SECTION 620 Credit for Income Tax of Another State 2022

What is the SECTION 620 Credit For Income Tax Of Another State

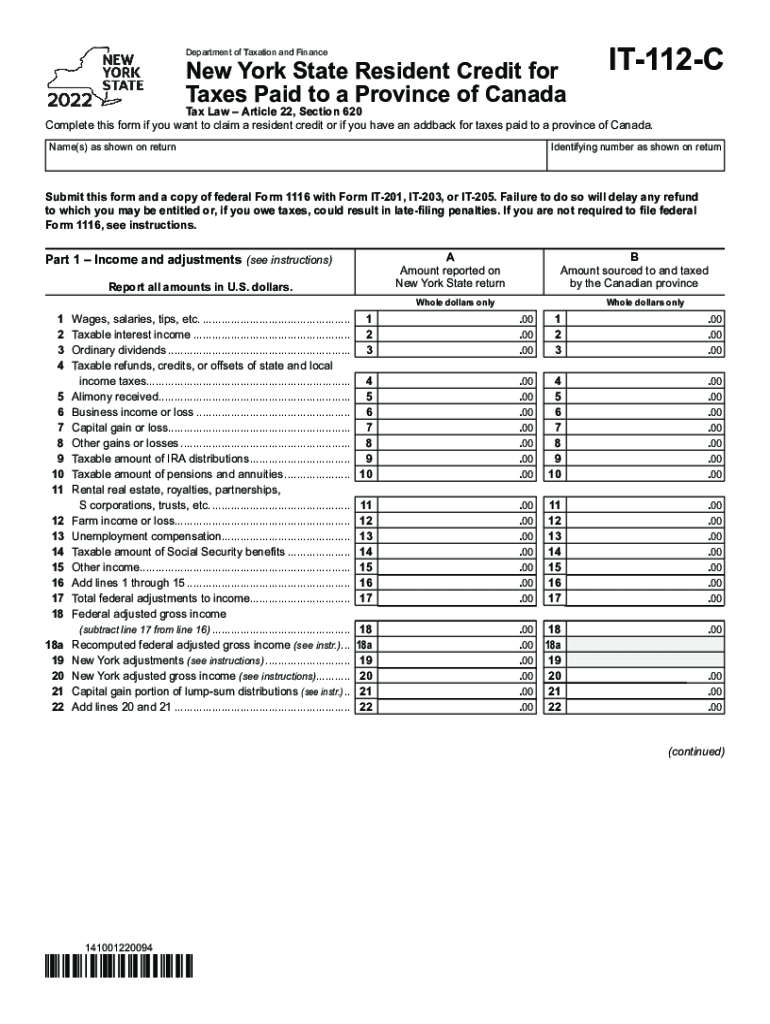

The SECTION 620 Credit For Income Tax Of Another State allows taxpayers to receive a credit for income taxes paid to another state. This provision is particularly beneficial for individuals who earn income in multiple states, as it helps to avoid double taxation. By claiming this credit, taxpayers can reduce their New York state tax liability based on the taxes they have already paid to other states, ensuring a fairer tax burden.

How to use the SECTION 620 Credit For Income Tax Of Another State

To utilize the SECTION 620 Credit, taxpayers must first determine the amount of income tax paid to the other state. This involves obtaining documentation from the other state’s tax authority. Once the amount is established, taxpayers can claim the credit on their New York state tax return by completing the appropriate sections of the return, ensuring that all calculations are accurate to maximize the benefit.

Steps to complete the SECTION 620 Credit For Income Tax Of Another State

Completing the SECTION 620 Credit involves several key steps:

- Gather documentation of income taxes paid to the other state.

- Complete the relevant sections of the New York state tax return.

- Calculate the credit based on the lesser of the tax paid to the other state or the New York tax on the same income.

- Include the credit amount on the tax return and maintain records for future reference.

Legal use of the SECTION 620 Credit For Income Tax Of Another State

The legal framework surrounding the SECTION 620 Credit is designed to prevent double taxation on income earned in multiple states. Taxpayers must adhere to specific guidelines set forth by the New York State Department of Taxation and Finance to ensure compliance. This includes accurate reporting of income and taxes paid, as well as timely filing of tax returns to avoid penalties.

Eligibility Criteria

To be eligible for the SECTION 620 Credit, taxpayers must meet certain criteria. They must have paid income tax to another state on income that is also subject to New York state tax. Additionally, the income must be reported on the New York state tax return, and the taxpayer must be a resident of New York for the tax year in question. Meeting these criteria ensures that the credit is applied correctly and legally.

Required Documents

When claiming the SECTION 620 Credit, taxpayers need to provide specific documentation. This includes:

- Proof of income taxes paid to the other state, such as tax returns or payment receipts.

- Documentation showing the income earned in the other state.

- Any additional forms required by the New York State Department of Taxation and Finance.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines related to the SECTION 620 Credit. Typically, New York state tax returns must be filed by April fifteenth of each year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is crucial to submit all necessary documentation by this date to ensure that the credit is applied correctly and to avoid any penalties.

Quick guide on how to complete section 620 credit for income tax of another state

Complete SECTION 620 Credit For Income Tax Of Another State effortlessly on any device

Online document management has become increasingly popular among both organizations and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed forms, allowing you to access the necessary document and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without any delays. Manage SECTION 620 Credit For Income Tax Of Another State on any platform using airSlate SignNow applications for Android or iOS, and enhance any document-focused process today.

How to modify and eSign SECTION 620 Credit For Income Tax Of Another State without difficulty

- Find SECTION 620 Credit For Income Tax Of Another State and then click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign tool, which takes just moments and has the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Banish lost or mislaid documents, tedious searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign SECTION 620 Credit For Income Tax Of Another State and establish excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct section 620 credit for income tax of another state

Create this form in 5 minutes!

How to create an eSignature for the section 620 credit for income tax of another state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to IT 112 R instructions?

airSlate SignNow offers essential features such as customizable templates, cloud storage, and secure eSigning that are perfect for managing your IT 112 R instructions. These tools streamline document creation and management, ensuring you can efficiently handle tax forms and submissions.

-

How can airSlate SignNow help my business with IT 112 R instructions?

By utilizing airSlate SignNow, businesses can simplify the process of collecting signatures and managing documents for IT 112 R instructions. The platform provides a user-friendly interface that enhances productivity and reduces the time spent on paperwork.

-

Is airSlate SignNow a cost-effective solution for handling IT 112 R instructions?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing IT 112 R instructions. Flexible pricing plans allow businesses of all sizes to access the features they need without overspending on unnecessary services.

-

Does airSlate SignNow integrate with other software for IT 112 R instructions?

airSlate SignNow boasts several integrations with popular software, making it easier to incorporate your existing workflow with IT 112 R instructions. Whether using CRM systems or document management tools, airSlate SignNow ensures seamless connectivity.

-

What security measures are in place for IT 112 R instructions on airSlate SignNow?

Security is paramount when dealing with IT 112 R instructions. airSlate SignNow uses advanced encryption, two-factor authentication, and compliance with global security standards to protect your sensitive data.

-

Can I customize templates for IT 112 R instructions in airSlate SignNow?

Absolutely! airSlate SignNow allows users to create and customize templates specifically for IT 112 R instructions. This feature saves time and ensures that your documents meet all required specifications, tailoring the experience to your needs.

-

How does airSlate SignNow facilitate collaboration on IT 112 R instructions?

Collaboration is made easy with airSlate SignNow, as users can invite team members to review and sign IT 112 R instructions in real time. This feature ensures that everyone involved can contribute efficiently, leading to faster processing of documents.

Get more for SECTION 620 Credit For Income Tax Of Another State

- Demand to commence suit by corporation or llc south dakota form

- South dakota commencement form

- Letter from landlord to tenant as notice to remove wild animals in premises south dakota form

- South dakota notice 497326167 form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497326168 form

- South dakota tenant form

- Letter from tenant to landlord containing notice that doors are broken and demand repair south dakota form

- South dakota windows form

Find out other SECTION 620 Credit For Income Tax Of Another State

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word