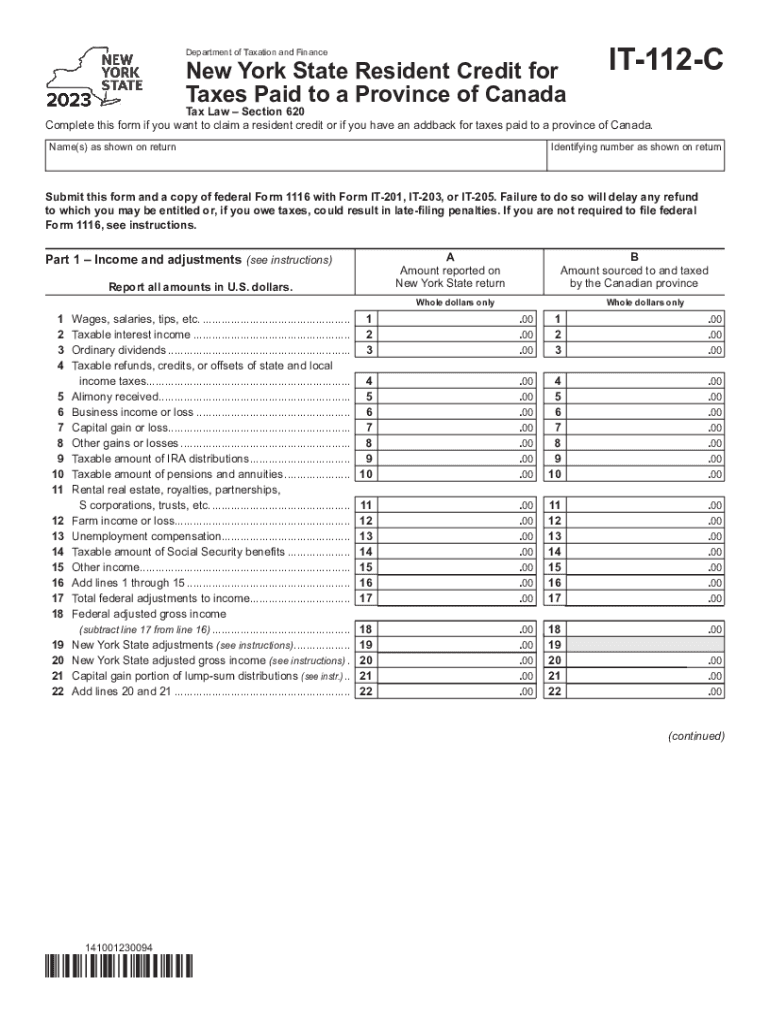

Form IT-112 C is a crucial document for taxpayers in New York who need to report their income and calculate their tax liability. This form is specifically designed for individuals and businesses that qualify for certain tax credits or deductions. The form allows taxpayers to claim credits that can significantly reduce their overall tax burden. Understanding the purpose and requirements of Form IT-112 C is essential for accurate tax filing.

Steps to Complete Form IT-112 C

Completing Form IT-112 C involves several key steps to ensure accuracy and compliance with New York tax regulations. First, gather all necessary documentation, including income statements, previous tax returns, and any relevant financial records. Next, carefully fill out the form, ensuring all fields are completed accurately. Pay special attention to sections where you need to claim credits or deductions. After completing the form, review it for any errors before submission.

Required Documents for Form IT-112 C

To successfully file Form IT-112 C, certain documents are essential. Taxpayers should have their W-2 forms, 1099 forms, and any other income-related documents ready. Additionally, records of any deductions or credits being claimed, such as receipts for charitable contributions or proof of educational expenses, should be included. Having these documents organized will facilitate a smoother filing process.

Filing Deadlines for Form IT-112 C

It is important to be aware of the filing deadlines for Form IT-112 C to avoid penalties. Generally, the form must be submitted by April fifteenth of the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any extensions they may need to file their taxes, which can be requested through the New York State Department of Taxation and Finance.

Common Scenarios for Using Form IT-112 C

Form IT-112 C is applicable to a variety of taxpayer scenarios. For instance, self-employed individuals can use this form to report their business income and claim relevant deductions. Similarly, retirees may need to file this form to report pension income and other retirement benefits. Understanding how this form applies to different situations can help taxpayers maximize their credits and ensure compliance with state tax laws.

Legal Use of Form IT-112 C

Form IT-112 C must be used in accordance with New York tax laws. This means that taxpayers must provide accurate information and only claim credits and deductions for which they are eligible. Misuse of the form can lead to penalties, including fines or audits. It is advisable for taxpayers to consult with a tax professional if they are unsure about their eligibility or how to properly complete the form.

Quick guide on how to complete instructions for form it 112 c tax ny gov

Complete Instructions For Form IT 112 C Tax NY gov effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Instructions For Form IT 112 C Tax NY gov on any platform with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The simplest method to modify and eSign Instructions For Form IT 112 C Tax NY gov seamlessly

- Find Instructions For Form IT 112 C Tax NY gov and select Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize crucial sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the information carefully and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Instructions For Form IT 112 C Tax NY gov and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 112 c tax ny gov

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 112 c tax ny gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is taxation 112 c and how does it impact me?

Taxation 112 c refers to a specific guideline affecting certain tax obligations for businesses. Understanding taxation 112 c is crucial for maintaining compliance and avoiding penalties. It highlights the nuances of tax liabilities that your business may face.

-

How can airSlate SignNow help with documents related to taxation 112 c?

AirSlate SignNow streamlines the process of sending and eSigning documents essential for maintaining compliance with taxation 112 c. Our platform allows for secure storage and efficient tracking of important agreements, ensuring that you have everything in order to meet tax obligations.

-

What features does airSlate SignNow offer for managing taxation documents?

AirSlate SignNow includes features such as customizable templates, in-app editing, and automated reminders that can help you manage documents related to taxation 112 c. These features make it easy to keep track of your tax-related paperwork and streamline the eSigning process.

-

Is airSlate SignNow affordable for small businesses dealing with taxation 112 c?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses navigating taxation 112 c. With flexible pricing plans, you can find an option that fits your budget while still accessing powerful eSigning and document management tools.

-

Are there integrations available for managing taxation 112 c documentation?

AirSlate SignNow integrates seamlessly with various accounting and business management tools, which can be vital for efficiently managing taxation 112 c documentation. These integrations help ensure that all your documents are in sync and easily accessible for audit or compliance purposes.

-

How does airSlate SignNow enhance the security of my taxation 112 c documents?

Security is a top priority at airSlate SignNow, especially for sensitive taxation 112 c documents. Our platform uses advanced encryption, secure cloud storage, and two-factor authentication to protect your data from unauthorized access and ensure compliance with industry standards.

-

Can airSlate SignNow assist with remote signing of taxation 112 c documents?

Absolutely! AirSlate SignNow facilitates remote signing of taxation 112 c documents, allowing you and your stakeholders to sign from anywhere, at any time. This capability is essential for streamlined operations, especially in today's remote work environment.

Get more for Instructions For Form IT 112 C Tax NY gov

- Iowa individual cdac form

- Form 470 5170 iowa department of human services iowagov dhs state ia

- Vital statistics idaho state form

- How fill out ioci 15 383 form

- Drowning injury illness report illinois department of public health idph state il form

- Polst illinois form

- Is illinois dept of human services open form

- Cfs 717 g form

Find out other Instructions For Form IT 112 C Tax NY gov

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure